Part 2: Cell And Gene Therapy Is Transforming Healthcare

By Sanjay Srivastava, Ph.D., Managing Director, Supply Chain & Operations, Accenture

Second in a two-part series

Healthcare sector players are neither adequately equipped nor strategically placed near patients to accommodate the  anticipated volume of clinical trials to evaluate cell and gene therapies (CGT) in development. While the industry is adjusting and deploying the required capabilities, the transformation is evolving and incomplete. Real change requires rethinking how current sector players are adopting and how they will operate in the future.

anticipated volume of clinical trials to evaluate cell and gene therapies (CGT) in development. While the industry is adjusting and deploying the required capabilities, the transformation is evolving and incomplete. Real change requires rethinking how current sector players are adopting and how they will operate in the future.

In our view, the scale to support the current and projected development activity and enable innovation will require transformation on two levels. The first requires decentralizing the operating model, including how we access patients, manage the cell journey and manage drug manufacturing. The second is to drive the emergence of several dominant business entity archetypes that will enable and sustain the decentralized operating model and support development and commercialization of treatments.

Decentralizing the operating model

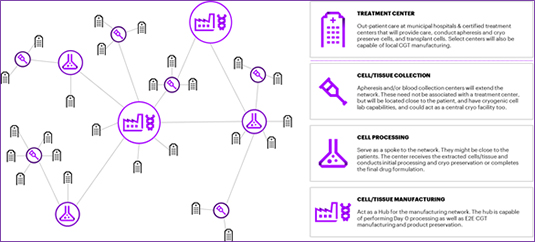

The challenge of finding eligible patients, sourcing raw material and orchestrating just-in-time manufacturing and supply chains will bring the value chains closer to the treatment centers and patients. Life sciences companies will then need to build hub and spoke models to drive their innovation engine and supply chain to help establish a manufacturing footprint. This means the ecosystem will move away from a traditional, linear and centralized operating model to a decentralized model with multiple hubs and spokes to create flexibility around where to develop therapies, collect cells/tissues, treat patients and manufacture the product [Figure 1].

Figure 1. Decentralization of Cell and Gene Therapy Ecosystem

In a decentralized hub and spoke model, the roles of the current value chain partners will evolve, and their capabilities will expand. The exponential rise in scientific knowledge and innovation driving the next generation of CGTs will not necessarily require inpatient treatment. Instead, municipal hospitals will have the capabilities to conduct clinical trials and support treatment delivery in the commercial setting. Additionally, there has been a steady rise in treatment centers seeking Foundation for the Accreditation of Cellular Therapy accreditations in the last two years.

Several of the new mature sites will be able to access apheresis centers, cryopreserve cells and transplant genetically modified products. The wide network of municipal hospitals and qualified treatment sites will dramatically increase patient access, decrease overall therapy costs, improve translational research capabilities and address patient referral impediments, minimizing patient leakage. These new sites will also enhance the adoption of the therapies when commercially available. The decentralized model could help reduce operational risks.

As patient volume increases, the bottlenecks will shift from manufacturing to the availability of patient/donor raw materials and third-party logistics provider capacity. We envision clinical sponsors and commercial CGT life sciences companies relying on new blood collection centers and existing centers such as the Red Cross to conduct apheresis. Distributed apheresis centers will provide access to additional resources to extract and process cells and tissues. Shorter patient and cell transit times will increase access to clinical trial subjects and CGT patients. Having apheresis centers closer to patients will simplify logistics operations to preserve cell viability during the long transit from the apheresis sites to the manufacturing location. This will help address the raw material availability and increase patient access.

The advancement in manufacturing automation and closed manufacturing systems are beginning to simplify the manufacturing footprint strategy, bringing it to the treatment site and facilitating the decentralization of the operating model. The decentralized model will also enable clinical sponsors to provide cell/tissue processing services, serve as a spoke to the manufacturing footprint and be closer to the patient. This is already occurring in some markets including the U.S., Europe and China where CAR-T sponsors have built manufacturing locations, with clinical-stage biotech companies following this strategy.

Meanwhile, CGT manufacturers have deployed strategies closer to the patient with day 0 (zero) cell processing or drug substance processing for final formulation for gene therapies. Maintaining centralized cell/tissue manufacturing closer to the markets where highly specialized CGT manufacturing capabilities already exist provides certain advantages. Contract development and manufacturing organizations (CDMOs) are rapidly acquiring and/or building facilities to enable the deployment of this strategy for the smaller biotech companies, which often have limited resources to build their own infrastructure.

Rise of the Disruptors

The decentralized operating model will likely accelerate the emergence of new types of businesses, which could disrupt the legacy biopharmaceutical business model. As these new entities emerge, ecosystem stakeholders will need to understand how they will contribute to developing transformative therapies—from early research to clinical development to manufacturing and commercialization.

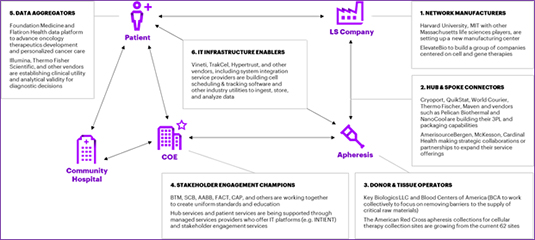

Healthcare sector players will be faced with a choice: Take advantage of their position and build capabilities to strengthen their foothold or let the incoming entrants fill the capability void. Regardless of the path sector players choose, we will witness non-traditional players or newcomers in adjacent industries entering the market as cross-sector collaboration increases. To manage the tsunami of CGT development assets and capitalize on the market dynamics, we envision six types of business emerging, co-existing and collaborating with existing ecosystem players. In fact, these businesses are already developing and helping decentralize the current business model [Figure 2].

Figure 2. Emerging Business Entities and Examples

1. Network manufacturers—They will provide a distributed network of CGT products to de-risk the supply chain. These manufacturers will fall into two types: Those providing cell/tissue processing services and those providing Good Manufacturing Practices (GMP)-in-a-box manufacturers (or automated and efficient full-fledged CGT manufacturers). There is tremendous interest from both traditional and non-traditional players to catalyze the development of CGT therapies by shortening the path between research and clinical application. For example, a group of academic, healthcare, biotech and biopharma industry leaders have converged to establish a new center in Boston. Additionally, MLP Ventures is creating a CDMO and building a $1.1 billion gene and cell treatment manufacturing operation near Philadelphia.

Since about 2016, there have been about 20 M&A transactions worth more than $30 billion in the CDMO community. While the majority of the deals address the vector manufacturing constraint, they are also designed to add a geographical footprint. These acquisitions have added patient cell processing and manufacturing services, allowing life sciences companies access to a harmonized manufacturing network that is more efficient than working with separate providers or a loosely affiliated network. We expect that fast pace of manufacturing company acquisition activity will continue, leading to a network of manufacturers, enabling the distributed operating model. ,

The development of automation and closed-loop systems in CGT manufacturing will reduce the cost of goods sold and make scaling out technically easier. For example, Lonza joined Octane Biotech to develop a system called Cocoon, a GMP-in-a-box concept designed to offer manufacturing in non-traditional locations such as treatment sites. Additionally, Miltenyl Biotech is developing a similar clinical scale CAR-T manufacturing system known as CliniMACS Prodigy®. It will simplify manufacturing processes and enable the automated production of CAR-T cells. Such closed-loop and GMP-compliant capabilities will accelerate the decentralized operating model, decrease manufacturing and supply chain management costs and increase the overall capacity in the ecosystem.

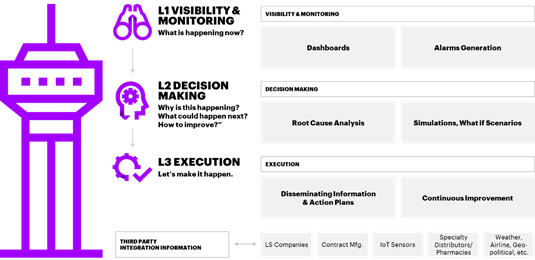

2. Hub and spoke connectors—These are next-generation logistics providers that run the just-in-time supply chain, facilitate cell transfer operations and deliver raw material to manufacturers and final product to hospitals. These logistics providers’ capabilities such as a Control Tower [Figure 3] will not only enable end-to-end supply chain visibility and a 360-degree view of the products they transport, but also help integrate planning and execution. The Control Tower capability will evolve logistics provider’s role from providing reactive fixes to creating synchronized event-driven value networks.

Figure 3. Hub and Spoke Connector Control Tower

We expect logistics service providers to follow a similar pattern to the CDMO market—industry consolidation will provide harmonized and integrated equipment and third-party logistics provider networks.

3. Donor and tissue operators—They are modular and distributed manufacturing facilities that will help add local capacity to the system, further accelerating decentralization. The global apheresis market is projected to reach $4.2 billion by 2023, growing 7.3 percent between 2017 and 2023 with therapeutic apheresis expected to grow at the highest rate. Observers contribute the increase in the market size to the growing number of blood centers and the rise in apheresis procedures across several specialties such as hematology, neurology and oncology.

Besides the traditional centers, which are already playing a bigger role in CGT, we are seeing nonprofits such as Blood Centers of America and Key Biologics addressing apheresis capacity issues. These organizations will enable the collection and management of raw materials that will be used in curative CGTs. Such an infrastructure already exists in France, where the French Blood Establishment has 128 collection sites and organizes more than 40,000 mobile blood collections a year. We will see more entrants and transplant centers increasing their apheresis capacity through collaboration with new players.

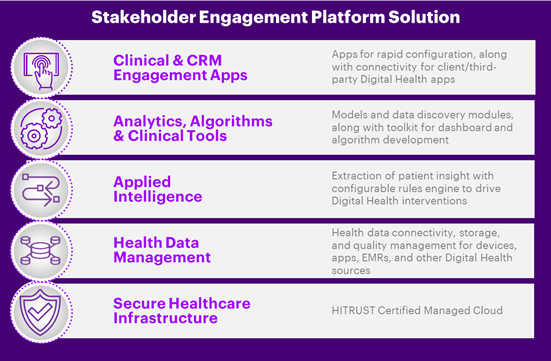

4. Stakeholder engagement champions— They will working with industry standards bodies and IT infrastructure providers to drive standards harmonization and implementation. For example, Be The Match has been working on developing standards for on-site audits that the Foundation for the Accreditation of Cellular Therapy is likely to adopt when manufacturers look to certify treatment sites. This category also includes companies that will enable improved site stakeholder engagements by providing end-to-end solutions that support stakeholder engagement and patient services to deliver ongoing treatment and long-term follow-up data collection and utilization requirements. These businesses will be equipped with advanced solutions that facilitate care team and patient services engagement and provide a superior customer experience through seamless and coordinated collaboration across the CGT ecosystem. Artificial intelligence, smart automation, machine learning and advanced analytics—at scale—will help providers discover and apply new insights [Figure 4].

5. Data aggregators—With rich longitudinal clinic-genomic data from thousands of patients, data aggregators are helping oncology research evolve and driving innovation across the drug development lifecycle. In recent years, we have seen a number of organizations—including academic research institutes—collaborating with data aggregators to create and disseminate open-source tools for storing, sharing and analyzing life sciences information [Real-World Evidence In Support Of Precision Medicine: Clinico-Genomic Cancer Data As A Case Study, health affairs, vol. 37, no. 5: precision medicine]. Additionally, health tech startups and non-traditional players such as Apple are coming into this space with their own patient records applications. Apple applications will be used not only to support patient recruitment and clinical decision tools, but also in the core foundation around data and insights. Because patients are the bioreactors, combining real-world data with clinical and manufacturing data will provide useful insights to advance the development and placement of CGTs in the marketplace.

6. IT infrastructure enablers—Organizations that provide tools that facilitate the collection, breakdown and analysis of disparate patient, tissue, transport, manufacturing and health outcomes data. These digital disruptors will galvanize the convergence of healthcare transformation by integrating operating models, bringing together people, process and technology elements. After reaching a critical threshold of patient numbers, managing data, its exchange among players and the insight it generates becomes cumbersome. Current cell scheduling and tracking tools facilitate end-to-end data collection and allow users to adjust schedules in line with manufacturing capacity and each treatment center’s availability. Using these tools, clinicians can prospectively and retrospectively view and analyze the progress of therapies.

Providers that facilitate data collection and insight generation will be developing next-generation solutions. These companies will build integrated software that orchestrates the cell therapy supply chain for autologous and allogeneic therapies more efficiently. They will look to provide a patient-centric, multi-tenant partner platforms with codified onboarding for all network partners involved in developing and launching CGTs. This will enable collaboration and data sharing, providing real-time contextual visibility of all events and activities, and tracking unique serialized product flows across network partners to the patient's treatment care teams. The embedded track and trace capabilities of the solution will ensure that essential product safety attributes and specifications are continually tracked and reported from supply to patient (such as cold chain conformance, monitoring diversion and counterfeits, tracking chain of custody and recalling, if necessary).

This will reduce "outside-in" supply chain complexity and improve life science companies’ responsiveness, eliminating expensive waste caused by disruptions in patient schedules or other supply chain and manufacturing exceptions.

The next generation of solution providers will address current pain points and provide industry utilities while offering fully integrated and enhanced workflows to enable a superior stakeholder experience—both internal and external—to CGT clinical trial sponsors. They will potentially provide solutions to improve the interoperability of datasets across ecosystem players and enable collaboration and information exchange among them and facilitate scientific and economic insight generation. The solutions will help launch digital IoT transformation programs across the end-to-end supply chain using sensors and tags to sense, capture and analyze real time supply chain trends in-process rather than after the fact.

The evolving marketplace

Today’s healthcare system fosters the development and commercialization of disease management treatments for chronic diseases. Although there’s been tremendous progress in medical diagnosis and treatments, the drug development and care delivery paradigm hasn’t structurally changed much. It was never designed to deal with the vast growth of potentially curative and personalized medicine, now a focus of significant healthcare investments.

The current and projected cell and gene therapies development pipeline and the anticipated commercial demand are challenging the healthcare ecosystem, creating significant constraints in the overall system to deliver potentially transformative therapies to the market. The industry is experiencing unprecedented change, presenting opportunities for industry incumbents to rethink their business models. We believe that the growth in development and commercialization of potentially curative CGTs will drive the business operating model from a centralized, linear value chain to a decentralized model. In the near-term, the decentralized system will co-exist with the legacy linear operating model.

The incumbents have a choice to determine the role they want to play in this evolving marketplace. They can adopt and expand their capabilities, use M&A transactions and/or collaborate with new players to meet the anticipated demand.

Due to the extensive stakeholder interactions and collaboration required, these therapies are driving life sciences companies to start looking at healthcare from the perspective of the patient and other “customers” of the system, including treatment center and apheresis professionals and third-party partners. The proposed decentralized model is similar to other consumer industries, putting customers and influencers at the center of the value chain. The patient-centered, connected hub and spoke system will usher in the future of healthcare—very different from today. The growth of a network of robust treatment centers, wearable technology and remote monitoring will increase the emphasis on gathering and analyzing large amounts of real-world outcomes data that will further accelerate the prevention, proactive diagnostics, development and commercialization of more personalized CGTs.

1 Evolving the Delivery of CAR T-Cell Therapies to the Outpatient Setting, J Clin Pathways. 2018;4(8):42-47

2 http://www.factwebsite.org/News.aspx#news-id1995

3 New center for innovating and manufacturing next-generation medicines planned for metro Boston; Harvard University Press, November 25, 2019

4 Real estate group creating $1.1B gene therapy CDMO at former GSK site; Fierce Biotech, Jan 23, 2020

5 Roots Analysis: Cell Therapy Manufacturing Market (2nd Edition), 2018-2030

6 Datamonitor Healthcare’s Gene Therapy Deal-Making Trends