How Cell And Gene Therapy Is Transforming Healthcare

By Sanjay Srivastava, Ph.D., Managing Director, Supply Chain & Operations, Accenture

First in a two-part series

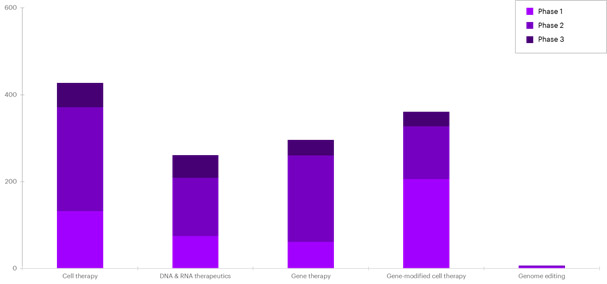

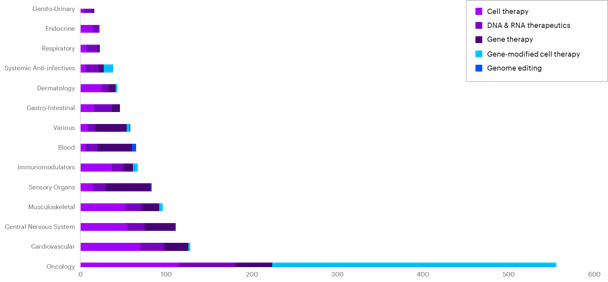

Today we’re seeing several successes in cell and gene therapy (CGT) clinical trials. There has been measurable  progress in the fight against cancer and other diseases using CGT, with stem-cell research leading these efforts.1 By some estimates, there were more than 1,000 CGT clinical trials across a range of modalities [Figure 1] targeting a variety of diseases across therapeutic areas around the world by the end of 2019 [Figure 2].2

progress in the fight against cancer and other diseases using CGT, with stem-cell research leading these efforts.1 By some estimates, there were more than 1,000 CGT clinical trials across a range of modalities [Figure 1] targeting a variety of diseases across therapeutic areas around the world by the end of 2019 [Figure 2].2

We’re also seeing a great deal of financing funneling toward CGT research, with companies raising nearly $2.6 billion in the third quarter of 2019. These funds have added up to a total of more than $7.4 billion going toward CGT research [Quarterly Regenerative Medicine Sector Report, Alliance for Regenerative Medicine Q3, 2019]. Given the number of clinical trials in various stages, the U.S. Food and Drug Administration (FDA) expects that it will receive more than 200 investigational new drug applications a year through 2025. Additionally, the FDA estimates it will approve up to 20 CGT products a year by 2025.3

These potentially beneficial therapies are causing significant ripple effects up and down the social, clinical and economic spectrum. We are seeing vast improvements in disease prevention, diagnosis and management, with the potential to improve patient outcomes and provide larger, significant long-term societal benefits.

However, the rise of success in the research arena brings many challenges. Chief among them: Today’s drug development environment was largely designed around small molecules and biologics such as proteins and monoclonal antibodies, a constrained system that has not significantly changed in 50 years. Additionally, under these limitations, CGT research is showingno signs of slowing down. Research suggests that by 2030, up to 60 new cell and gene therapies could be launched, treating upwards of 350,000 patients.4

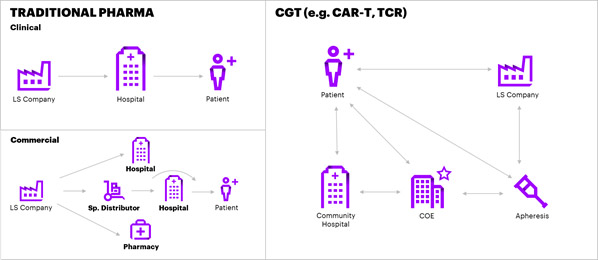

Furthermore, the CGT environment is ill-equipped. The patient, product and value chain for cell and gene therapies are far different than traditional pharma [Figure 3] and requires new and specialized sets of capabilities.

A fundamental shift

The accelerated development in gene therapies is causing a fundamental shift in the traditional biopharmaceutical business model. While the research offers enormous potential social, clinical and economic value, these advances will require new thinking in operating principles across the entire drug delivery value chain. The dynamic pipeline of CGT therapies is constraining sector participants. The drug development system is designed for pills, and the biologics sector urgently needs to adopt new capabilities and address constraints to accommodate growing demand.

We need new capabilities to develop and commercialize CGT at scale while rethinking the end-to-end system. With that, here’s a look at the challenges we face as the CGT development cycle evolves:

Finding and managing the right patient

Patients need to meet specific clinical and health criteria to qualify for trials. A majority of the CGT therapies under development are for monogenic rare diseases with few patients who require first-line treatment, making it difficult to find qualified clinical trial subjects and commercial patients.5 Additionally, a majority of clinical trials—two-thirds—fail to meet their enrollment targets, and about 20 percent of oncology trials fail because of inadequate patient recruitment. Given the overwhelming number of clinical trial options, most trial sponsors and investigators are expected to encounter recruitment challenges.

Additionally, managing the clinical trial subject and patient experience throughout the treatment process is challenging. Unlike traditional therapies, CGT requires significant patient engagement and support during a much longer treatment process. And many life sciences companies as well as treatment centers lack the capabilities to set up a patient monitoring, support and therapy orchestration model.

Over the next three years or so, the industry will need more than 100,000 patients to fully enroll current and upcoming CGT clinical trials. Identifying and accessing the right patients at the right time and managing the recruitment targets within the required timeframe will remain problematic.

Creating a high-touch treatment center model

Scaling operations to manage the increased patient volume, sites also require a robust operational and technical infrastructure. The current legacy model, however, offers clinical trial sponsors limited engagement with site and sponsors, typically interfacing with no more than a few site personnel. To deliver CGT therapies, treatment centers have to engage with clinical trial sponsors’ patient operations and services functions to shepherd patients through the treatment process, which is currently a challenge for most treatment centers.

Collecting raw materials

Typically apheresis centers are strictly used for therapeutic purposes, and clinical trial sponsors must compete for available capacity. Due to complex processes, apheresis centers often allocate more days for stem cell apheresis, and leukapheresis procedures compete with stem cell and other apheresis procedures, creating a capacity squeeze on CGT clinical trial sponsors, physicians and patients.

Autologous CGTs require a process of extracting either immune or stem cells, with specialized handling such as cryopreservation. These processes require just-in-time orchestration of the supply chain and must follow the FDA’s Good Manufacturing Practices, which can be problematic for many centers. Additionally, these centers are required to manage cell processing, packaging and shipment, while following manufacturer-specific processes. The cell labs are typically constrained for storage space and staff and find it challenging to follow non-standard procedures specific to clinical sponsors.

What’s more, the majority of apheresis centers have their own health information technology infrastructure, which is often not interoperable or connected with treatment centers. The lack of infrastructure and data interoperability limits optimization of unit capacity in highly manual patient scheduling and treatment processes.

When clinical trials ramp up near the peak of patient enrollment targets and anticipated commercial launches commence, apheresis capacity will become a critical bottleneck in the autologous CGT treatment pathway. Many centers and cell labs cannot scale efficiently to manage multiple clinical trials and high patient volume.

Orchestrating the cell journey with specialized couriers

Cell and gene therapy logistics is integral to treatment and drug manufacturing, requiring a radically different distribution chain. The supply chain is being reconfigured to serve the new environment where there is limited inventory or no inventory of finished product. The role of a wholesale distributor has diminished while the role of logistics providers have increased. Hence, these therapies have put tremendous pressure on ecosystem participants to orchestrate on-demand and just-in-time supply chain operations, which require robust logistics and asset monitoring capabilities.

While 100 percent of life sciences companies stock cold chain SKUs, less than 5 percent of prescription SKUs require cold chain handling.7 Hence, distributors and third-party logistics providers have limited ultra-cold chain management capabilities to handle the influx of CGT therapies. One-third of the manufacturers monitor the temperature of cold chain products in transit, and the industry has relatively sufficient capabilities to monitor the temperature. However, CGT demands additional variables such as shock and orientation of the sample that needs to be monitored in near real-time. The industry is evolving but currently has limited experience and capabilities to incorporate these types of sensors in the supply chain to manage the deluge of anticipated shipments.

Today, there are very few couriers with the capabilities to meet the rigorous quality standards, special handling and tracking requirements for shipments under refrigerated, frozen and cryogenic conditions. With a minimum of two shipments for every patient and working with more than 500 manufacturers globally, the current capacity and capabilities of the current package and logistics service providers is tightly constrained.

Centralized and high-cost manufacturing operations

Life sciences companies are pursuing cell and gene therapies through in-house development, in-licensing or partnerships. However, the majority of the current CGT developers are startups and small biotech companies.8

Startups have limited resources to acquire data and, as a result, depend on contract development manufacturing organizations (CDMO) to manage cell processing and production. But there are only about 100 CDMOs, most of which are at capacity with long waiting lists.9 Demand simply far exceeds supply. CDMOs and manufacturers are responding by building and buying cell and gene therapy manufacturing capacity and capabilities. Despite these M&A activities, however, there will be a lag as these investments take hold.10,11

What’s more, CGT requires a strategic functional network footprint to manage clinical and commercial operations. The autologous CGT requires a supply chain to be orchestrated within 48 hours, and delivery timelines are easily disrupted by patient-specific issues, resulting in delays or lost treatment opportunities.

Ensuring patient safety

Transformation in the cellular mechanisms puts clinical trial subjects and commercial patients at increased immunologic risk, which would typically require assessment over a number of years. In fact, in some cases, the FDA requires clinical trial sponsors to monitor trial subjects for up to 15 years.

Throughout the treatment journey, managing patient safety is complicated for institutions handling patient changes. During the clinical trials, the principal investigator and patient care teams within the clinical sites are key in ensuring patient safety during the first 30 days post-infusion. For long-term monitoring, a majority of patients enrolled in extensive studies and commercial patients who have undergone CGT, referring physicians in municipal non-certified centers are pivotal to ensure patient safety and assess long-term durability of the therapy.

While there are official guidelines on conducting long-term follow-up studies, there are still several questions about capturing and utilizing data. As the patient volume increases, the challenges of managing long-term follow-up data increase dramatically. As more patients undergo therapy in both clinical and commercial settings, the sheer volume of data to collect will increase exponentially. Additionally, with so much variability in outcomes among various CGT candidates, the factors that drive therapy success remain to be defined.

The next piece in this series addresses some ways we can overcome the challenges to CGT outlined here to make a lasting, positive impact.

1 Quarterly Regenerative Medicine Sector Report, Q3 2019

2 Ibid 1

3 Statement from FDA Commissioner Scott Gottlieb, M.D. and Peter Marks, M.D., Ph.D., Director of the Center for 1 Biologics Evaluation and Research on new policies to advance development of safe and effective cell and gene therapies, January 15, 2019

4 Estimating the Clinical Pipeline of Cell and Gene Therapies and Their Potential Economic Impact on the US Healthcare System, ScienceDirect, Value Health. 2019 Jun;22(6):621-626

5 Ibid 1

6 Foundation for the Accreditation of Cellular Therapy. FACT Accredited Organizations. 2018. http://accredited.factwebsite.org/

7 90th Edition HDA Handbook

8 Gene-ie in a bottle: gene therapy opportunity is a treasure trove but CMOs lack capacity, Global Data Healthcare, October 28, 2019

9 Ibid 6

10 Roots Analysis: Cell Therapy Manufacturing Market (2nd Edition), 2018-2030

11 Future of gene therapy manufacturing is a concern for investors and industry alike. Pharmaceutical technology, May 2019