Cell & Gene's 2020 Outlook: Supply Chain, Drug Pricing, Outsourcing, And More

By Erin Harris, Editor-In-Chief, Cell & Gene

Follow Me On Twitter @ErinHarris_1

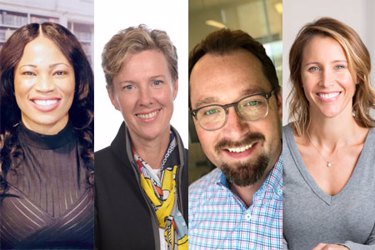

In the final segment of Cell & Gene’s 2020 Outlook series, you’ll hear from Natalie Holles, President & Chief Executive Officer of Audentes; Ryan Bartock, Head of Supply Chain and Network Strategy at Spark Therapeutics; Janet Lambert, CEO of Alliance for Regenerative Medicine (ARM); and Sophia Ononye-Onyia, PhD MPH MBA, Founder and CEO at The Sophia Consulting Firm. These industry luminaries and Cell & Gene Editorial Advisory Board members provide their insightful outlooks as it pertains to their role in the sector.

Be sure to read (or re-read) our entire 2020 Outlook series. Bruce Levine, Ph.D. detailed 7 trends to watch in cell and gene sector, and Bruce Bunnell, Ph.D. shared valuable data on three intense areas of stem cell research. Rachelle Jaques, CEO of Enzyvant, Jamie Ring, Head of Patient Advocacy at Spark Therapeutics, and Mark Rothera, President and CEO of Orchard Therapeutics discussed continued momentum in regenerative medicines, demystifying gene therapies, and treatment of disorders of the CNS respectively.

Ryan Bartock, Head of Supply Chain and Network Strategy at Spark Therapeutics on the outlook for Supply Chain in 2020 for the gene therapy space.

In two words, rapid growth.

Last year Scott Gottlieb, former commissioner of the FDA, stated that the Agency expects to see more than 200 INDs in gene and cell therapy products per year, and by 2025, they’re predicting 10 to 20 cell and gene therapy product approvals each year.

The industry is continuing to see strong financing activity comprised of IPOs, Follow-Ons, venture capital investments, and other corporate partnerships. More drug candidates are approaching late-stage and commercial milestones and therapeutic targets are beginning to shift from rare diseases, which typically require smaller batches to diseases with higher incidence/prevalence and higher demand. All of this makes for increased pressure across the supply chain.

As a result, I expect to see more companies making investments to scale process productivity and capacity in 2020. These initiatives will take time to realize, so limited capacity will continue to persist, and available capacity will come at a premium as external manufacturing and testing partners continue to build expertise.

Supply chain leaders should continue advancing the fundamentals to manage risk AND seek to innovate in order to keep pace with this growing demand without compromising quality, service, and cost.

Gene therapy supply chains will continue looking for opportunities to secure supply by creating redundancy and predictability. This means de-risking the supply of critical raw materials, intermediates and components, internalizing investments in process productivity, consistency and in manufacturing/analytical capacity.

Outsourcing production and testing will still be part of the industry’s story in the near term, which means innovator companies will be looking for external partners to increase collaboration, data generation, and knowledge management to reduce tech transfer errors and supply cycle times.

Recent events like the Australian wildfires and coronavirus outbreak should prompt a fresh look at business continuity planning, response logistics and disaster recovery.

Automation and digital technologies are continuing to mature and will become increasingly important as our portfolios and supply chains become more complex. Creating digitization roadmaps to connect, collect, and mine data on physical and information flows will be important for continued optimization of demand/supply planning and distribution.

This is a time of unprecedented growth that’s been decades in the making, and 2020 will no doubt have its fair share of excitement, challenges, and changes. That said, one motivation for supply chain leaders remains unchanged — patients are waiting.

Janet Lambert, CEO of Alliance for Regenerative Medicine (ARM) on the overall outlook for the cell and gene sector in 2020.

There will be several significant milestones for the cell and gene therapy sector in 2020. There are over 1,000 clinical trials underway in regenerative medicine, and 94 of those are in Phase 3. Consequently, we’re expecting a substantial number of data readouts — including several from late stage trials — this year. We’re also expecting a number of product approvals to be announced. In gene therapy particularly, the number of approved products on the market could easily double in the next one to two years.

On the technology side, we’ve seen a lot of interest in improving cell and gene therapy manufacturing and delivery, and I expect that will continue to be a significant theme for the sector in 2020. Specifically, I think we’ll see advances to combat immunogenicity. And as cell-based immuno-oncology continues to advance as a field, we’re anticipating increased development activity in allogeneic therapies, particularly in those utilizing iPSCs.

2019 was the second strongest year for regenerative medicine financings on record, with therapeutic developers raising nearly $10 billion. In 2020, the demand for financings will likely continue to be strong. While the IPO market may be constrained by the US election cycle, overall, the indications are for another robust year for financings in the sector, especially in venture financing and corporate partnerships.

Finally, we’re expecting that the policy environment will continue to be supportive of cell and gene therapies. There has been a lot of focus over the past year on reimbursement and innovative financing models, such as value-based payments and annuities. As additional products are approved, I expect that we will see more of these alternative payment models adopted by both public and private payers. The Senate Finance Committee’s proposed drug pricing plan, approved by the committee last July, included a provision allowing state Medicaid programs to enter into value-based payment models for gene therapies for rare diseases. As the drug pricing conversation continues, it is vital that ARM and other sector stakeholders continue to emphasize the value of these transformative therapies and the need to work collaboratively to adapt current payment models.

The European Medicines Agency (EMA) and U.S. FDA have been very proactive in engaging with stakeholders in the regenerative medicine sector. In 2020, we expect additional cell and gene therapies to receive the EMA’s PRIME designation, as well as the FDA’s RMAT designation. We also anticipate additional FDA enforcement activities against clinics advertising unapproved stem cell therapies (the period of enforcement discretion comes to an end in November), and increased international dialogue on point-of-care therapies, including the Hospital Exemption in the EU. ARM will continue to work with all stakeholders to develop and promote the necessary policy frameworks to help advance these potentially life-saving therapies.

Natalie Holles, President & Chief Executive Officer, Audentes, An Astellas Company on the major trends to expect in the cell and gene development this year.

There are three major trends that I think we are going to see in cell and gene therapy development in 2020.

First, manufacturing is going to be a critical focus from both a technology and capacity perspective. Both will need to converge in order to find more productive means to manufacture as we continue to see an influx of companies and a growing number of promising therapies being developed. It is exciting to watch the manufacturing element evolve and the realization that it is such an important part of the success story of bringing our treatments to patients.

Second, as the field begins to gain more experience in the development and manufacturing of genetic medicines/cell and gene therapies, there is a new opportunity to expand our scope and focus beyond rare conditions to more common diseases and to broaden the reach of our technology to a larger subset of specialized medicines. This is one of the key opportunities we see in our recent merger with Astellas, which will allow us to invest beyond our current portfolio into some of these next-generation research initiatives.

Last, I think we are going to begin to see an expansion of geographic focus and reach with these medicines. Through the power of global companies, it is possible to expand our work more quickly and efficiently to global markets. This is certainly the case with Astellas where we will look to bring our medicines, in particular, to the Asian markets. This is exciting, because these advanced technologies now have the potential to reach patients all over the world.

Sophia Ononye-Onyia, PhD MPH MBA, Founder and CEO at The Sophia Consulting Firm on three major points to consider in 2020.

Cell therapies, particularly CAR-Ts, will continue to remain prominent with the potential approval of at least one BCMA CAR-T for multiple myeloma management. Here are three major points to consider in 2020:

- Drug pricing and reimbursement dynamics will remain hot topics particularly for new cell and gene therapies that are considerably more expensive than other small molecule drugs

- Patient advocacy will become more important as evidenced by emerging social and online communities particularly for rare, genetic disorders.

- Technology will become more pivotal to success as more life science companies partner with technology firms to improve R&D efficiencies through artificial intelligence, nanotechnology, and other new technologies.