Why Elevating Responsibility To The C-suite Can Help Avoid Manufacturing Missteps

By Omkar U. Kawalekar, Hussain Mooraj, and Amit Agarwal, Deloitte Consulting LLP

Cell and gene therapies (CGTs) have quickly emerged as one of the most transformative innovations in biopharmaceuticals in recent times. CGTs are being tested in therapeutic areas (TAs) beyond their initial oncology focus to include neurology, ophthalmology, and COVID-19 treatment. Today there are over 1,000 CGT products in phase I-III clinical trials globally[1] and experts predict that within 10 years up to 60 new CGTs could be launched, treating about 350,000 patients in the United States alone.[2]

CGT commercial success hinges on early planning to scale manufacturing and supply. This is evident from difficulties reported in scaling up manufacturing for the recently approved COVID-19 mRNA vaccines,[3] as well as recent delays in the launch of CGT products (see callout box). CGT manufacturing executives are, therefore, under immense pressure to make strategic decisions that enable flawless orchestration of manufacturing operations, avoid regulatory hiccups, and achieve operational efficiency and cost-effectiveness.

CGT companies encounter and overcome manufacturing hurdles to CGT product launches

- Manufacturing concerns delayed the launch of Bluebird Bio’s highly anticipated drug Zynteglo in 2019 as regulators required the company to "tighten up" its manufacturing before treating its first commercial patient.[4]

- Even after an FDA approval, in 2019 Novartis’ Kymriah faced manufacturing related concerns with cell variability, which were recently addressed.[5]

- Juno received multiple observations during FDA site inspection(s) in 2020, highlighting the need for more robust manufacturing and quality processes, delaying its product launch until 2021.[6]

Unlike traditional pharmaceutical production, CGT manufacturing does not take place within the four walls of a single facility. It’s a multi-step, multi-stakeholder, and multi-facility process. Deloitte spoke with technical operations executives from leading CGT organizations to understand what factors they consider when making strategic manufacturing decisions. They identified three critical priorities:

- Creating a consistent product that is efficacious in humans, regardless of the subject-to-subject variability in the starting material

- Reducing labor-intensity via digitization and/or automation

- Minimizing patient wait time to receive the therapy by streamlining the manufacturing and supply chain

“When the first [CGT] commercial products were launched, the industry was not ready. No one knew what it takes to get these products sourced, manufactured, and delivered with(in) the existing pharma infrastructure.” – CGT executive

While each CGT company’s situation is unique, most of the executives we spoke with agreed that addressing the following issues may help organizations navigate the manufacturing decision journey to achieve improved clinical and economical effectiveness.

How and when to scale-up or scale-out. At the onset of the CGT era, companies acquired academic assets to accelerate commercialization. Manufacturing scale-up was often an afterthought. CGTs, which were initially developed using lab bench manufacturing techniques, were not as reproducible as industrial-scale manufactured products. Maintaining scale-up consistencies and cost-effectiveness needed to be addressed early in the asset’s lifecycle. We often hear technology executives stating that the chasm between start-up and scaled manufacturing can be exceptionally expensive and needs to be addressed very early in the game. In addition, moving from clinical studies to market is significantly faster for CGTs as compared to more traditional therapies, so starting with a robust, commercial-ready manufacturing process from day one becomes paramount. “When designing early-phase clinical trials, CGTs should consider chemistry, manufacturing and controls (CMC) issues and think proactively about the materials and equipment they use because once the promising clinical data appears, it’s hard to change the process,” noted the head of CMC at a gene therapy company.

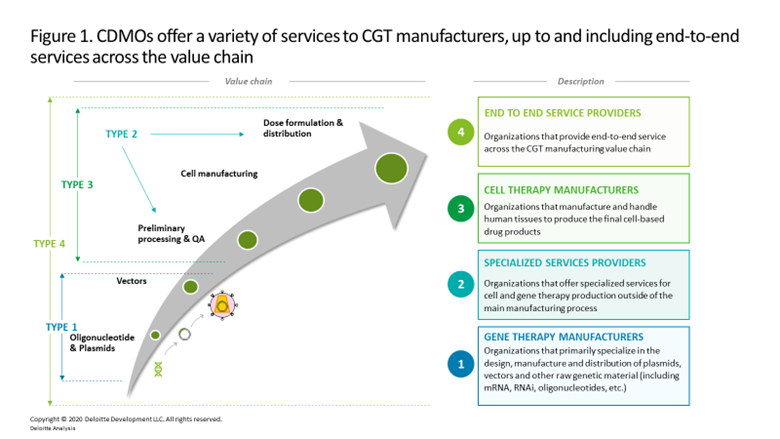

What, when, and with whom to outsource. Many early-stage CGT developers rely on contract development and manufacturing organizations (CDMOs) that offer specialized or end-to-end services (figure 1) to bridge manufacturing until the company matures and can shift production in-house. This practice is explained by:

- A company’s strategy to build-up internal capabilities for future products. As organizations grow, they aim to scale the technology both within an indication and for other indications. Many companies view the ability to quickly iterate on their manufacturing processes as a competitive advantage.

- Manufacturing capacity is highly constrained, particularly for lentiviral and AAV vectors. Supply reliability is critical for commercial products that are made-to-order and where a stockout means that a patient doesn’t get treated.

- Companies considering future insourcing to be a key lever to slash their cost of goods. The cost of leasing a dedicated suite in a CDMO for CGT manufacturing can be north of $1 million annually, not including hefty non-refundable reservation fees of about $10-$15 million. In recent years, CGT therapeutic companies have invested between $80 million to $155 million to build and renovate GMP-compliant manufacturing facilities, which excludes annual operating costs or the incremental expense to obtain cGMP certification.[7]

When and how much to invest in building supportive digital infrastructure. A common pitfall in foundational CGT technical architectures is designing processes rigidly around a single manufacturing source. Executives have voiced frustration with legacy systems and architectures that hamper maximum capacity utilization and manufacturing efficiency when scaling up. This creates a ripple effect of insufficient and unreliable supply capacity, which can slow therapy adoption and grant competitors the opportunity to usurp market share.

Another common challenge is difficulties onboarding and integrating CDMO and manufacturers’ systems, which can lead to lack of visibility into the batch status and quality batch records. CDMOs do not always have the technical capabilities or compatible legacy systems to match the CGT developers’ internal plant operations. Internal plants commonly leverage enterprise resource planning (ERP) or manufacturing execution systems (MES), which only capture internal manufacturing movements, are only accessible to internal users, and do not easily synchronize with systems on a CDMO’s floor.

What do to with mined (or missed) data. Many interviewees have admitted they lack awareness of all the data they collect and possess. Additionally, some of the data they have access to is not mineable. Being able to consume manufacturing data through methods including real-time process monitoring, predictive production analytics, lot quality predictive analytics, and identification of process variables effecting yields can help achieve manufacturing excellence. Case in point: The need for data analytics that can address multiple variables is well illustrated in viral vector manufacturing, a key, multi-step production process for many CGTs that has unavoidable and unpredictable variability within each step. Such variability has direct impact on product yield, titers, and purity. Surveying and drawing insights from these variables could be leveraged to refine and streamline the overall process and produce a more consistent, reliable and a predictable output. However, most companies currently have limited bandwidth to build an analytics engine on the manufacturing floor even when data may be available.

How to acquire and retain talent. Skilled and experienced manufacturing talent is in short supply across the CGT industry. Organizations located in academic hotbeds (e.g., Philadelphia, Boston, San Francisco) with local universities graduating trained scientists have had greater success with their recruitment efforts. As one executive commented, “being situated in talent-rich areas takes precedence over tax breaks.” However, even these companies face talent challenges. The CGT industry is nascent, and few academic graduates have experience in scaling manufacturing process from the lab bench to commercial scale. “Poaching” experienced talent has become commonplace but is hardly a sustainable solution. Instead, we believe that companies should partner with academic institutions to create CGT manufacturing training programs to increase the talent supply. In addition, companies should grow talent organically by training those who come in at early levels as quickly as their capabilities allow.

How much to automate. Current CGT manufacturing processes are manual and require multiple handling steps, making high costs and high batch failure rates the norm. Deloitte estimates that about 35-50 percent of the cost of manufacturing a CAR-T product batch is attributable to labor. While several advanced manufacturing technologies are under development, including automated closed loop systems and robotics, manufacturers are still playing catch-up.

Preparing for the Future

There likely will be no one-size-fits-all approach to maturing and industrializing CGT manufacturing. Every organization will need to evaluate its strategic aspirations, capabilities, market conditions, and risk appetite to determine the path forward. Based upon our experience assisting multiple CGT manufacturing organizations, we suggest that executives consider the following actions:

- Elevate manufacturing and supply chain to a C-suite issue. It is important to designate manufacturing as a C-level decision during the prenatal stages of a CGT business’s establishment. Time, effort, and capital investments to build manufacturing capabilities are substantial, and can increase dramatically if actions taken during early clinical stages need to be redone for commercial readiness. Ensuring that manufacturing-related discussions are an established C-suite agenda item can help avoid missteps.

- Open the door to external stakeholders for manufacturing design discussions. CGT manufacturing and supply chain processes should not be designed in silos. Manufacturers should conduct “voice of the customer” assessments that include patients, physicians, and hospitals to understand current protocols and preferences. Marrying stakeholder inputs with internal process design can help minimize disruptions and training time, and boost therapy adoption.

- Embrace innovation. Certain aspects of CGT manufacturing are standardized—for example, the production of oligonucleotides and plasmids—however, there is ample opportunity for CGT companies to embrace innovation in other CGT modalities. Already, technologies have advanced from robotic arms-based cell seeding and media pipetting to complete automation on a sequence of operational units working in tandem to facilitate scale-up and continuous process validation and monitoring. Stem Cell Factory, AUTOSTEM, Breez (by Erbi Biosystems), are a few such innovative manufacturing technologies to explore.

- Go digital or perish. In a world where technology drives transformation, long-term value can be enabled by employing robust industrialization plans that marry business and technology strategies. These plans should include investments in digital capabilities and systems that provide flexibility and compatibility. We suggest selecting systems that have native synergies to each other and the company’s unique manufacturing process. Also, explore atypical technologies that draw references from other industries. An example is the use of a blockchain-based distributed ledger system that provides end-to-end traceability of authenticated records of raw materials, reagents, and the final drug product. CGT traceability and manufacturing process management could be expanded to help manage products in transit. Hypertrust and Schrocken Inc. are examples of vendors creating innovative solutions in this area.

CGT manufacturing is costly, complex, and high-risk. The decisions executives make to build-out their company’s infrastructure, processes, and talent pool can have significant near- and long-term consequences. CGT executives can strengthen and simplify the decision-making process by focusing on early and small wins: assembling the right team with the right skillsets; building incremental, interoperable, and scalable point solutions rather than a complex manufacturing network; and understanding potential pitfalls in established and new systems and processes as well as opportunities for continuous improvement.

# # #

This is the first in a three-part series of strategic insights for CGT CxOs and senior executives. The next article is addressed to the CIO/CTO and will discuss how a digital operations command center (or digital core) can help optimize CGT operations:

“The life cycle of a typical CGT order touches multiple independent entities, from patient enrollment by a prescribing care team, to material sourcing, logistics legs, infusion centers, cryo-preservation labs, distribution depots, and internal or external manufacturing plants. A digital core enables all parties to see common information that increases the processing efficiency of each unit, while enforcing required traceability, audit trails, and other regulatory laws. This article will focus on the frameworks for evaluating the underlying systems that support and enhance these digitized processes as the system is developed and matures.”

Hussain Mooraj is a principal at Deloitte Consulting, leads the Next Gen Therapy practice, and is the New England regional lead for life sciences. Mooraj brings more than 25 years of experience in manufacturing, supply chain, enterprise technology, sales and marketing, and strategy consulting to his role. He works closely with senior executives from global life sciences firms, helping them transform their end-to-end businesses and build start-up organizations to launch life-saving new therapies, especially on the CAR-T and gene therapy side.

Hussain Mooraj is a principal at Deloitte Consulting, leads the Next Gen Therapy practice, and is the New England regional lead for life sciences. Mooraj brings more than 25 years of experience in manufacturing, supply chain, enterprise technology, sales and marketing, and strategy consulting to his role. He works closely with senior executives from global life sciences firms, helping them transform their end-to-end businesses and build start-up organizations to launch life-saving new therapies, especially on the CAR-T and gene therapy side.

Amit Agarwal is a managing director in Deloitte Consulting’s life sciences practice. He has more than 25 years of management consulting experience and has led multiple projects in both strategy and operations. Agarwal co-leads the Next Gen Therapy practice, which focuses on advising clients on taking advantage of and/or developing strategic responses to new disruptive technologies which leapfrog older business models and establish new clinical practices. Agarwal has worked with life sciences clients in the U.S., Europe, and Asia on high-impact projects. He holds an MBA in finance and technological innovation from the MIT Sloan School of Management and a bachelor’s degree in history and pre-med from Occidental College.

Amit Agarwal is a managing director in Deloitte Consulting’s life sciences practice. He has more than 25 years of management consulting experience and has led multiple projects in both strategy and operations. Agarwal co-leads the Next Gen Therapy practice, which focuses on advising clients on taking advantage of and/or developing strategic responses to new disruptive technologies which leapfrog older business models and establish new clinical practices. Agarwal has worked with life sciences clients in the U.S., Europe, and Asia on high-impact projects. He holds an MBA in finance and technological innovation from the MIT Sloan School of Management and a bachelor’s degree in history and pre-med from Occidental College.

Omkar U. Kawalekar, PhD, is a manager in Deloitte Consulting LLP’s Strategy & Analytics practice and leads eminence for Deloitte’s NextGen Therapy practice. With a graduate degree in cell & gene therapy from the University of Pennsylvania, he has primarily worked with executives at small and large biotech companies, defining and implementing transformative capabilities as they develop, manufacture, and commercialize cell and gene therapies. He continues to present at numerous scientific conferences and publishes regularly in this field.

Omkar U. Kawalekar, PhD, is a manager in Deloitte Consulting LLP’s Strategy & Analytics practice and leads eminence for Deloitte’s NextGen Therapy practice. With a graduate degree in cell & gene therapy from the University of Pennsylvania, he has primarily worked with executives at small and large biotech companies, defining and implementing transformative capabilities as they develop, manufacture, and commercialize cell and gene therapies. He continues to present at numerous scientific conferences and publishes regularly in this field.

[1] https://www.biopharma-reporter.com/Article/2020/03/16/Growing-pipeline-of-cell-and-gene-therapies

[3] https://blogs.bmj.com/bmj/2021/03/17/scaling-up-covid-19-vaccine-production-what-are-the-problems-and-implications/.

[4] https://www.fiercepharma.com/manufacturing/bluebird-bio-s-delays-zynteglo-launch-as-manufacturing-trips-up-another-gene-therapy.

[5] https://www.biopharmadive.com/news/novartis-kymriah-car-t-manufacturing-difficulties-cell-viability/568830/.

[6] https://www.fda.gov/media/144142/download.

[7] Deloitte analysis of several CDMO contracts in the US (data as of Nov 2020).