Shaping A System That Enables Patients To Access High-Cost Cell & Gene Therapies

By Boris Bogdan, M.D., Managing Director, Sandra Dietschy-Künzle, Ph.D., and Sanjay Srivastava, Ph.D., Cell & Gene Therapy Lead, Life Sciences IX.0/SCO Practice at Accenture

Cell and gene therapy (CGT) is revolutionizing healthcare, promising access to more personalized care and better health outcomes. CGT development is also speeding up, with more than 771 therapies currently in the clinical development pipeline.1 But costs can be prohibitive, so new payment mechanisms are being considered to ensure that access to CGT is equitable, that patient experiences are optimal, and that desired health outcomes can be achieved. The health and life sciences industry needs to create an effective financial system to support the complex new payment structures (outcome-based, high value, less frequent) being adopted.

CGT therapies’ upfront cost is much higher than conventional therapies, which are often reimbursed on a per-unit basis over an extended treatment period. For many genetic conditions, the high cost of CGT is lower than the lifetime cost of conventional treatment, which helps to justify the initial expense. However, CGT’s long-term effectiveness is not immediately apparent. The combination of high upfront costs and uncertainty about long-term efficacy is difficult for payers to swallow. That means broad access remains prohibitively expensive for most patients.

Payment Innovation is Happening

The industry recognizes that widespread patient access to CGT will require current therapy-payment systems to change. Several alternative innovative payment concepts are already being tested. The alternatives spread reimbursement costs over time and share the risk between the payer and the manufacturer using annuity-based payments or outcome-based payments. Accenture research indicates that a fraction of payers currently reports that outcomes- and value-based contracts represent a quarter of their portfolios. However, 38 percent of payers believe that in five years at least a quarter of their contracts will be value- or outcome-based. By 2025, payer executives expect 30 percent growth in value- and outcome-based contracts.

Operational Challenge

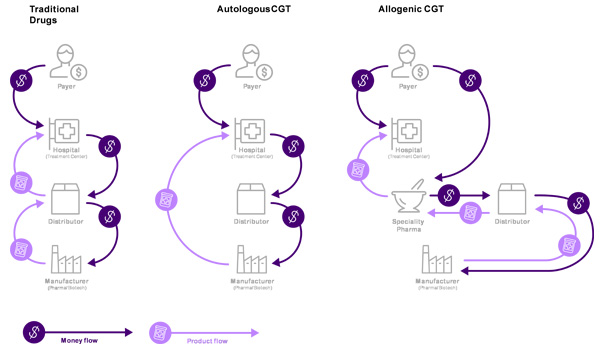

The challenge in going live with innovative payment concepts is the disparity between conventional and CGT treatments’ payment and delivery processes, and the lack of financial and administrative systems to support unique CGT payment arrangements (Figure 1).

With conventional treatments, wholesale distributors play a key role in the order, product, and payment flows (as intermediaries between hospitals and manufacturers). Distributors may keep products in stock, or order as needed from manufacturers. They then accept payment from the hospital and deliver the product.

CGT distributors typically do not keep inventory. For autologous2 CGT, the product is manufactured for a specific patient, only when ordered, and shipped directly from the manufacturer to the hospital. In certain cases, direct shipment may not be possible for quality or regulatory reasons. In cases of direct shipment, distributors operate as intermediaries for orders and payments, billing the hospital and paying the manufacturer. In this situation, distributors handle information and financial flows, but no physical product. For allogenic3 CGT orders, product ownership is transferred from manufacturers to specialty pharmacies and then to the hospital, with distributors acting as intermediaries between manufacturers and treatment centers.

The current system has limited ability to support CGT:

- The billing services in a “fee for service” financial model is not a core activity for distributors. Additionally, there is limited incentive to offer this service for a small transaction fee, or to work with smaller players like specialty biotech companies.

- As more complex payment mechanisms and diverse contract types are adopted for CGT, specialized contract and payment process design support is needed. A robust process with simple, flexible contracting model for different asset modalities, markets, and payers is essential. Developing this process for each individual manufacturer would be highly resource intensive. Smaller biotech companies are unable to deploy the legal and financial resources needed for complex innovative financing mechanisms.

- Smaller companies with limited resources have trouble handling deferred cash flow from outcome-based contracts and annual payments.

Emerging Operating Models

The added operational complexities associated with CGT will likely accelerate the emergence of new, digital operating models to manage order-to-cash processes. Traditional and non-traditional players, and newcomers from adjacent industries, will enter the market to simplify operations. As new models develop, ecosystem stakeholders need to find ways to contribute to transformative therapy delivery.

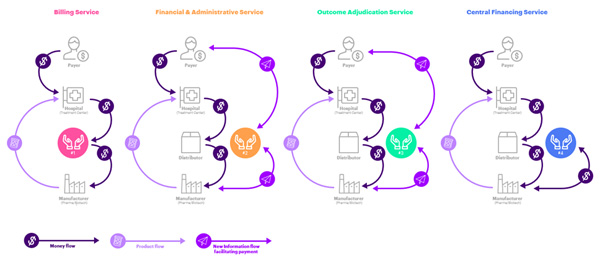

We envision four digitally enabled operating models with cross-sector data sharing to operationalize CGT payment: billing service, financial and administrative service, outcome adjudication, and central financing (Figure 2). In fact, the first model is already operational, addressing the evolving business transactions to manage CGTs.

- Billing services: manage financial flows for autologous CGTs (currently provided by distributors). Small manufacturers are often left out as they have no established relationship with the large distributors, and there is little incentive for distributors to provide CGT transaction-based billing support. The business model for billing services is based on fee-for-service or transactions to facilitate fund transfer.

- Financial and administrative service: clearing houses to administer financial services for CGT manufacturers. New market entrants will likely support small biotech companies and facilitate financial transactions. Innovators could administer end-to-end order to cash process (O2C) management, including business processes related to claims, accounts receivable, payment collection, and credit risk management. Small biotech manufacturers without the resources to support complex contract administration could transact with new entrants on a fee-for-service or commission basis.

- Outcome adjudication (for payers and manufacturers): an independent trusted third party who would track outcomes against targets, capture efficacy and safety, and adjudicate payments to manufacturers. Such an entity would provide complete contracting and financial administration services, and facilitate contract setup (negotiation, outcome and metric agreement, value-based standard definition, and provider/pharmacy eligibility) and manage revenue (claims management, accounts receivable, payment collection, credit risk management). This would mitigate potential conflicts of interest where the payer or manufacturer is responsible for patient outcome evaluation based on hospital data. A trusted third-party could combine data pools from multiple hospitals to assess a treatment’s benefit — a great benefit to both payers and manufacturers. The cost would be split between payer and manufacturer, and either party could purchase the broader data analysis for their own purposes.

- Central financing (for manufacturers): a newly formed third party financial intermediary, paying the manufacturer for treatment up front, and taking over the longer-term (annuity- or outcome-based) payment contract. Payment to the manufacturer would be discounted to reflect risk and delayed cash flow, which the financier would capitalize. The financier could further benefit from a lower cost of capital because of the pooling of risk in its portfolio. A major benefit for the manufacturers would be having cash in hand to cover their costs, invest in innovation and mitigate the risk of non-payment.

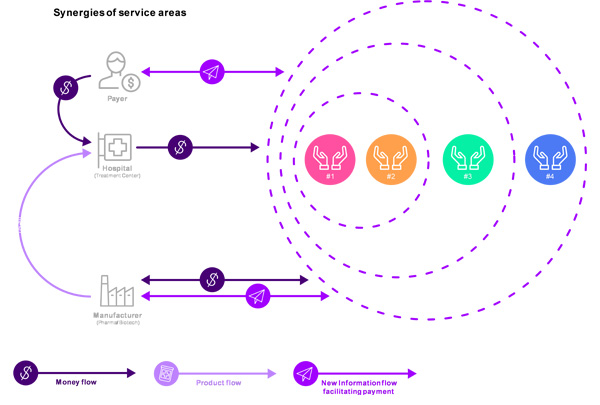

Information and payment flow would be transformed, and the first three models (billing, contract and financial administration, and outcome adjudication) could be combined to create obvious synergies. (Figure 3).

Incumbents Have an Opportunity to Participate in the Shift

Any of these four operating models could be adopted by existing players, or by new entrants who could replace or supplement traditional players and offer one or more of the services. There is a general belief that managing reimbursement with payers is onerous. The two sides have different priorities so it can become adversarial. A third party-brokered solution could ease that tension. We believe that a central financial institution acting as an intermediary between payers and pharmaceutical developers would be well positioned. The intermediary would provide different reimbursement models, payment forms and insurance products suited to CGT. Such an entity will serve as an industry utility to provide services to both big and small ecosystem partners, including CGT manufacturers.

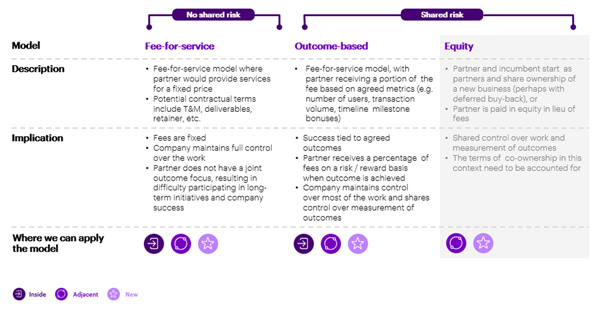

While such an entity could be built organically, we believe there is a strong case for incumbents to partner with an intermediary financial services supplier. As shown in Figure 4, there are several partnership options, from a fee-based service model to an outcome-based model, to co-investment in a joint venture. Depending on their choice of where and how to play, incumbents can determine which partnership model best suits them, and identify appropriate partners to engage with. The new business could be operated by the incumbent company completely within the business, be adjacent to the current core business or be an entirely new organization completely outside the organization.

Better Access Means Better Health Outcomes

Existing healthcare systems are geared to manage traditional biopharmaceutical products. Since CGT was first launched a few years ago, innovative reimbursement models (like amortized and outcome-based models) have been developed, but several challenges remain. Aside from potential legal and regulatory barriers to these new payment models, both business and cash flow processes to facilitate better interactions between manufacturers and payers need to be reinvented. The industry sits on the brink of a global explosion in the use of CGTs. That explosion means incumbents must decide how to adapt their organizations to either partner or compete with new entrants — and remain relevant players in a disrupted industry. Either way, the new models will evolve, and patients will enjoy better access to specialized CGTs.

- Alliance for Regenerative Medicine, 2020, Annual Report Highlights Record Sector Growth and Resilience in 2020, https://alliancerm.org/press-release/alliance-for-regenerative-medicine-annual-report-highlights-record-sector-growth-and-resilience-in-2020/ (accessed 07/9/2021).

- Manufactured from cells obtained from the individual

- Manufactured from cells obtained from another individual (not the same as the patient)