Scaling Cell & Gene Therapies For The Healthcare Industry: Industry Requirements, Healthcare Personnel Perspective

By Jamie Drost – Technology Delivery Consultant, R&D; Kealy Walters – Management Consultant, Cell & Gene Therapies; Samantha Rubin – Management Consultant, Cell & Gene Therapies; and Dr. Sanjay Srivastava – Managing Director, Cell & Gene Therapy Lead at Accenture

Direction Of Travel

The effectiveness of cell and gene therapies (CGT) captured the clinical and pharmaceutical markets attention, causing many companies to expand their pipeline to include these new therapies. The current market uses autologous therapies to treat rare cancers and diseases. The success of these therapies brought growth to the industry, with a predicted annual growth of 18% from 2021 - 2023 [1].

CGT is a constantly evolving space, and we are in the midst of a transition to a new age within the market. CGT 1.0, as we call it, was focused on rare disease autologous treatments, however, technology is looking forward to a new era, CGT 2.0, with an expansion beyond just orphan drugs, into lower cost, allogenic therapies. Lower costs and a larger number of disease states will come with its own set of unique challenges, requiring industry players to adapt to this market shift.

Allogenic therapies recently entered the market mainly targeting chronic diseases. These allogenic therapies are starting to roll-out, such as Atara’s “off the shelf” T-cell therapy, Ebvallo, that recently received approval in Europe. Experts predict this new wave of cell and gene therapies, CGT 2.0, will cause a drastic increase in the number of patients and a significant shift in the market landscape. This widespread treatment will increase accessibility by offering the ability to scale, lower the costs of treatments, and increase patient volume.

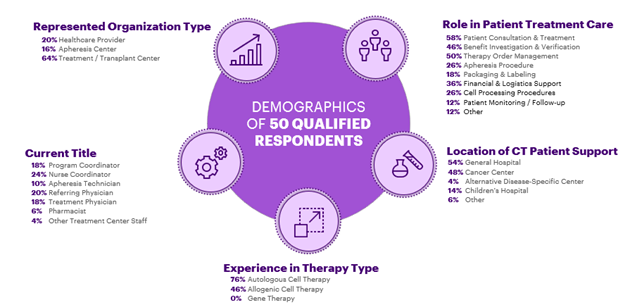

The Accenture team released a quick survey to 50 healthcare provider practitioners within the CGT space to directionally assess the impact of market evolution towards mainstream treatments and increased patient access to CGTs. The survey results confirm and validate the general assumptions about the challenges and opportunities within this new market and warrants further investigation. We have done some preliminary work with industry practitioners to understand if these challenges and opportunities are already present, and what they are experiencing and planning to do as this market shift occurs. We will follow up this article with detailed findings in coming months.

Survey Respondents Span Entire Patient Treatment Value Chain

The industry is accustomed to the growth rate of the CGT 1.0 market, however, the predicted CGT 2.0 patient volume increase of 2x – 3x will significantly strain the healthcare system. The current healthcare model is built around customization and low patient numbers. While many of the CGT 1.0 attributes will be applicable to CGT 2.0, the infrastructure and capabilities must be expanded to support the increase in patients and treatments. In the survey, we asked healthcare practitioners about two bottlenecks in the healthcare system: treatment centers and manufacturing capabilities, and their experience in managing complex patient treatment protocols. Across the respondents, 86% of healthcare providers (HCPs) said they were under-prepared for the projected growth in patient volume. The exposed challenges in the current infrastructure will crack under the increased pressure in

CGT 2.0 if capabilities are not built to support them.

Appetite For Universal Solutions & Expanded Capabilities

With the expansion of cell and gene therapies currently approved for commercial use, as well as the large number in clinical trials, the quantity of branded treatment center portals (TCP) has also risen. This surge in the number of treatment center portals has become an increasingly apparent pain point identified by HCPs. However, it has also created opportunity within the cell and gene therapy space to move towards simplification and harmonization of processes and healthcare provider facing IT infrastructure. With a multitude of platforms, there has been an opportunity to identify the most prevalent shortcomings among portals, as well as the most appreciated capabilities and needs.

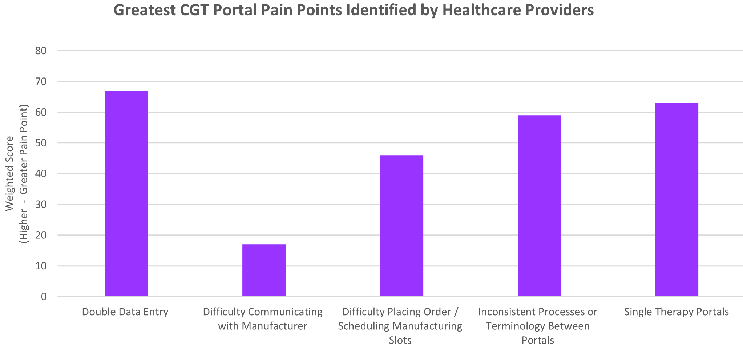

Based on the survey conducted among health care practitioners within the cell and gene space, a list of the most common pain points among cell therapy portals were identified (Figure 1) with a key trend among them.

Figure 1: Key Pain Points identified when surveying 50 Healthcare Practitioners with experience in the Cell & Gene Therapy space

Having to repeatedly enter the same data points into multiple TCPs, each one being utilized for only a single therapy, and each TCP with differing processes/terminology were consistently noted by all practitioners as the largest issues associated with cell and gene therapy treatment center portals. The respondents also recognized that as cell and gene therapy expands, this problem would only be exacerbated and noted their biggest concerns would be managing multiple logins, multiple therapies on differing TCPs, and keeping up to date on portal trainings from multiple manufacturers.

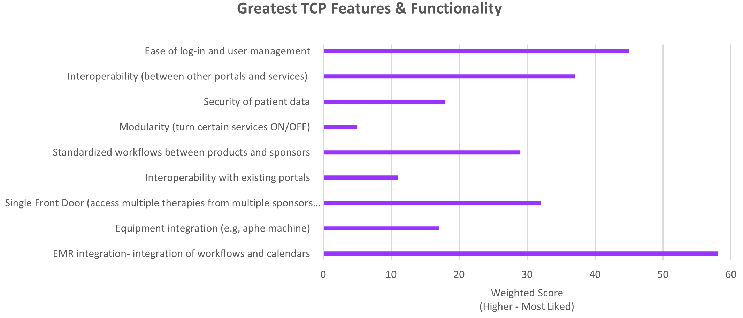

Figure 2: Most appreciated Treatment Center Portal Features (ranked by Healthcare Practitioners)

Although these findings may have identified a larger issue within the cell and gene space, it also helped illuminate some of the most appreciated capabilities (Figure 2) in TCPs currently in use, as well as capabilities that are most desired given the expected growth in cell and gene.

A user-friendly UI/UX requiring little training was identified as the greatest need, along with availability and access to customer support in local language. Among the most desired future functionality, integration with current EMR systems and generally interoperability across all systems used along the cell and gene treatment journey ranked the highest.

It is clear there is not only an opportunity, but a desire by HCPs for a universal treatment center portal that can remove the previously identified shortfalls, include key favored capabilities, and expand to include other capabilities that will be critical to support the future state of CGT 2.0.

Opportunity For Manufacturers To Support

The industry survey highlights concerns with treatment centers’ infrastructure, capabilities, talent, and more. To meet increasing patient demands the treatment centers have identified three key areas requiring support.

Internal Capabilities

To administer cell and gene therapies at scale, treatment centers (Tx) must have defined processes and capabilities in place. Nearly half of the respondents said their treatment center is preparing for increasing patient volume, while the other half said they do not currently have plans for expansion. With plans for expansion not quite underway yet, the industry needs to consider the support these Tx centers will need and how it can offer it. The biggest capability and infrastructure related challenges that HCPs mentioned were (1) patient sample management capacity such as apheresis capacity and (2) talent and requisite expertise constraints. It is known that the healthcare industry is generally constrained in both staff and space, treatment centers are concerned that they do not have the resources and dedicated space to administer these complex therapies. Additionally, the type of cell and gene therapy being administered determines the required Tx center capabilities. For example, if a cell and gene therapy is administered intravenously, typically the nurses and physicians on site are responsible for administering the treatment. Alternatively, therapies that are administered surgically and have a limited cell viability window require a different set of capabilities and processes.

Respondents noted that their willingness to onboard a new therapy and further constrain their system will depend on three key factors: 1) Product Efficacy and Safety Profile; 2) Confidence in On-Time Product Delivery; 3) Available Manufacturing Slots. The onus will be on the manufacturers to convince why Tx centers should onboard a new therapy and will need to collaborate with HCPs to define the required capabilities and decide what role pharmacists, nurses, physicians should have in the pre-treatment preparation and final delivery processes.

Patient Coordination & OOS Handling

The patient scheduling process was a major challenge flagged by survey respondents. Currently treatment centers have limited timeslots available for CGT treatments and with increased volumes, Tx centers need more timeslots for cell therapy handling. This is where having a robust TCP comes into play. The centers need the capability to seamlessly schedule patients without a huge delay. While HCPs need to be able to easily schedule patients, they also need to be able to handle the out-of-spec (OOS) cases. 84% of respondents said that manufacturers OOS handling practices and guidance influences their decision to onboard therapies. Higher volume of patients also means a higher number of out-of-spec cases. Manufacturers’ out-of-spec handling practices have a significant influence in getting treatments to patients. Key HCP pain points include delays in delivering the treatment to patients, limited risk assessment information, and lack of clear triaging and decision-making support. These reasons overwhelm the already constraint system and HCPs are getting vocal about OOS management practices. There is a need for manufacturers to work with HCPs and regulators to set guidelines and to be able to quickly process OOS cases.

Robust Payment Model

Another reported challenge raised by HCPs was streamlining the process for payment and providing an alternative pathway to expedite reimbursement. The current payment reimbursement model is very complex and does not offer much flexibility to HCPs and patients, and increased patient volume will multiply reimbursement challenges. Creating innovative payment models that enable patients to get their treatment as quickly as possible is imperative as more and more individuals sign up for treatment. For a new model to be successful it must meet certain conditions: the insurance must demonstrate reliable coverage, patient demand exists, and centers can receive financial gain from product margins. When all of these conditions are true, it can create a payment model that does not put a financial burden on the patient, but this requires the cell and gene industry to be innovative.

Industry Imperative

While the science is cutting-edge, healthcare systems are creaking at the hinges. The system is not ready for the rising tide of expensive treatments. We believe that manufacturers must think beyond their product and help shape the healthcare systems of tomorrow. To transform the system into the new normal, HCPs, payors and patients need more: we need to bring simplicity, harmonization, and help expand infrastructure. Tx centers need to expand specialist nursing personnel and infrastructure to safely push CGTs through. Pharma would need to agree to construct and contribute to the upkeep of these centers.

There is an opportunity for the industry to be forward thinking as CGT scales and establish universal solutions, build scalable strategies for product handling, patient coordination, product reimbursement, etc. While this brief industry assessment tells the ‘where’ we need to focus, next step is to do a deep dive to determine the ‘how.’

About the Authors:

Jamie Drost – Technology Delivery Consultant, R&D

Jamie Drost – Technology Delivery Consultant, R&D

Jamie is a Business and Technology Delivery Consultant in Accenture's Life Sciences R&D practice, with over 5 years of experience across the medical device and biopharmaceutical industries. Jamie specializes in the delivery of complex platforms that support the end-to-end cell and gene therapy patient journey.

Kealy Walters – Management Consultant, Cell & Gene Therapies

Kealy Walters – Management Consultant, Cell & Gene Therapies

Kealy is a Management Consultant in Accenture Life Sciences Supply Chain & Operations practice, with biopharmaceutical industry experience specializing in Cell & Gene Therapies.

Samantha Rubin – Management Consultant, Cell & Gene Therapies

Samantha Rubin – Management Consultant, Cell & Gene Therapies

Sami is a Management Consultant in Accenture’s Life Sciences R&D practice, with biopharmaceutical industry experience specializing in building end-to-end Cell & Gene Therapy capabilities.

Dr. Sanjay Srivastava – Managing Director, Cell & Gene Therapy Lead at Accenture

Dr. Sanjay Srivastava – Managing Director, Cell & Gene Therapy Lead at Accenture

Sanjay has a broad and deep expertise in the underpinning science and business challenges in developing and launching both in-vivo and ex-vivo cell & gene therapies. He directs his C> team at Accenture, who has global expertise in R&D, supply chain, manufacturing, and commercial operations