5 Proven Steps To Successfully Select & Onboard Outsourced Logistics Partners

By Carla Reed, president, New Creed LLC

In preceding articles in this series, we reviewed some of the challenges and remediation approaches for the storage and distribution of life science products, highlighting some of the specific risks related to storage, transportation, and material control across an extended chain of custody. This brings us to the final article, in which we will discuss best practices for selecting the partners that will be an extension of your staff for monitoring and control across an ever-changing global landscape.

From R&D To Commercial Product — Transitioning Your Supply Chain

Life science R&D is a complex and arduous process, spanning many years from the identification of a promising molecule to the completion of clinical trials to the nirvana of commercialization. During the course of this process, there are often many players involved, each of whom may have their own preferred network of supply chain partners.

Once commercialization has been achieved, however, it is up to the marketing authorization holder to review the requirements for the storage and distribution of inbound materials into manufacturing operations — as well as the storage and distribution of the finished product to patients — no matter how convoluted the drug’s supply chain has become.

The supply chain for a commercial product will often be very different than it was during R&D, with specific locations for manufacturing, packaging, and distribution. In most cases, regional distribution centers are needed to meet the needs of specific markets, as are capabilities to distribute product across international geographic boundaries. Each distribution model will have different levels of complexity, with related rules and regulations, beyond the basic requirements of good distribution practices (GDPs).

Frequently, the level of expertise within the marketing authorization holder’s ecosystem will be inadequate for this degree of complexity, and it will be necessary to engage the services of subject matter experts in the areas of global trade compliance. Supply chain planning should ideally take place concurrent with preparations for ramp-up to commercialization.

Such planning should take into account:

- Contractual arrangements – roles and responsibilities

- Communication Channels – between the supply chain partners and between groups within the organization (quality, regulatory, legal affairs, security, etc.)

- Operational sequence of activities – order; pro forma or invoice issue; and port and customs clearance, storage, and transportation

- Product and shipment integrity – origin, authentication, and quality control of imported materials and products (shipping lane qualification, packaging, labelling)

- Applicable documentation – forms and records (e.g., manifest, air waybill, bill of lading, certifications, batch record, certificate of analysis, etc.)

- Denied parties screening – identifying forbidden, restricted, controlled, or hazardous materials and products

- Lot and item-level traceability and security – for material and product

Although it is unlikely that a single company will be able to meet all your logistics needs across a global environment, it is important to find a partner that has the reach (directly or indirectly) to support your most critical origin and destination locations.

The following sections outline five important steps every life science company should take when evaluating and onboarding partners for global supply chain management.

Survey The Security And Regulatory Landscape

One of the first steps is to understand the regulations governing global import and export, as well as the requirements for safe and secure transportation and distribution of life sciences products.

In addition to the oversight required to maintain the correct level of time and temperature control, global distribution also requires familiarity with the risks for product adulteration, diversion, and counterfeit — a growing problem in the industry. The risk and reward for the illicit sale and distribution of counterfeit or adulterated pharmaceuticals and other life science products has attracted many illegal activities in this area. Leveraging the infrastructure that already exists for the illegal drug trade (which in many cases is more efficient than the formal supply chain), many global networks of drug traffickers include name-brand pharmaceuticals in their stock-in-trade.

Several high profile incidents, such as the heparin adulteration and counterfeit Avastin cases, have spurred governments and regulatory bodies around the world to implement legislation and policies to tighten supply chain security. In the U.S., the Food and Drug Administration Safety and Innovation Act (FDASIA) and Drug Supply Chain Security Act (DSCSA) were enacted to address risks throughout the pharmaceutical supply chain. Actions already taken include:

- FDASIA granted the FDA new authorities to address upstream risks including refusing entry of an imported drug if the manufacturing facility inspection is denied or limited, enhanced penalties for suppliers of counterfeit or substandard products, and requiring a unique manufacturing facility identifier for both domestic and foreign facilities.

- DSCSA, also known as Title II of the Drug Quality and Security Act (DQSA), was established in 2013 to address downstream risks and will facilitate the exchange of information about where a drug has been in the supply chain. The aim is to enable drug legitimacy verification, enhance detection of illegitimate products, and facilitate more efficient recalls. The law requires the FDA to develop standards, guidance, and programs to support efficient and effective implementation over a 10-year period.

Similarly, the EU’s Falsified Medicines Directive seeks to address supply chain security by validating that all manufacturers and distributors of APIs comply with good manufacturing practices (GMPs) and GDPs, and by verifying the authenticity of medicinal products. In China, the Chinese Food and Drug Administration (CFDA) introduced revised GMP regulations in 2010, modeled after U.S. and Europe rules, and made serialization mandatory for over 275 therapeutic classes of individual units.

Create A Product Profile

All products have different characteristics and risk profiles, so it is important to develop a product profile for each that takes into account requirements for packaging, material handling, and any measures that should be implemented in order to ensure it arrives at the final destination in the same state in which it departed the point of origin. Following are some factors that should be included in the product profile:

- Product or material identification and characteristics

- International identification name (if available)

- Global code and brand, and any other classification intended to identify the material or product (e.g., dosage form),

- Regulatory classification (taking into account global Harmonized Tariff Schedule, or HTS, codes)

- Presentation (primary and secondary packaging)

When developing a profile, you should also consider and document:

- Intended use of the product, including the country in which it will be sold and used

- Material handling and storage conditions, specifically for temperature- and time-sensitive materials or products, such as vaccines or cell therapy

- Potential hazards, including both environmental hazards and hazards to personnel (e.g., from hormones, cytotoxic drugs, radiopharmaceuticals and radiolabeled materials, and others)

- Potential risks, such as the likelihood of cargo theft, materials and products with high potential for abuse, and the potential for counterfeiting, tampering, adulteration, and diversion

- Site and country of origin, including identification/registration number

- Contractual agreements, such as intellectual property and ownership, terms of purchase, responsible parties, and importer of record

In addition to documenting how a product should be stored and transported, the product profile also provides a foundation for the development of service level agreements (SLAs) and standard operating procedures (SOPs) for all third parties that will be responsible for material handling and protection across the global chain of custody.

Perform Process Mapping And Risk Assessment

GDP guidelines are the baseline for developing logistics best practices within a marketing authorization holder, and for ensuring that these practices are upheld by outsourced partners in the distribution environment. However, in many cases these are not necessarily enforced beyond the immediate links in the chain of custody, and there are risks that true visibility may be lost unless there is tight integration between all participants across the supply chain. It is therefore imperative to ensure that true due diligence takes place when designing local, regional, and global networks.

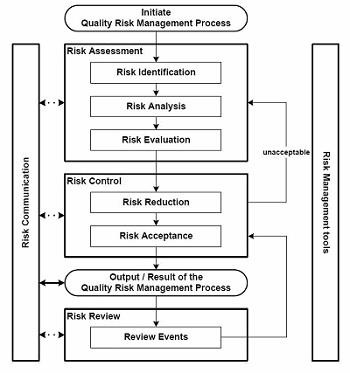

This starts with the preferred approach for all planning exercises, performing a detailed process map and engaging in a risk assessment. The risk assessment process should take into account all activities outsourced to third party logistics providers, as well as those that they, in turn, contract out to other regional and international service providers and partners.

Figure 1: Risk assessment — shipment level based on new item/shipping location or other risk factors

Conducting this activity requires a high level of collaboration and cooperation between key functional entities, to include product management, quality, logistics, sales, marketing, and legal departments. A holistic approach should be taken that also includes participation from customers, ensuring that all activities and constraints are taken into account for preparation of the shipment through to delivery at the ultimate consignee location. The legal liability and responsibility is less important at this stage than is the identification of each of the steps in the process across the links in the supply chain. This is therefore an important activity irrespective of the terms of sale.

The output of this activity is a series of process flows that depict each of the steps in the shipment lifecycle, which can then be reviewed with transportation and related supply chain service providers.

Determine Supplier Requirements For The Service Level Agreement

The process and framework developed in the previous step is useful to evaluate product-level requirements for global trade and transportation, as well as for developing checklists that can be integrated into service level agreements with customers, carriers, and related service providers across the global chain of custody.

Follow these process steps to ensure compliance with this procedure:

- Develop a list of approved/unapproved suppliers, service providers, and customers, with formalized performance measurement and key performance indicators (KPIs)

- Define roles, responsibilities, and contractual terms between the freight forwarder, carrier, supplier (e.g., exporter), and customer (e.g., importer) to handle the inland freight, temporary storage, and overseas shipment; import/export documentation (e.g., licenses, certificates, letter of credit, etc.); customs clearance arrangements; and cargo insurance.

- Document the scope of work and service levels (e.g., arrange clearance, documentation to be provided by the supplier and by the consignee, security, deviation remediation, etc.).

- Define information and documentation requirements based on mode of transportation (e.g., importer security filing for ocean vessels).

Clearly defined and documented guidelines remove ambiguity, which is critically important when moving product across geographic borders where there are differences in language and interpretation.

These guidelines should be integrated into material handling instructions, packaging, and labelling. In the case of multimodal shipments (which could introduce additional hazards during transshipment), take into account additional packaging that may be necessary if the item is being handled multiple times or removed from a consolidated shipment or external packaging component (e.g., an air or ocean container). The devil is in the details — reviewing each of the links in the chain with your transportation and logistics partners will help reduce risk factors.

Establish A Formal Supply Chain Operations Policy

Once established, supplier, service provider, and customer requirements need to be embedded in practices and controls that can be monitored to ensure an acceptable level of performance and compliance with important and export regulations. These should be formalized into a supply chain operations policy document, to include standard operating procedures (SOPs) such as:

- Documented procedures for port clearances – specific actions the organization or third-parties should take, including but not limited to communication of expected arrival date of shipments and obtaining the documents necessary for clearance and warehousing

- Re-exportation requirements and/or limitations – and a warranty against them (e.g., statement of non-re-export of product)

- Information systems - validated computer systems used for placing orders, order processing, supplier and customer registration, and tracking of licenses, product information, regulatory status, denied countries, and controlled substances (names and allowed amount),.

- Controls and defined procedures for irregularities — should be in place to review and identify suspicious orders, to include but not limited to:

- Different contact information from that filed with authorities

- Large amounts of controlled substances

- Any other red flags (Your legal affairs or security department should be notified of any suspicious orders, and the local health authority or law enforcement agency (or both) should be notified as appropriate.)

The supply chain operations policy document, once developed, should be shared with customers and service providers, along with related metrics and controls.

Conclusion

Having a clearly defined sequence of activities, events, roles, and responsibilities will enable effective selection of transportation and global trade partners. These elements can also be formalized into SLAs, with related metrics and controls, to ensure that all outsourced activities take place as planned.

Related References and Regulations:

- U.S. and EU Good Distribution Practices (e.g., the European Commission’s Guidelines on Good Distribution Practice of Medicinal Products for Human Use and the U.S. Pharmacopeial Convention’s General Chapters <1079>, <1083>, <1179>, etc.), taking the principles and controls of good manufacturing practices (GMPs) into functional areas to include transportation, customs, security, storage, and temperature control

- Health Canada, Guidelines for Temperature Control of Drug Products during Storage and Transportation (GUI-0069)

- U.S. Food and Drug Administration Safety and Innovation Act (FDASIA), addressing upstream product risks

- U.S. Drug Supply Chain Security Act (DSCSA), to address downstream visibility, track, trace, and authentication

- EU Falsified Medicines Directive, to ensure manufacturers and distributors of API comply with cGDPs and cGMPs

About The Author:

Carla Reed is a supply chain professional with more than 20 years of experience in supplier engagement, manufacturing, emerging market development, outsourcing, global trade, regulatory compliance, storage, and distribution. Her firm, New Creed LLC, provides change leadership to facilitate sustainable solutions, providing hands-on experience in all aspects of supply chain operations. You can email her at newcreed11@gmail.com.

Carla Reed is a supply chain professional with more than 20 years of experience in supplier engagement, manufacturing, emerging market development, outsourcing, global trade, regulatory compliance, storage, and distribution. Her firm, New Creed LLC, provides change leadership to facilitate sustainable solutions, providing hands-on experience in all aspects of supply chain operations. You can email her at newcreed11@gmail.com.