PDG-FDA Town Hall Notes — DSCSA Readiness Is At Hand

By Carl Accettura, Global Pharma Advisory

The PDG-FDA Virtual DSCSA Town Hall on March 26 focused on manufacturer’s readiness, and key players highlighted significant strides toward Drug Supply Chain Security Act (DSCSA) compliance with a focus on data quality as the final critical area for improvement before the May 27 manufacturer deadline. Industry leaders reported strong progress with refined data systems and processes, but optimism was tempered by the need for sustained effort.

Sadly, the virtual format of this town hall lacked any substantive Q&A, and we all missed the face-to-face networking of an in-person event. Nonetheless, we can be thankful it was not canceled like other key recent FDA meetings, which speaks to the strength and persistence of the Partnership for DSCSA Governance’s (PDG) public-private partnership with FDA. Town hall recordings and summaries are available on PDG’s website.

Upcoming events to watch

In contrast to prior industry meetings, trading partners have begun to accept the importance of keeping these compliance deadlines firm as opposed to any further extension. “It’s time to rip off the Band-Aid!” surely has been uttered more than once as we get closer to the end of the protracted exemption period.

Town hall messages were important, insightful, and demonstrated significant progress taken by supply chain partners to stabilize systems for the phased DSCSA deadlines. A majority of manufacturers are now connected and sending quality data. Still, supply chain partners reported some remaining persistent hurdles, including challenges in data quality and data exceptions. So, stabilization efforts must continue unabated.

Gillian Buckley, senior director in science and regulatory affairs at PhRMA, said it well. The PhRMA members have prepared for the end of the exemption period in May. Still, she emphasized that intense cross-sector collaboration and continuous process improvement and risk assessment remain critical to DSCSA compliance as the exemptions expire.

The themes were consistent with the preceding HDA Distribution Management Conference (DMC) industry event March 2-5. In addition, HDA DMC also highlighted the growing importance that state enforcement will bring to:

- state regulators using verification router services (VRS) to verify product on wholesaler and pharmacy shelves,

- state regulatory audits including SOPs around verification systems and processes under DSCSA, and

- revoking licenses, where necessary.

Quarantine Risk Is Now Immediate For Regulatory Stragglers

PDG highlighted some “outstanding pockets of disengaged or unprepared manufacturers.” If you are one of these lagging manufacturers without quality, aggregated enhanced drug distribution security (EDDS) data attached to every shipment, you should already be working on contingency plans at the executive leadership level, including the submission of waiver, exemption, and exception (WEE) requests to FDA. Keep in mind that such WEE requests can take months to process, and approval is not guaranteed, meaning you could be at significant risk of having your product quarantined and unavailable for sales come May.

To create other challenges, a few days after the town hall, we learned of disruptive RIF layoffs at the FDA. FDA’s Office of Drug Security, Integrity, and Response (ODSIR) was not eliminated, but Leigh Verbois, ODSIR director, who spoke at the town hall, decided to retire. After 23 years of public service, we wish Verbois the best. We’re lucky to still have Abha Kundi in ODSIR for continuity.

Leigh and Abha emphasized that data quality imperfections are expected, so they advocated for robust risk-based processes to manage errors rather than aiming for perfection.

Unwrapping The Town Hall’s PDG and HDA Survey Data

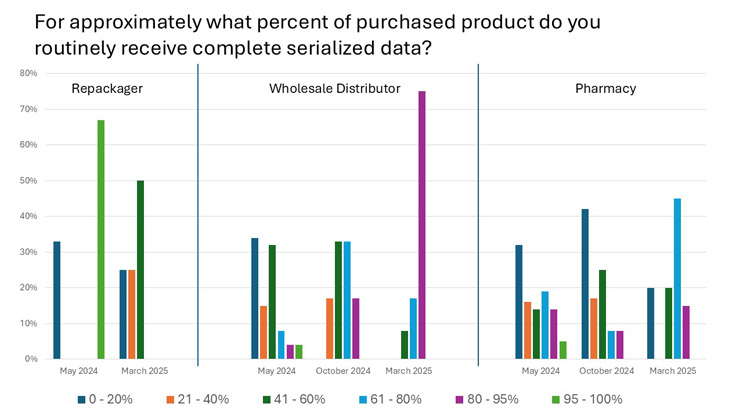

It began with PDG and FDA reiterating the important DSCSA Foundational Blueprint framework and DSCSA guidances, respectively. Eric Marshall shared the latest March 2025 survey data points, which have improved compared to October and May last year.

The PDG summary and survey report noted that:

- “Significant progress has been made in stabilizing the quality of data based on inbound receipt of manufacturer data by the wholesalers.”

- All 35 manufacturers and 15 wholesalers surveyed had 100% interoperable EDDS to verify product identifiers. But two of 15 wholesalers don’t capture EDDS transaction information (TI) back to manufacturers.

- Improvement is significant from 2024’s low levels (17%) when purchasing product, with wholesalers now receiving 75% of purchases with 80% to 95% complete TI data.

Source: PDG

- Wholesalers are assessing the quality and accuracy of serialized data when purchasing product (i.e., transaction info) in up to 93% of events. Is it enough?

- The Good News: “Manufacturers are shifting into a refinement stage with a focus on improving rapid data issue resolution as they receive feedback from their downstream trading partners.”

- “The process for managing discrepancies has significantly improved, and the types and scope of discrepancies are narrowing.”

- When selling product, 88% of manufacturers and 86% of wholesalers report assessing the quality and accuracy of serialized data

- Remaining challenges include incomplete or inaccurate serialized data, with exceptions like missing fields or delayed transmissions still prevalent.

- “The prevalence of master data issues ... has significantly decreased, and trading partners are increasingly focusing on narrow one-off exemptions and difficult channels, such as 340B, replenishment product, and drop shipments.”

- “However, more granular visibility of data quality at package level (i.e., serial number level) will be achieved as direct trading partners further transact products and manage data outbound.”

- “Without cross-sector, bi-directional collaboration, manufacturers can’t fully understand their internal or external gaps.”

- Trading partners must continue to prioritize data quality validation and continuous improvement ahead of upcoming deadlines.

- “Continuous improvement of systems and processes to support data quality and information exchange is occurring, and stakeholders anticipate it will continue to occur for an extended period … managing expected data imperfections is a key to success.”

- “Manufacturers emphasized that, while progress has been significant, additional progress and refinement is expected to continue beyond the expiration of the exemption for eligible manufacturers. For example, some stakeholders emphasized the importance of staffing and training and increased visibility and feedback on data quality will also inform appropriate staffing levels.”

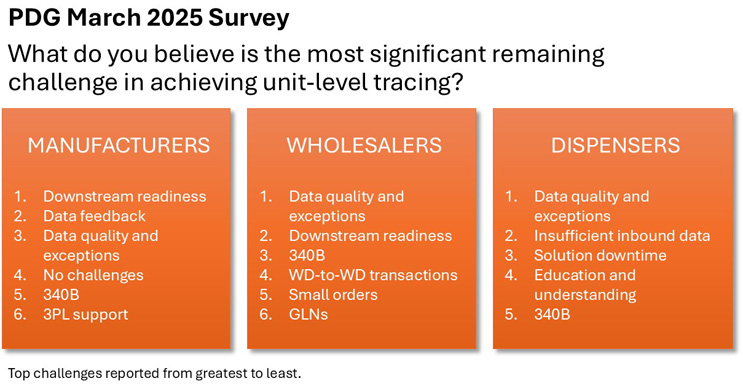

- PDG’s survey cited the most significant remaining challenges, including 340Bs, for the three trading partner categories as follows:

- Manufacturers: downstream readiness; data feedback, quality, and exceptions.

- Wholesalers: data quality and exceptions; downstream readiness; small orders; GLNs.

- Dispensers: data quality and exceptions; insufficient data flow; downtime; education.

Source: PDG

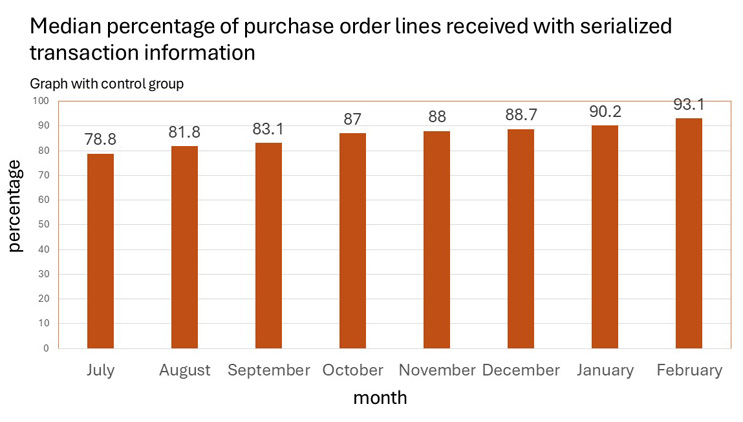

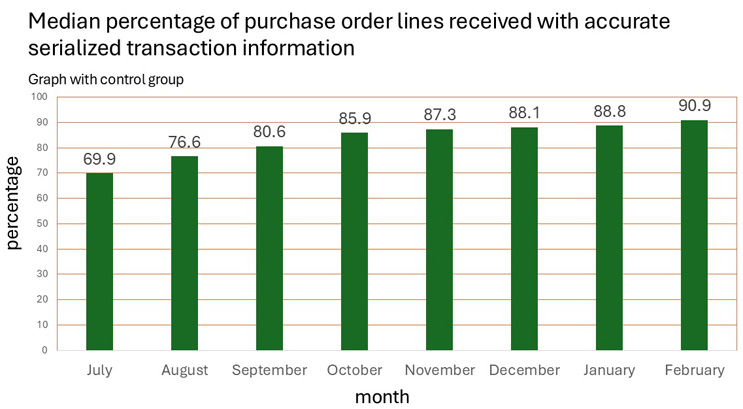

HDA shared their latest July 2024 - February 2025 survey data points, which have steadily improved month by month, as follows:

- HDA reported to FDA that expected DSCSA disrupted product levels, due to missing or inaccurate purchase order (PO) data from manufacturers, improved from 25% to 9% (from September 2024 to February 2025).

- HDA alerted FDA that the final 9% of data quality issues may be the hardest to fix.

- Roughly 9% of PO lines face various types of data transmission or content issues.

- This still risks disruption due to these upstream inaccuracies.

Source: HDA

Source: HDA

Since the town hall, HDA’s Nicolette Louissaint noted that they are seeing 92% of PO lines with accurate data, which she discussed during an April 10 INMAR webinar. Thus, there’s still a risk of disruption of 8% of supply when the manufacturers’ exemption expires on May 27, unless WEEs are FDA-approved and shared with trading partners for these PO items.

What They Said

During the PDG-FDA town hall, industry representatives had the chance to speak about the successes and shortcomings they had observed and share any concerns.

Cencora’s Gregg Gorniak, vice president of manufacturer operations and data services, added some excellent additional perspective about laggards and improvement:

- In a cautionary note, around 3% (12 to 15) of Cencora’s 500 manufacturers are still lagging and are not connected electronically.

- Those 3% must have WEEs by May 1 to avoid quarantine and supply disruption.

- After the town hall, I heard an even higher number —up to 5% for shipments to all wholesalers — had no data, so those manufacturers must urgently prepare their contingency plans with their trading partners to avoid business disruptions.

- Overall, manufacturers have steadily improved in 2023, 2024, and 2025, providing POs with data at an increased performance rate, up from 48% to 85% to 97%, respectively.

- Exceptions processes are ongoing and are needed to resolve final data quality.

- Gorniak said some CMOs are not yet sending fully compliant aggregated EDDS data.

- Gorniak highlighted a new, growing issue: 100 SKUs have unreadable 2D bar code IDs!

- Due to faulty product identifiers, Cencora classifies those packs as “damaged goods.”

PhRMA’s Buckley called for inquiries across trading partners to be traveling upstream and downstream with equal frequency and for regular feedback (e.g. scorecards) on data quality to be stabilized.

Genentech’s Vid Rajaram, director of product traceability and innovation, referenced having over 20 teams working across many time zones for years to reach an effective point of readiness. It is clear that this also included significant work to handle the related change management to ensure any groups in an organization that might interact or receive issues related to DSCSA are effectively trained with up-to-date procedures. Other manufacturers have spoken of establishing DSCSA "hypercare teams."

Rajaram emphasized the following factors for the company’s success:

- Genentech went live in 2023 with EPCIS data transfer and continued to conduct rapid data issue resolution through November 2024, while emphasizing internal education and training.

- The current focus is on exceptions resolution, with detailed, rapid resolutions for minor data issues of one to three days versus weeks for quality-related fixes, underscoring the need for workarounds.

- Inbound wholesaler issues from manufacturers’ pick-pack-ship transactions are resolved within one business day.

Dave Mason, a regional supply chain compliance and serialization lead at Novartis, gave us the following seasoned opinions:

- Mason stressed the need for data stabilization and process improvements as we work through the details concerning data quality and validation.

- While systems and processes have improved and stabilized, he sees the next important push for data stabilization, meaning both data integrity and data accuracy, rising above low 90% levels. Novartis has used internal audits to achieve 98% to 99% compliance.

- Trading partners must focus on outbound data, where they will encounter more exceptions that are harder to remediate.

- Downstream analysis and remediation efforts are critical before and after the May 27 deadline.

- He voiced his concern that a lack of data expertise and GS1 standards knowledge downstream is hindering remediation.

- The focus needs to shift from system building to ensuring the data flowing between these systems is accurate and properly formatted.

The Association for Accessible Medicines’ Brian Rezach noted members’ “builds are complete,” yet data refinement will extend beyond May because of complexity and varied discrepancies reported by downstream partners. AAM said members have over 90% of prescription volume spread over 5,800 SKUs, with just a few of those not fully complying with labeling and transaction data transfers. However, concerns remain as Rezach noted that AAM members’ data acceptance rates are not known or certain.

Jillanne Schulte Wall, a senior policy director at the American Society of Health-System Pharmacists (ASHP), noted that there are still some “niche” areas needing work, such as 340B transactions, drop shipments, and replaced products.

Josh Bolin, associate executive director, government affairs and innovation at the National Association of Boards of Pharmacy (NABP), shared the growing use of DSCSA product verification tools by state regulators and how they already are aiding investigations. As highlighted at the HDA DMC, Bolin noted the successful use of the NABP Pulse system to provide a “not verified” response in less than a second to confirm a counterfeit product in the Arkansas State Board of Pharmacy’s investigation, which led to a license revocation. However, he did note that 10% to 15% of verification scans do not have listed global trade identification numbers (GTINs) in the industry verification router service lookup directory, which is governed by an HDA group.

Bolin recommended that manufacturers check with their solution providers or IT associates to ensure their GTINs are listed and that they have DSCSA contact information being returned in verification responses.

Gil Roth, founder and president of Pharma & Biopharma Outsourcing Association (PBOA), the pharma CDMO trade association, noted that their members are well prepared. However, Cencora’s Gorniak did note that some CMOs are not yet sending fully compliant aggregated EDDS data. There remains a wide array of smaller, fragmented CMO players, who may be less compliant than PBOA members.

Leatha Lynch, director of regulatory affairs at Vetsource, said that her wholesale distributor organization handles a significant number of human prescription products being distributed in the veterinary supply chain and hopes FDA might consider a broad exemption if the distributor can ensure that no product handled is ever intended to be further distributed by a DSCSA authorized trading partner.

Conclusions

In the end, we have some lessons learned and notable takeaways for manufacturers to consider and to focus ongoing efforts ahead of May 27 and through 2025:

- Scorecards and real-time, bi-directional, cross-sector compliance data collaboration need focused improvement.

- “What’s measured gets done” is crucial to continuous improvement.

- Scorecards must be generated and shared to drive universal improvements.

- We must move beyond PDG periodic survey data to more real-time collaborative scorecard data sharing across a comprehensive set of trading partners.

- Simply relying on PDG’s survey data and HDA's monthly data likely leads to visibility gaps.

- Data expertise downstream is critical to remediation, as Mason noted.

- “What’s measured gets done” is crucial to continuous improvement.

- Manufacturers need to focus on rapid exception handling and achieving data integrity downstream. Industry has evolved and is building on established interoperable EDDS connections. With serialized labels and data well established and connections largely in place, the focus shifts to identifying, handling, and resolving exceptions and getting to even higher levels of data accuracy with continuous improvement.

- Gary Lerner, of Gateway Checker, conducted a study of several thousand files from several wholesalers, which indicated that about 7% of the files contained critical defects that must be addressed. These issues include missing expiration dates, incorrectly formatted serialized global location numbers (SGLNs), and missing purchase orders, among others.

- Lerner also noted that inbound checking and continuous quality assurance for strict EPCIS and DSCSA conformance requirements must be adopted industrywide to spot hard-to-detect errors and to prevent faulty, improperly formatted, or inaccurate files from flowing undetected downstream.

- Several niche areas and difficult channels will require further alignment.

- Niche areas surfaced in the town hall that still need further alignment, communication, or training across industry and state/federal regulators.

- These include transactions for narrow one-off exemptions and difficult channels, which have expanded, such as 340B, replenishment product, drop shipments, and consignment inventory.

- The DSCSA journey ahead is still uncharted waters. We don't know what we don't know yet, so we need robust contingency plans:

- AAM is concerned due to the complex nature of the movement of DSCSA aggregated transactional data.

- Trading partners should ensure they have robust exception management and contingency plans that will enable them to respond quickly to challenges and develop acceptable workarounds as issues arise.

Collaboration remains vital to measure and continuously improve on exceptions handling, data quality and integrity, eliminating inaccuracies, and addressing niche challenges as DSCSA EDDS data moves downstream from manufacturers to their trading partners, to achieve phased implementation by sector in 2025, beginning with manufacturers on May 27.

About The Author:

Carl Accettura is a 40-year veteran of FDA-regulated operations with diversified global experience in both large and small pharmaceutical manufacturers. He has made senior management-level contributions in the areas of global supply chain management and global drug development and commercialization, across numerous therapeutics and new product launches. He holds a B.S. in mechanical engineering from Cornell University, an M.Sc. in mechanical engineering from the University of Illinois, and an MBA from New York University.

Carl Accettura is a 40-year veteran of FDA-regulated operations with diversified global experience in both large and small pharmaceutical manufacturers. He has made senior management-level contributions in the areas of global supply chain management and global drug development and commercialization, across numerous therapeutics and new product launches. He holds a B.S. in mechanical engineering from Cornell University, an M.Sc. in mechanical engineering from the University of Illinois, and an MBA from New York University.