New Economics Of Cell And Gene Therapy – Part II

By Jason C. Foster, MBA, Ori Biotech, Gaurav Shah, Accenture, and Sanjay Srivastava, Ph.D., Accenture

Challenging the current orthodoxies to promote desired clinical and business outcomes

Cell and Gene Therapy as a Modality is at Risk

In a previous article “New Economic Realities of Cell and Gene Therapy Development,” we argued that business viability of cell and gene therapy (CGT) industry is at risk. The old model of small molecules and biologics of racing to get good clinical data (safety and efficacy) in order to partner/sell to big pharma isn’t working in cell and gene therapy. The traditional model assumes the ability to reach manufacturing scale, profitability, and market access, which have proven difficult to achieve for CGTs thus far.

With each new cell or gene therapy that is priced at $400K-$4M per patient, we are limiting our ability to get widespread coverage and early line usage for these therapies with these products frequently struggling to achieve scale. While both Carvykti and Breyanzi are covered at 2nd line, they are not often used there because of cost and shortage of supply. For the most part, Big Pharma and venture investors are sitting on the sidelines until the CGT industry can prove it can make commercially viable products. Cell and gene therapy developers need to strike a balance between shortest path to clinic and product viability, else, CGTs could be relegated to the dustbin of history as a fantastic science project that never lived up to its potential.

What Must Change

What does this mean for CGT developers and investors. Therapy developers must spend time to optimize their process before entering clinical trials so that they can develop a robust, repeatable, reliable and scalable process otherwise they risk entering the clinic with a process that leads to a dead end for the product once approved. The approach introduces a new pillar of early development, viability of the product, alongside the traditional pillars of safety and efficacy. The CGT industry cannot continue to develop and launch products that are safe and effective but not commercially viable, or we will risk the future of this promising modality.

- What elements make up viability?

- Reasonable COGS to achieve target profit margins at an acceptable price point

- TPP that provides the likelihood of target line coverage (i.e. market access)

- Manufacturing process that can be scaled to meet the anticipated peak demand

- Supply expansion strategy for earlier line coverage/indication expansion/global access

Focusing on viability early in the development ensures there is an acceptable target COGS in the Target Product Profile (TPP), a strategy to manufacture at scale and that companies have a good understanding of market access/pricing even at pre-clinical stage to see if a product is even worth developing.

If you are an academic medical center or pre-commercial biotech hoping to partner/license a cell therapy program, you need to have a plan to meet these viability criteria. If you are an investor, you need to push the development team to demonstrate they have a plan for manufacturing that will lead to commercial viability and a deal with Big Pharma – going it alone through commercialization can be a very difficult and expensive proposition. Relying on lab scale tools like t-flasks, bags, and gas permeable flasks is no longer good enough. Over the last decade these technologies have been proven not to be fit for purpose to deliver manufacturing at scale and a path to commercial viability even after billions of dollars of investment developing processes on them.

Cell therapy manufacturing is a technologically complex, highly regulated process. In comparison to biologics, cell therapy manufacturing requires far more planning, investment, and skilled personnel and is, therefore, riskier. The philosophy that "process defines product" governs regulatory actions and because manufacturing is so complex, the US Food and Drug Administration (FDA) believes it is insufficient to define the product by just its molecular composition. Instead, a product is also defined by the process with which it is made.

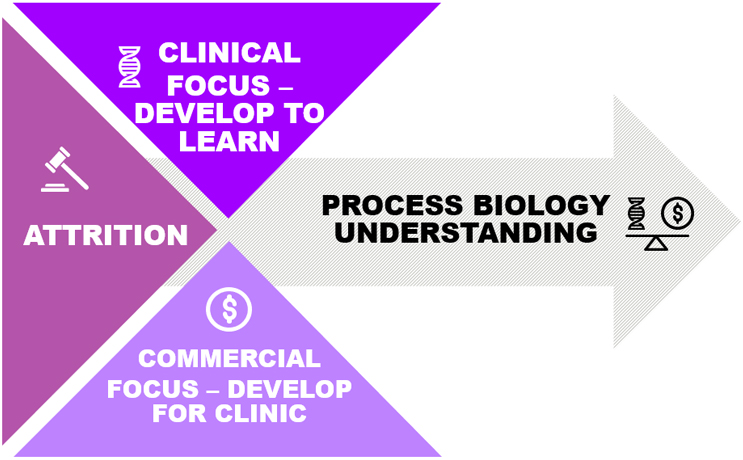

Today’s product development processes are predominantly manual – resulting in low-efficiency, unclear understanding of the process biology, unpredictable yield, high costs and high failure rates. Industry should adopt a Design for Manufacture (DFM) framework to help design and develop reproducible and robust therapies, processes and analytical methods, that incorporate the principles of quality by design, thus expediting regulatory approval and ensuring manufacturability at scale with reasonable COGS. Benefits of DFM approach would link product attributes, patient efficacy and safety through an approach that drives assessment of process variables, identification of CPPs and unit process understanding. Implementation of DFM would help strike the right balance between “develop to learn” and “develop to clinic” and improve odds of knowledge-rich BLA submissions demonstrating understanding of product and process and confidence for scaled operations (Figure 1).

Figure 1. Design for Manufacture

Advanced manufacturing technologies and digital infrastructure can facilitate the implementation of DFM. Data-driven process insights alongside automated tools can support faster and more objective decision-making would improve root cause analysis, alleviating the inconsistent product quality and addressing the bottlenecks created by manual, paper-based processes, while at the same time shortening time to clinic, reducing development timelines/risk and improving the viability of the next generation of therapies

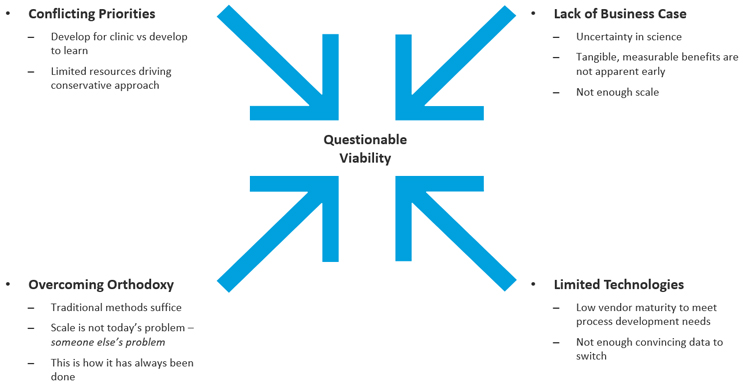

The CGT industry must adopt DFM with flexible technology platforms to develop, test and scale manufacturing of these products from pre-clinical development through clinical testing and then through commercial launch; digitally enabled platforms that optimize the flow of information between process and people to enable collaborative data intelligence for the entire technical operation. However, traditional, manual methods continue to power the majority of current development approaches. When we speak to the industry leaders, they cite various reasons for delaying the adoption of advanced manufacturing technologies and the digital infrastructure approaches along with DFM implementation (Figure 2).

Figure 2. Barriers to adoption of automation and digital technologies

This thinking remains prevalent in early-stage biotechs and academic institutions. This belief is also influenced by the assumption that once the asset has passed the inflection point in development, the technology can be offloaded in a co-development and/or co-commercialization partnership; essentially believing that manufacturability of the asset is going to be someone else’s problem. This old model of thinking only worked when there was plenty of dry powder within the Venture Capital industry and Biopharma, who needed to invest in the breakthrough science of cell and gene therapies. Of late, investment within CGT has all but dried up and is targeted at only a few exceptional companies. Gone are the good old days when non-viable scientific assets could be flipped for a profit to a partner.

We must identify foundational technological and DFM enablers that can be implemented without the need for a full-scale solution from the start; capabilities that allow a company to proceed with pre-clinical research enhancing the probability of both clinical and commercial success of the development asset. Foundational capabilities are ones that organizations not only need for pre-clinical and early development activities but also those that have latent business value. An ideal foundational capability is one that can even be monetized in the worst-case scenario if a development program must be terminated. Examples of foundational capabilities include digital infrastructure like electronic lab notebooks (ELNs), laboratory information management systems (LIMS) to assist in design, execution and transferability of development methods as well as standardized automated manufacturing platforms that can be broadly applicable across several different programs.

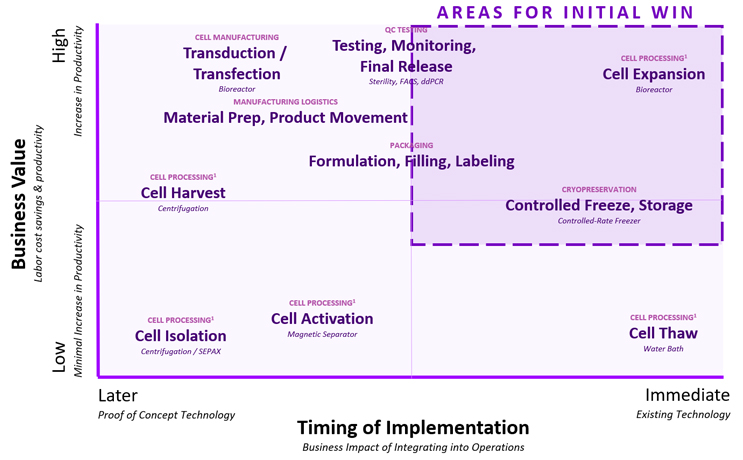

Another option is to consider technology platform specific manufacturing capabilities that provide the most value to the business during development and assess them against the maturity of the vendor landscape. Companies should invest early in high business value generating capabilities that are readily available and mature. Figure 3. provides an approach for cell therapies to assist in such decisions.

How do we encourage emerging biotechs and companies with early-stage assets to adopt such an investment approach during development? As argued in our previous article, the investor community can assist not only by providing necessary funding for these investments during development but also by ensuring company management focuses not only on clinical readiness but also on process and manufacturing development early enough to ensure product viability. Investors could positively influence early-stage development and provide a way for managers to implement stage appropriate strategic technology investments that can deliver outstanding results while increasing the likelihood of achieving clinical and commercial success.

Another approach could be for investors to consider a portfolio-based approach and provide foundational technological capabilities and ensure that these are prioritized and adopted by portfolio companies early in the development phase. Securing common manufacturing capabilities/ approaches/ technologies to define controls and processes across the portfolio can create consistency, predictability and redundancy in operations. Investors may even want to consider an approach that leverages shared infrastructure, sometimes called Infrastructure as a Service (IaaS), allowing portfolio companies to share resources ranging from cleanrooms to technologies to people.

Companies and investors often fear that trying something new is “too risky” but doing the same thing over and over again and expecting a different result is not only riskier but also the definition of insanity. If we continue to follow the old therapeutics investment playbook for advanced therapies, we will likely continue to get products that are approvable but not accessible or affordable while more companies fail commercially after being unable to deliver an ROI back to their investors, bolstering investor scepticism of this promising modality.