21 New Downstream Technologies Being Considered To Fix Capacity Problems

By BioPlan Associates Inc. staff

Over the past 20 years, the bioprocessing industry has seen consistent improvements in manufacturing efficiency, including improved upstream titers and process optimization. However, as upstream capacity has increased, it has often pushed the capacity problem downstream. Although fixes have been achingly slow in coming, our annual industry report shows new downstream technologies are emerging.

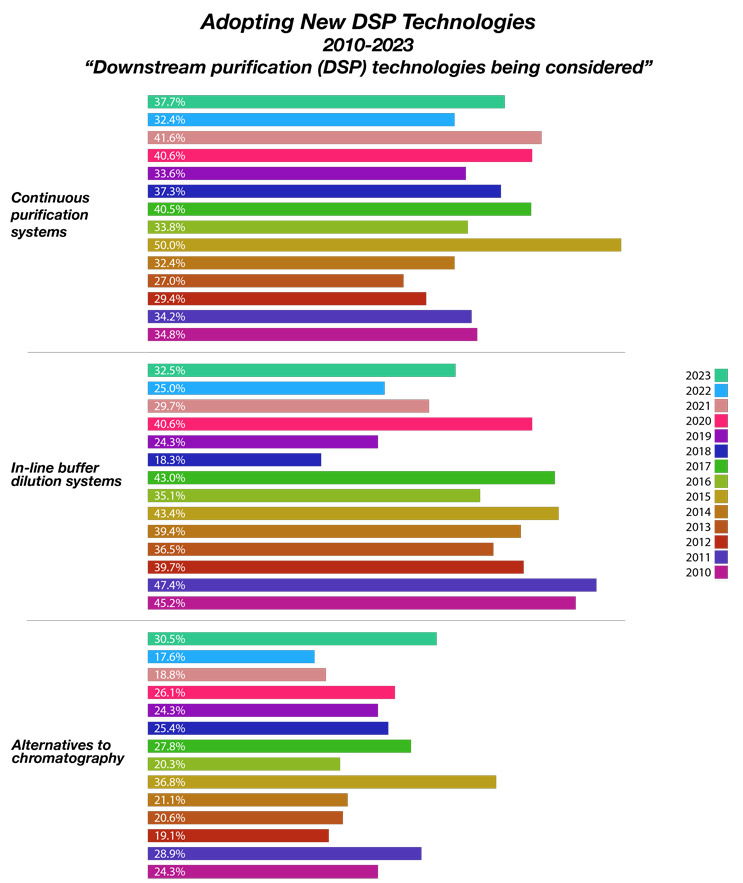

We measured 21 new downstream process (DSP) technologies being considered by end-users . This year, continuous purification systems were noted as the top new technology end-users are considering to fix their capacity problems. According to BioPlan’s 20th Annual Report and Survey of Biopharmaceutical Capacity and Production, 37.7% of bioprocessing facilities expect to fix downstream capacity problems through continuous platforms.

New Downstream Processing Solutions

The industry has attempted to move away from costly legacy systems such as protein A resin chromatography toward more efficient and cost-effective downstream processing systems. But in our DSP studies over the past 15 years, we have found that most in the industry continue to agree that protein A chromatography works well enough. So, making changes to what is seen as a long-accepted operational and regulatory solution is difficult.

But increasingly, the DSP bottlenecks are causing end users to consider new technologies. Those technologies being considered offer an alternative to legacy systems that tend to be costly and difficult to optimize. Viable commercial-scale alternatives that reduce cost and improve performance and capacity relative to these resins are now beginning to emerge and be adopted by the manufacturing industry.

In our 20th Annual Survey, we asked “Which new downstream purification (DSP) technologies are you actively considering to address bottlenecks and problems?” We sought to identify potential future adoption of DSP innovation. Of the 21 new DSP technologies, the top being actively considered include those in Figure 1, with continuous purification systems, and in-line buffer dilution systems topping the list. Alternatives to chromatography continue to show up, with nearly a third of the industry showing frustration with this legacy system.

The list of technologies being actively considered by bioprocessors today is extensive:

- Continuous purification systems

- In-line buffer dilution systems

- Alternatives to chromatography

- Disposable UF systems

- Single use disposable TFF membranes

- Centrifugation

- DSP automation/control systems

- Use of high-capacity resins

- Buffer dilution systems/skids

- Membrane technology

- Single use-prepacked columns

- Single use filters

- Online analytical and control devices

- DSP process modeling software

- Use of filters instead of resin chromatography

- Countercurrent chromatography

- Precipitation

- Field fractionation

- Two-phase systems

- Moving beds

- Small substrates

Over the past 13 years, this list of new technologies has grown, and some approaches have waned in the rankings as they failed to meet expectations. But given the number of DSP innovators and the nonstop flow of innovative technologies being brought forward, it is likely only a matter of time before one or more disruptive technologies enter mainstream bioprocessing.

Fig 1: Selected New Downstream Processing Solutions Being Considered (2010-2023)

Source: 20th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity, BioPlan Associates Inc. April 2023

COVID’s Impact On DSP Decision-making

An interesting finding in the 2023 annual study was the near doubling of bioprocess executives’ interest in alternatives to chromatography. Between 2017 and 2022, interest in alternatives to chromatography declined from nearly 28% to 17.6%. Then we saw a rapid increase to 30.5% in 2023. This is potentially due to availability problems with protein A resins during COVID. It is possible that with access to consumables post-COVID will diminish interest in alternatives. This remains to be seen.

What End Users Want From Their Suppliers

In a separate question we asked end users where they wanted their suppliers to invest in innovative technologies, including DSP. Here we found the demand for innovation included a laundry list of areas, with the following taking a lead position:

- Continuous bioprocessing — downstream (chromatography)

- Ultrafiltration filters and membranes

- Protein A resins/alternatives

- Virus filtration

- Disposable/single-use: purification

- Automation, software, IT, networking, etc.

- Buffer preparation improvements

- Chromatography automation and data handling

This wish list of innovations from suppliers also amplifies the general areas in demand: continuous purification, ultrafiltration, and protein A alternatives. In addition, automation shows up on this list but is not a headliner. Separately in our study, we ask suppliers to identify which technologies they are actively working on. Automation shows up at the top of the list, with over half of suppliers developing solutions to automate bioprocessing. The fact that end users are not yet asking for these automation solutions is possibly because introducing automation may require significant changes in operations, such as, for example, shifting from batch processing to more continuous platforms. Possibly, end users may not be projecting as far into the future of their bioprocesses as their suppliers.

New DSP Technologies Suppliers Are Working On

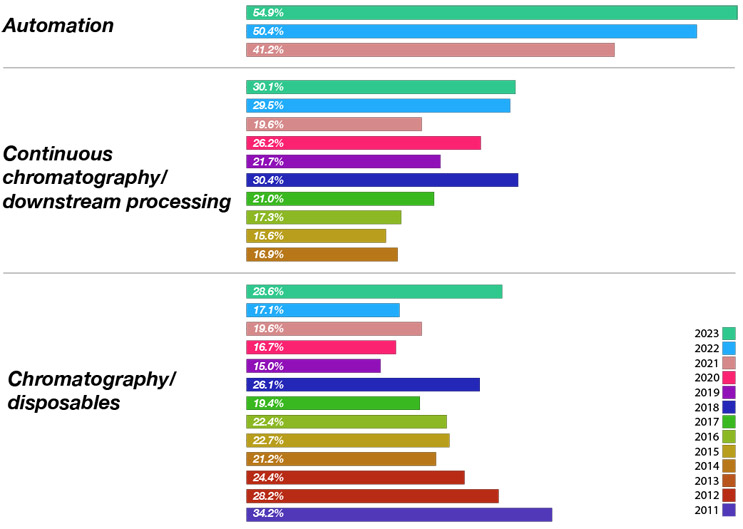

To identify the gap between what bioprocessing professionals want and what the suppliers are actually working on, we asked the suppliers, “What are the top new technology areas your company is working on today?” Overall, of the 49 different areas suppliers are developing, the top responses from vendors (of all types) in this year’s survey included:

- Automation — 54.9% (category added in 2021)

- Viral/gene therapies — 47.4%

- Bioprocess development/optimization services/bioprocess modeling — 42.9%

- Automation software — 35.3%

- Continuous chromatography/downstream bioprocessing — 30.1%

When we look at only the DSP technologies being evaluated, we found that there is reasonable alignment between what bioprocessors want and what suppliers are investing in. For example, continuous bioprocessing is being demanded by nearly 38% of bioprocessing facilities this year. At the same time, over 30% of industry suppliers have new product development projects in this area.

Fig 2. Top New Downstream Technologies Bioprocess Suppliers Are Working On Today

Source: 20th Annual Report and Survey of Biopharmaceutical Manufacturing Capacity, BioPlan Associates Inc. April 2023

Other findings among end users and suppliers suggest the industry would like to move away from legacy chromatography technologies, but these current systems generally work quite well (albeit they are quite expensive). So, it may take a clearly effective, less costly, regulatorily acceptable approach before this move from protein A, for example, will take hold in the industry.

The limitations of existing DSP process lines and technologies to keep up with the increases in titer in upstream processes are unlikely to go away. Upstream process development will continue to improve product titers, and facilities that have fixed DSP capabilities will continue to push their DSP to their limits.

Downstream challenges will continue as improvements in upstream process development, media, and feed optimization drive quality and volume of material coming out of upstream processes. This continues to create bottlenecks in downstream processing. Facilities are looking to the future and to potential solutions. These include higher-capacity resins, in-line buffer dilution (IBD), pre-filters, simpler scale-up of chromatography steps, and more intensive recycling of chromatography resins.

Conclusions

With so many suppliers working to develop commercial-scale, viable alternatives intended to reduce cost and improve performance and capacity, it is likely that changes in the dominant DSP platforms are coming. These will drive change in an industry that is generally slow to adopt new technologies.

The biopharma industry continues to focus on increasing productivity while reducing costs and maintaining product quality. Downstream bioprocessing hurdles continue to block these efficiency objectives. But innovative technologies that have, in some cases, been in the works for decades, such as continuous biomanufacturing, dual-affinity chromatography, and other novel downstream strategies, offer potential options for commercial scale improvements.

However, these advances are moving relatively slowly, according to our report. Further, disruptive strategies like continuous bioprocessing face implementation challenges. For example, continuous centrifugation used as an initial clarifying step, as well as depth filtration, often lacks scale-down models, making it difficult to optimize.

Incremental improvements are being made in affinity chromatography, ultrafiltration, membranes, etc. And it is likely only a matter of time before breakthrough technologies are introduced and evaluated. On the other hand, novel platforms like cell therapies continue to emerge. These require unique downstream purification technologies that often just do not exist at commercial scales. Although there are only a small handful of FDA-approved cell and gene therapies, the need for commercial-scale improvements continues.

These advances in cellular and gene therapies will also push the demand for greater innovation because moving them from clinical to commercial scale will require different scale-up strategies as well. So, the pressure will continue for industry suppliers to create solutions, and new DSP technologies will enable new therapies to be produced more efficiently. This will drive down healthcare costs and allow improved efficiencies and higher yields.