Manufacturing CAR-T In Vivo

By Tyler Menichiello, Chief Editor, Bioprocess Online

Biochemistry aside, manufacturing chimeric antigen receptor (CAR) T-cell therapies is a complicated, costly, and logistically challenging process. Cells first need to be collected from patients and shipped to a central manufacturing facility before being manufactured and then sent back to the patient — a round trip that can take several weeks. Autologous CAR-T manufacturing is also limited by its bespoke nature, as facilities can only produce so many therapies at once. This per-patient manufacturing leads to delays and waitlists, with some patients getting sicker — even dying — before they can be treated.

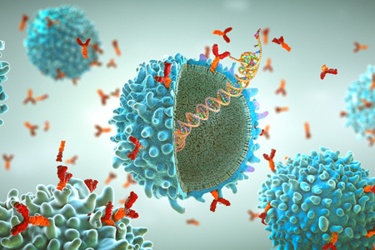

That’s why Interius BioTherapeutics is developing a lentiviral gene therapy to create CAR T and CAR NK cells inside patients’ bodies. This therapy, INT2104, is being developed as an off-the-shelf, one-time treatment for patients with B-cell malignancies. I had the chance to speak with the president and CEO of Interius, Phil Johnson, MD, as well as VP of R&D, Tim Culp, Ph.D., about the company’s mission to develop this in-vivo CAR therapy, as well as why the company chose to do so. They believe that producing CAR T/NK cells in the body has the potential to not only reduce the cost of these therapies, but to expand access to more patients, making waitlists a thing of the past.

Re-engineering The Lentiviral Vector

Perhaps unsurprisingly, the best vector to transduce cells with in vivo is the same type used to do so ex vivo: a lentiviral vector.

“What we did was re-engineer that vector to be amenable to in-vivo administration and began exploring ways to target it specifically to immune cells that could create CARs,” Johnson says. The company decided to target CD7, a surface antigen on both T cells and NK cells. Finding a suitable target was only the first step, according to Culp.

“The binder we use had to bind to both human and monkey CD7,” Culp explains, “and there was only one available antibody that could do that.” The antibody in question, a one-of-one, was discovered in the 1980s, and it had never been sequenced. “We had to actually sequence the protein and then reverse engineer it into a nucleic acid sequence that we could clone into the vector,” he says.

There was also a second surface antigen to address — a fusogen, found on the lentiviral vector, that’s responsible for vector entry into target cells. “We had to modify it so that it didn’t bind to its native receptor,” says Johnson. This involved some structural re-engineering of the protein itself.

“Those two pieces were really the cornerstones of getting the vector engineered,” Johnson says. “The rest of it is really like the other lentiviral vectors that have been around for 30 years.”

In-House Suspension Manufacturing

When the Interius team set out to engineer the INT2104 lentiviral vector, the aim was to design something that was manufacturable at a commercial scale. “In the history of science, and especially in biologics, it’s well-known that you can make stuff in an academic lab that would never be commercially viable because you can’t actually manufacture it,” says Johnson. “So, that’s where Tim came into the picture.”

Along with Culp, the company also brought in CMC experts to build its internal process development team, analytical development team, and formulations team. This early investment in people and knowledge “really paid off,” Culp says. “It’s accelerated our timeline in the sense that we’ve been able to make our own material for all of our animal studies,” which included close to 10 non-human primate (NHP) studies. “NHP studies require a substantial amount of vector, and instead of going to some CDMO and asking them to make more, we’re able to make it in house.”

Interius is using an adherent cell culture process for Phase 1 manufacturing, Culp says, because it provided the fastest path to the clinic. While planning the first clinical study, the team is already working on the next steps — a suspension process, which would take the program into Phase 2 and eventually into commercial manufacturing.

Leaning on its internal process development team and expertise, Interius has been developing a suspension process that can be scaled up to around 2,000 liters, Culp tells me. “The only way to increase volume for adherent cell culturing is by scaling out,” he explains. “If you use 100 cell stacks and have to move up to 1,000 or 10,000, at some point it just becomes undoable. It gets extremely expensive and prone to contamination.”

Part of developing this suspension process involves preparing the cell lines and adapting them to a serum-free suspension process. “That was something we started working on even while we were doing other things, because we knew that was the path forward for the future,” says Culp.

Bigger Batches, Less Testing, More Affordable Therapy

The cost of cell and gene therapies often depends on the dose. And while the company hasn’t established dosing for INT2104 yet, Culp says the suspension manufacturing process is inherently cheaper than traditional adherent cell culturing. “We believe we can knock the cost down by about a hundred-fold with this suspension process,” he tells me.

There are several factors that make suspension manufacturing better from a cost-of-goods standpoint, according to Culp, but most significantly, it’s more productive than adherent cell culture manufacturing. Not only can it be scaled up to higher volumes, but the density of cells can be increased, as well as how much vector is produced per cell.

Being able to make bigger batches (from a volume and vector-production standpoint) means you have to make fewer batches to get the same amount of product, Culp explains. This ultimately means less time and money is spent on analytical testing — something that’s imperative for every batch — which, according to Culp, is an underappreciated step that factors into the cost of goods.

“It’s like your rent,” he tells me. “Every month you have to pay your rent, and every batch you manufacture, you’ve got to do the analytical on. It just doesn’t go away.” He says manufacturing bigger batches is a major area where “you can make a ding in the cost of goods.”

Aside from the cost of goods, Johnson says, Interius is aiming to address “the entire envelope of costs” associated with ex-vivo CAR products — i.e., the unforeseen and often overlooked technical costs from the hospital. “Not the least of which is sitting a patient down in a clinic and hooking them up to an apheresis machine and all the people that are required to do that,” he says. “In our case, the patient comes into the clinic to see the physician and the physician orders the vial from the pharmacy. It’s a simple IV infusion and they’re done.”

Starting Phase 1 In Australia

Interius is starting its Phase 1 trial in Australia later this year, with plans to dose its first patient in October. The company has already made the GMP Phase 1 study drug product, so “it’s just a matter of getting those sites up and running,” according to Culp. While the first patient is being dosed in Australia, the study will expand to a several countries in Europe.

From early pre-IND regulatory conversations with the FDA, Culp says, it was clear a Phase 1 study in the U.S. wouldn’t be able to progress as quickly as possible. “The FDA was extremely cautious in how they were approaching it, to a point where we felt the study could get stalled and never be able to do a dose escalation,” he says.

Regulators at the Paul Ehrlich Institute (a federal regulatory agency for biomedicines in Germany), on the other hand — who were handling Phase 1 applications for E.U. countries — seemed to have a better understanding of the product than the FDA, Culp says. “So, we felt like, let’s not start in the U.S. Let’s come back to the U.S. after we get some human data.” The company’s plan is to return to the U.S. in the second half of the Phase 1 study, or in a Phase 2 study.

There is no regulatory precedent for an in-vivo CAR T/NK cell therapy product, so the FDA’s conservative attitude is understandable — and I’m sure these same regulators are happy to be proven wrong. After all, INT2104 stands to fundamentally change the way cell therapies are designed and manufactured. If all goes well, not only can it revolutionize CAR therapy, but it can also be the industry’s first step into a future where these therapies are more widely accessible and affordable for patients — a future we’re all striving for.