Imbalance In The CDMO Market And The Long-Term Implications

By Alex Klarer, Founder, Managing Director, Engelex

The cell and gene therapy (CGT) industry has witnessed remarkable growth over the past decade, driven by groundbreaking scientific advancements and treatments for indications with high unmet needs. The industry got a boost in attention and investment during the pandemic in 2020 more than doubling the dollars investment from the previous year and seeing a 20% increase in clinical trials1. This ‘boom time’ was an undeniable benefit to the progress and adoption of new innovations and created a heavy incentive to build new, purpose-built cell and gene therapy manufacturing infrastructure, however, too many of the products that entered the clinic had no path to commercial viability. This rapid expansion had an equally rapid decline that has also led to a significant imbalance between the number of contract development and manufacturing organizations (CDMOs) and the number of clinical trials. This article explores how this disparity came about and how the market for manufacturing services will change as a result.

The Rise of CDMOs

CDMOs have become an integral part of the CGT industry, offering specialized manufacturing services that enable biotech companies to bring their therapies to market more efficiently. The proliferation of contract manufacturing has been fueled by the increasing complexity and cost of manufacturing advanced therapies, which often require highly specialized facilities and expertise. As a result, many biotech firms have opted to outsource their manufacturing needs to CDMOs.

This dynamic has allowed biotech companies to focus investments on their specific therapeutic pipelines and manufacturers to focus on the bulk success of the industry. This model worked effectively as demand for manufacturing surged, peaking at 256% of pre-pandemic highs as measured by total clinical trials in mid-2021 and incentivized heavy investment into the sector by established companies and upstarts alike1. CDMOs raced to add capacity with the expectation that we would maintain that peak demand or, at best, experience only a modest decline.

The Bottleneck

However, the demand for manufacturing did not keep pace with the rate CDMOs built new facilities. The cell and gene therapy industry does not have a mature commercial industry with consistent manufacturing demands to buffer against downturns. Between two-thirds and three-quarters of all capacity is used for the manufacture of clinical stage products, and, with commercial capacity concentrated on in-house manufacturing, contract manufacturers are further dependent on clinical products2. At face value, the industry has seen significant growth over a short period of time as the current number of active human trials is nearly double what it was five years ago. Unfortunately, this represents an average attrition of roughly twenty active trials per month from the 2021 peak as opposed to the historic trend of netting nine additional trials per month.

High costs begot even larger investments as companies raced to have their facilities ready ahead of their competition. The inflated cost of construction materials, supply chain delays, and scarce expertise all contributed to higher-than-average costs of construction. The land grab locked in sky-high infrastructure costs that were only acceptable when clients desperate for capacity to start their clinical trials.

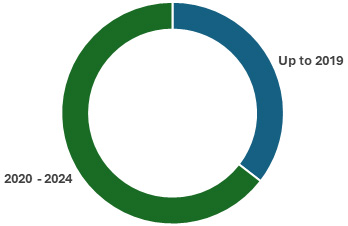

Figure 1. Cell and gene therapy manufacturing capacity added up to 2019 and between 2020 and 20243.

There is now vastly too much available capacity. Between 2019 and 2024 the growth in manufacturing capacity has outpaced that of active clinical trials by over two-to-one3. As the industry matures, we do expect that later phase trials and commercial products will represent a larger proportion of active manufacturing which would serve larger patient volumes and more manufacturing capacity, but that is not the case here. Early trials currently representing a slightly larger percentage of the total active trials than in 2019, and CDMOs have simply built for demand that did not materialize. This forces CDMOs to significantly mark down their margins to win clients or leave facilities vacant causing CDMOs across the board to face profitability crises.

It’s (Mostly) Not the Market’s Fault

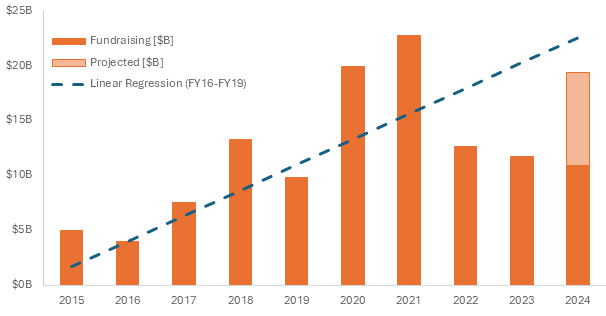

In 2024, funding for CGT has returned to historic trends, signaling a recovery from the fluctuations experienced in previous years. However, this recovery has not been uniform across the industry. This year has demonstrated investors dipping their toes in with fewer, larger rounds into firms with a strong technical backbone—or just for shelter in the crowd.

Figure 2. Total cell and gene therapy fundraising up to the second quarter of 20244.

As capital is deployed, the recovery has started peeking through with the number of active clinical trials showing signs of leveling off from the decline, the overall sentiment within the market remains cautious. There is some reputational damage that can only be repaired over time, but indications are that we have turned the corner.

Outlook

This disparity has created a highly competitive environment where many CDMOs struggle to secure enough work to remain profitable. Companies are forced to enter an arms race to maintain their position in the market. Manufacturers need to quickly differentiate themselves from the pack by making strategic investments, and firms should perceive this asymmetric environment as a prime opportunity to make forward-looking investments. A few examples of CDMO investment strategies include:

- Consolidation: Merging with or acquiring other CDMOs can help create larger, more resilient organizations that can leverage economies of scale to provide competitive pricing and depth of technical capabilities. (e.g. Resilience)

- Value Chain Integration: Further integrating into the product value chain can provide CDMOs with better control over bottlenecks up-stream and down-stream of product manufacturing, ensuring more predictable timelines and reduced costs. (e.g. Charles River Labs)

- Digital Systems and AI: Implementing advanced digital systems and artificial intelligence can optimize manufacturing processes, reduce knowledge barriers, and increase supply-chain transparency. (e.g. Omnia Bio)

- Innovative Manufacturing and Analytical Processes: Investing in cutting-edge manufacturing technologies and innovative analytical methods can enhance the quality and scalability of production, making CDMOs more attractive to biotech firms. (e.g. Cellares)

- Co-Investment in Products: Providing either direct capital or in-kind investment in the development of a therapeutic product can create a mutually beneficial relationship where the client gets immediate benefit in cash or defrayed costs and the long-term benefit of having a service provider that directly benefits from the commercial success of the client. (e.g. Elevate Bio)

These choices increase the complexity for therapeutic developers searching for manufacturing capacity and create new opportunities for companies developing new technology. Understanding how to engage with CDMOs during this dynamic period in the industry will be critical for all stakeholders.

Conclusion

The current imbalance between the number of CDMO vendors and the number of cell and gene therapy clinical trials presents a significant challenge for the CGT industry. These challenges will bear out as a rapid differentiation and diversification of manufacturing services. The strategies employed by services providers will undoubtedly be as diverse as the products they manufacture. Selecting a manufacture is a choice on which partner or set of partners provides the match for the developer. Companies need the proper insights and guidance to see through the fray and make the best choices for the long-term success of their company.

References

- Alliance for Regenerative Medicine. Clinical Trials Regular Report 2023 Q1. Published August 2023. Accessed October 23, 2024. https://alliancerm.org/wp-content/uploads/2023/08/Clinical-Trials-Regular-Report-2023-Q1-20230720-002.pdf[1](http://alliancerm.org/wp-content/uploads/2023/08/Clinical-Trials-Regular-Report-2023-Q1-20230720-002.pdf)

- Cell And Gene Therapy Manufacturing Market Report, 2030. Published 2023. Accessed October 29, 2024. https://www.businesswire.com/news/home/20230403005458/en/Global-Cell-and-Gene-Therapy-Manufacturing-Market-Report-to-2030---Growing-Pipeline-of-Cell-and-Gene-Therapy-Fuels-the-Sector---ResearchAndMarkets.com[2](https://www.businesswire.com/news/home/20230403005458/en/Global-Cell-and-Gene-Therapy-Manufacturing-Market-Report-to-2030---Growing-Pipeline-of-Cell-and-Gene-Therapy-Fuels-the-Sector---ResearchAndMarkets.com)

- Engelex, LLC internal data

- Alliance for Regenerative Medicine. 9_29_Deals_Final. Published September 2024. Accessed October 23, 2024. pdfalliancerm.org/wp-content/uploads/2024/09/9_29_Deals_Final.pdf

About The Author

Alex Klarer founded the strategy consulting firm Engelex to provide deep, quantitative insights into and provide actionable strategies for manufacturing, technology development, and vial/vein-to-vein supply chain management. Klarer is an industry professional with a decade of experience in a variety of roles from process development, CMC, manufacturing engineering, cGMP manufacturing, technology development, market analysis, and corporate strategy. He held those roles at Genentech, Minaris Regenerative Medicine, and BioCentriq.

Alex Klarer founded the strategy consulting firm Engelex to provide deep, quantitative insights into and provide actionable strategies for manufacturing, technology development, and vial/vein-to-vein supply chain management. Klarer is an industry professional with a decade of experience in a variety of roles from process development, CMC, manufacturing engineering, cGMP manufacturing, technology development, market analysis, and corporate strategy. He held those roles at Genentech, Minaris Regenerative Medicine, and BioCentriq.