Global Implications Of Zero Tariffs On Indian Pharma Exports To China

By Mathini Ilancheran, senior delivery lead - research, R&D, Beroe Inc.

In late September 2025, China removed its 30% import duty on Indian medicines, granting tariff-free access for Indian drug makers.¹ At the same time, the U.S. is proceeding with a 100% tariff on imported branded/patented drugs, with ally caps and carve-outs linked to U.S. manufacturing.²,³,⁴ These opposing moves will reroute global flows, with China opening up to Indian generics just as the U.S. is discouraging branded imports.

Impact Across The Pharma Value Chain

Research & Early Development

CROs and labs in China that relied on higher-cost imported reagents/comparators may pivot toward Indian generic substitutes where scientifically appropriate. Procurement response: Qualify Indian vendors and maintain origin/patent documentation for multi-region programs.¹

Preclinical & Translational Research

Comparator drugs and branded reagents imported from Europe or the U.S. could lose price competitiveness versus Indian equivalents. Procurement response: Establish multi-origin comparator inventories and implement tariff-protection clauses with Western suppliers.²,⁴

Clinical Development (Phases 1-3)

Clinical trials conducted in China may benefit from cheaper Indian comparators, but pivotal FDA/EMA-bound programs may still prefer incumbent SKUs for continuity. Procurement response: Embrace dual-sourcing India for cost-sensitive arms and originators for global dossier alignment.²,⁴

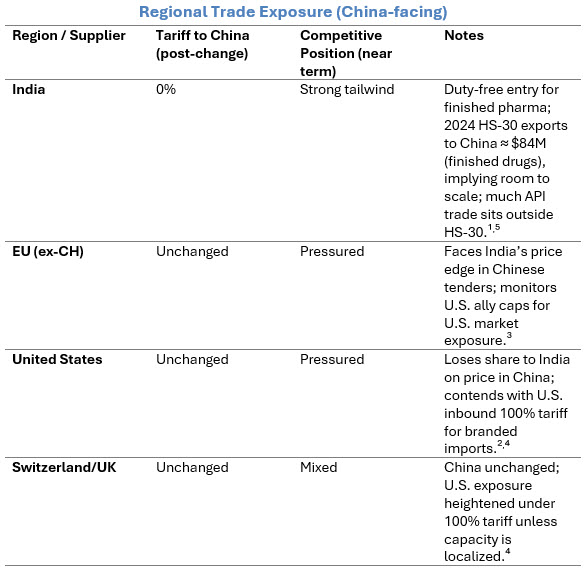

Drug Substance & Formulation

India supplies a notable share of China’s small molecule needs (APIs classified outside HS-30). With duty-free access to finished pharmaceuticals, India’s role expands. Procurement response: Conduct SKU-level mapping of API versus finished-dose exposure, and watch corridor concentration risk.⁵

Drug Product & Packaging

Indian-finished formulations and some components will undercut EU and U.S. imports in price-sensitive tenders. Procurement response: Consider localized secondary packaging/release testing in China, and partner with Indian exporters.¹

Advanced Therapies & Biologics

Near-term gains skew to small molecules, but biosimilar uptake bears watching as China’s National Medical Products Administration (NMPA) approvals advance. Procurement response: Track NMPA biosimilar approvals, and explore co-commercialization with Indian firms.¹

Sources: UN Comtrade via TradingEconomics⁵; ChemAnalyst¹; Reuters²; Financial Times³; Reuters.⁴

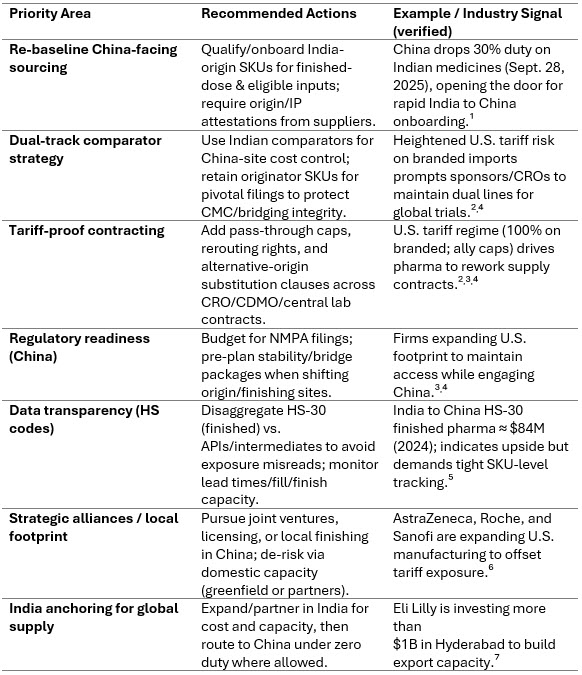

Strategic Procurement Priorities

In this new trade environment, procurement must shift from tactical spot-buying to a forward-looking, multi-axis strategy that balances cost, compliance, capacity, and geopolitical risk. The table below outlines core priorities, actions, and verified recent moves (September 2025–present).

Conclusion

China’s zero-tariff opening to Indian medicines is a structural market access shock: It lowers acquisition costs in China and reshapes supplier power across Asia, just as the U.S. moves the other way on branded imports. Procurement leaders that qualify India-origin pipelines, segment comparator strategies, hard-wire tariff clauses, and separate HS-30 from API flows will capture savings while hedging operational and geopolitical risk. Over the next 18 to 24 months, expect stronger India-China flows, accelerating U.S. localization, and more hybrid CRO-CDMO alliances. The winners will treat this as a multiyear realignment, not a temporary price event.

References:

- ChemAnalyst, “China Scraps Pharma Tax from 30% to Zero as Trump Levies 100% Tariffs,” Sep. 28, 2025.

- Reuters, “What to know about Trump’s tariffs on branded drugs, furniture and other goods,” Sep. 26, 2025.

- Financial Times, “US set to honour 15% tariff cap on drugs from the EU and Japan,” Sep. 26, 2025.

- Reuters Breakingviews, “Big Pharma’s tariff win leaves lingering aches,” Sep. 26, 2025.

- UN Comtrade via TradingEconomics, “India Exports of Pharmaceutical Products to China (HS-30), 2024,” Oct. 2025.

- Reuters, “Foreign companies eye US expansion to lessen fallout from tariffs,” Oct. 6, 2025.

- Channel NewsAsia / Times of India, “Eli Lilly to invest >US$1B in India (Hyderabad) to expand manufacturing capacity,” Oct. 6–7, 2025.

About The Author:

Mathini Ilancheran is an expert in market intelligence and industry analysis, specializing in delivering strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 35+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.

Mathini Ilancheran is an expert in market intelligence and industry analysis, specializing in delivering strategic insights that help Fortune 500 companies make informed decisions. With a focus on global pharma, biotech, and medical devices, she brings deep expertise in value chain analysis, industry and technology trends, competitive intelligence, and strategy. Mathini has authored 35+ publications on R&D outsourcing, offering actionable perspectives that guide global enterprises in optimizing outsourcing practices, category management, and long-term planning.