Gene Therapy Uptake: The Elephant In The Room

By Hanson Koota, Blair Miller, Shannon Anderson, Keren Shani, Theresa Morley McLaughlin, and Nathan Buchwald, Trinity Life Sciences

Gene Therapy Uptake Overview

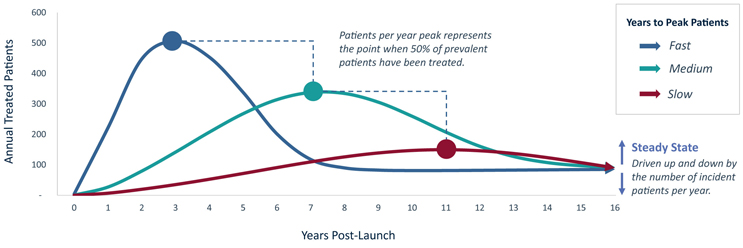

FIGURE 1 | Example Annual U.S. Patients Treated With Gene Therapy: 1.6K cumulative treated patients at different uptake speeds (1.5K Prevalence, 80 patient/year incidence)

Let’s first define gene therapy – in the context of this paper, when we say “gene therapy” we are referring to a single administration gene therapy meant to provide a durable clinical response without re-dosing. While gene therapies can take many forms, AAV vs. Lenti vs. LNP, Ex-Vivo vs. In-vivo; similar general principles apply. We recognize that the promise/potential of a safe, re-dosable gene therapy, and how health care providers (HCPs), patients, payers, and biopharma companies will value them is a challenge, and a full topic in itself.

Gene therapies’ single administration nature presents a unique commercial challenge for biopharmaceutical companies; unlike traditional small molecule or biologic therapies that can be dosed chronically or repeatedly on an “as needed” basis, the one-time per patient administration of a gene therapy means that as time passes, the eligible population decreases in size.

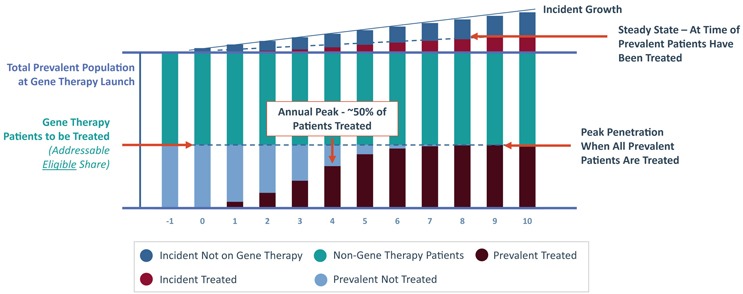

When a gene therapy class launches in a new market, there exists a bolus of prevalent patients eligible to receive the novel treatment. This patient pool decreases over time as eligible prevalent individuals either receive a gene therapy or become ineligible (e.g., if they age or progress past the eligibility window). Although the patient pool is replenished by newly eligible incident patients, this annual influx can be a small number of patients per year, particularly in rare or ultra-rare diseases. Once the gene therapy class reaches roughly half of its peak penetration, the number of patients receiving a gene therapy per year will begin to decrease - eventually reaching a steady-state annual treated patient volume, which is driven exclusively by annual incident patients after the prevalent population is treated.

This leaves gene therapy markets particularly sensitive to the prevalence and incidence of the target indication. For gene therapies targeting diseases with low incidence (e.g., Phenylketonuria, Hemophilia), revenue is primary driven by treating the prevalent population, and can be sustained by expanding the target population over time. In contrast, high incidence diseases (e.g., Spinal Muscular Atrophy, Huntington’s Disease) can sustain revenue through treating new patients each year. As a result, the epidemiology of an indication directly impacts its ability to sustain one or multiple commercially viable gene therapies.

FIGURE 2 | Total Population with a Gene Therapy Entrant

The speed of gene therapy class uptake, and subsequent time to peak annual patients treated and steady-state treatment rate, is expected to be driven by several factors that can be boiled down to a balance of unmet need and the quality of gene therapy options relative to available non-gene therapy treatments. These factors will ultimately influence the speed at which patients are willing to try new gene therapies that they are likely to be less comfortable with. Fully understanding the influence of these market and product attributes is necessary to properly forecast gene therapy uptake.

Key Market Drivers Contributing to Gene Therapy Opportunity

There are several key market drivers to keep in mind when predicting a gene therapy’s uptake within a specific indication. These include disease epidemiology, unmet need, and order of entry. While on the surface these drivers appear generally similar to the market factors impacting the uptake of any pharmaceutical, there are unique implications for one-time gene therapies in relatively small monogenic diseases.

Disease epidemiology provides information on the overall potential patient pool, while the level of unmet need within a population determines patient interest in receiving a costly, irreversible, and potentially invasive gene therapy. In high unmet need indications, there is often rapid disease progression, a large severe phenotype population and a relatively short treatment window for patients to receive a gene therapy. These factors will drive many patients in high unmet need indications to rush to receive the first gene therapy available to them. In contrast, in low unmet need indications there may be alternative treatments available, slow or no disease progression, a small severe phenotype and a wide treatment window. These factors allow patients to wait to receive a gene therapy until a better one is available or until they are certain a gene therapy is right for them. For example, if a patient is stable on an ERT or replacement therapy, and their disease course is not progressive, they have the ability to choose when they want to take a risk and try an innovative approach.

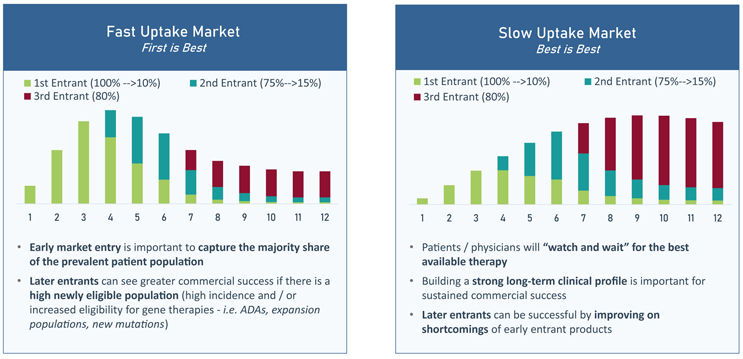

Driven by unmet need, uptake speed directly impacts the commercial upside of later-to-market entrants, as depicted in FIGURE 3. In fast uptake markets (where unmet need is high), the operating principle is “first-is-best”. The first gene therapy in a “first-is-best” market will capture the majority of the prevalent population, leaving later entrants to rely on treating primarily incident patients. In fast uptake markets, late entrants can only succeed if there is high incidence or increased eligibility for the late entrant (i.e., a different mutation/expansion population). In contrast, in slow uptake markets (where unmet need is low), patients may choose to wait for treatment, so being the first entrant is less important. In these markets, the operating principle is instead “watch and wait” or simply “best-is-best”. To have success in slow uptake markets, it is more important to build a strong long-term clinical profile, as late entrants can capitalize on the shortcomings of early products.

FIGURE 3 | Impact of the Speed of Uptake on the Commercial Upside of Later-to-Market Gene Therapy Entrants

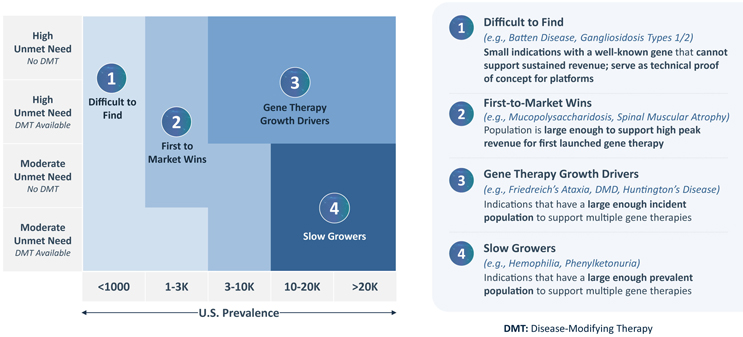

Further granularity regarding “first-is-best” or “best-is-best” market distinctions is found by placing the two key drivers, disease prevalence and unmet need, on axes to map four different gene therapy market archetypes, as depicted in FIGURE 4. These archetypes aid in determining whether a market can support multiple gene therapy entrants and what uptake speed those entrants should expect.

- Regardless of unmet need, ultra-rare indications (<1,000 U.S. patients) are considered “Difficult to Find.” Due to their low patient volumes, these markets are unable to support sustained revenue for even a single gene therapy. However, they may still serve as proof-of-concept indications.

- “First-to-Market Wins” indications can support high peak revenue for a single gene therapy in small, high need populations or slightly larger, moderate need populations. However, as the archetype’s name implies, these markets are too small or too low need to support multiple gene therapies. As a result, the first-to-market product is the only commercially viable entrant; later-to-market therapies are unlikely to see high peak or sustained revenues.

- In higher prevalence (3,000+ U.S. patients) indications with high need, the attractive market segment of “Gene Therapy Growth Drivers” exists. These indications have high enough need to see relatively quick gene therapy uptake, and their relatively large incident populations can support multiple gene therapies.

- Moderate need, but larger prevalence (10,000+ U.S. patients) indications will be “Slow Growers.” As the name implies, indications within this archetype will see relatively slow uptake, but the patient populations are large enough to sustain multiple gene therapies.

FIGURE 4 | Gene Therapy Market Archetypes

Key Product Factors Contributing to Gene Therapy Opportunity

Product Attributes

In markets that can support multiple gene therapies, having superior product features will drive product-specific uptake. While efficacy and safety will be the primary drivers of gene therapy success, durability and route of administration are also expected to influence gene therapy uptake and product preference when competitors are present, as depicted in FIGURE 5.

FIGURE 5 | Factors That Drive Gene Therapy Uptake Speed and Market Penetration

In most cases, gene therapies are expected to demonstrate strong efficacy data beyond biomarkers to drive initial product uptake. This is especially true when a therapeutic alternative is available as patients and providers will have to evaluate the risk of switching from a familiar treatment to a novel gene therapy.

As gene therapies are designed to have a sustained presence in the body, safety is a particular and inherent concern for treatments of this type. Even in high need indications, patients will not risk losing high quality-of-life years if the adverse events associated with a given gene therapy outweigh the risks of the disease. Significant adverse events can dramatically slow uptake if patients perceive the therapy as unsafe. The product’s delivery vehicle, route of administration and required conditioning regimen may each be the source of safety-related concerns. Even in high need markets, harsh conditioning regimens or invasive surgeries can lower patient interest and slow uptake considerably. Reducing gene therapy-associated burden relative to disease-based unmet need will ensure patients remain interested in a gene therapy treatment.

In addition to proving their efficacy and safety, one-time gene therapies must also convince physicians and patients that their durability is worth a high price tag and potentially intensive administration regimen, such as high dose steroids or surgeries, for instance. In the market today, durability data demonstrating five years of efficacy is viewed as the bare minimum for approval and initial uptake. Additional positive post-market approval data will lead to an inflection in uptake, particularly in low unmet need markets as patients may be waiting for additional data before choosing to receive a gene therapy treatment.

If patients are convinced of a gene therapy’s durability, how the treatment is administered can have a significant impact on its uptake as well. In low need markets, patients may opt not to undergo difficult regimens or surgeries if there exist other disease modifying therapies or gene therapies in development with lower administrative burden. Alternatively, in markets where multiple gene therapies are likely to enter, differentiating on durability, dosing, and route of administration can give a product a competitive edge.

Patient Identification, Site Selection, and Therapy Acceptance

Once a company has chosen a viable market and created a differentiated gene therapy product, the final piece of success comes from their ability to anticipate challenges associated with launching a gene therapy. Company preparedness for gene therapy launch will impact early uptake and market penetration; two crucial aspects to consider are patient identification and site dynamics.

In rare diseases, identifying addressable patients can be a challenge. Even in indications where epidemiological data indicate a certain volume of patients, the number that can be identified and prescribed a gene therapy after launch may be drastically lower. Companies need to consider if their addressable patient population is identifiable through readily available genetic testing and whether patients are currently being entered into registries. While testing likely exists, there may be various pitfalls in patient identification, including lack of referrals for genetic testing or other barriers to accessing said tests. Additionally, patients may be hesitant to follow-through with genetic testing due to a lack of desire to know their diagnosis, the perceived cost of genetic testing or a lack of understanding of how genetic testing will impact their treatment options. These challenges may considerably reduce the addressable patient population when the product launches.

If patients are identifiable, the next step is locating them geographically. In the management of rare diseases, there are often concentrated centers of excellence which already identify and treat most patients with a certain condition. However, in indications with no treatments available, patient care may be dispersed across different settings and geographies. Limiting administration of a gene therapy to select treatment centers may be feasible for some indications, particularly those with established centers of excellence. This approach may also be required for gene therapies that are difficult to administer and require substantial physician and staff training. In contrast, for indications with dispersed patient populations, preparing many potential sites for treatment administration may be advantageous to facilitate rapid uptake. In either case, adequate site readiness will greatly impact the rate at which gene therapy doses can be administered after approval. Properly anticipating and planning for potential hurdles or delays in the logistics of administering a gene therapy post-approval will allow for maximal uptake speed while simultaneously ensuring a positive patient and provider experience.

Once addressable patients are identified and located, patients and/or caregivers must be willing to accept the prescription for a gene therapy. Patients who are eligible for treatment with a gene therapy per the label criteria, may ultimately decide that they are not interested in receiving the therapy due to lack of affordability, safety concerns, hesitancy with gene editing or cumbersome pre- or post-treatment regimens. Patient payment assistance programs clearly communicated that safety data and patient educational materials can help to increase patient acceptance of gene therapies. Companies that are proactive in communicating with and educating patients and caregivers will see increased utilization of their gene therapy in their identified addressable patients.

Pricing

Finally, it is no secret that gene therapies are the most expensive therapeutics to ever launch, with prices in the range of millions of dollars per patient. It is important that companies carefully consider their pricing strategy as flexible pricing approaches can aid in payer negotiations and assist in unlocking large segments of the eligible population.

While another white paper about gene therapy market access, including what value can be achieved, and what pricing/reimbursement can be expected in different markets will be released by Trinity at a later date, we wanted to use this opportunity to highlight how different pricing strategies can impact a forecast.

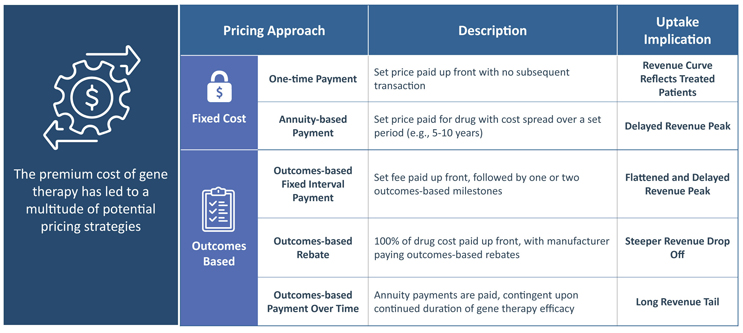

Overall, pricing strategies can be broken into fixed cost and outcomes-based approaches, as depicted in FIGURE 6.

FIGURE 6 | Gene Therapy Pricing Strategies and the Implication on Uptake

For fixed cost approaches, which include one-time or annuity-based payments, there is the potential for strong payer pushback due to gene therapies’ high cost.

- Most simplistic from a forecasting perspective, one-time payments will result in a revenue uptake curve that directly reflects the number of treated patients.

- For annuity-based payments, although the total cost is still fixed, revenue is spread over a set period (e.g., 5-10 years), leading to a delayed revenue peak. There is no precedent for this.

With outcomes-based pricing, including rebates, interval payments and payment over time, companies have the potential to negotiate a higher overall price with payers by linking payments to treated patients’ clinical milestones. The effect of each outcomes-based pricing approach on revenue varies based on the timing of both payments and patient outcomes assessments.

- In outcomes-based rebates the full cost of the drug is paid upfront, but the manufacturer is responsible for paying rebates if patients miss pre-determined efficacy milestones. While revenue for outcomes-based rebate pricing will follow treated patients, issued rebates over time will lead to a steeper drop-off.

The two other outcomes-based pricing strategies, spread payments out over time and include outcomes-based fixed interval payments or outcomes-based payments over time.

- With fixed interval payments there is a set price paid at treatment, with a few additional milestone-contingent payments. This method’s uptake curve would be similar to annuity-based payments with a delayed revenue peak, but the former would be slightly flattened due to some patients missing milestones.

- In contrast, outcomes-based payments over time would consist of smaller payments over a longer period of time, pending the continued durability of the gene therapy. This would lead to a long revenue tail.

The Unique Gene Therapy Forecast Curve

Compared to traditional pharmacotherapies, forecasting revenue for novel gene therapies presents a unique challenge due to the single-dose treatment model and limited precedent set by a single product with over one year of on-market data. The nature of a single-dose therapeutic will lead to a bolus of dosed prevalent patients with a subsequent tapering treatment focuses on new incident individuals. Maximizing potential sustained revenue will come from picking the proper market, ensuring the right entry timing, and creating the most desirable and accessible option.

Executive Summary

- Accurate revenue forecasting is critical to strategic and operational success in the biopharma industry; however, limited commercial precedent creates significant difficulty in modeling gene therapy revenue and uptake.

- One time administration provides a unique market dynamic – with first-to-market movement not only impacting physician experience and accumulating durability data, but also shrinking the treatment-eligible patient pool for subsequent entrants.

- The extent of this first mover advantage is driven by unmet need especially when there are alternative chronic therapies available, which impacts whether prevalent patients will jump to receive a gene therapy as soon as it launches or wait for either a better option to enter the market OR the time is right for them.

- Sustained, long-term revenue for one-time gene therapy markets is dictated by the size of the incident or newly eligible population.

- Understanding product-level drivers of uptake – including efficacy, burden of administration, and durability expectations – is crucial for maximizing revenue potential and market share, particularly in markets with multiple competitors.

- Navigating the unique market access environment created by gene therapy’s high price and potentially complex administration is critical for unlocking an eligible patient population and optimizing potential revenues.

Trinity’s take:

Gene therapy commercialization is in its infancy, with only one commercially successful product to date. The recent sales of Zolgensma® (Novartis) have put this into the forefront, underperforming “Analyst” expectations as annual treatment shifts from the “prevalent” to the “incident” pool. While we will see what the next decade holds, successful gene therapy companies will be those that understand and communicate the value of their gene therapy portfolio. Although there is a myriad of factors that drive value, we can take pause to evaluate factors that are unique to forecasting single administration gene therapy markets.

About the Authors:

About the Authors:

Hanson Koota | Engagement Manager, Strategic Advisory – Trinity Life Sciences

In Hanson’s 5+ years of consulting expertise, he has led numerous engagements in early-stage development, commercialization and forecasting of gene therapies.

Blair Miller | Partner, Strategic Advisory – Trinity Life Sciences

Blair is an experienced consultant, with over 11 years advising companies particularly with novel therapeutics, including cell and gene therapies.

Shannon Anderson, PhD | Senior Consultant, Strategic Advisory – Trinity Life Sciences

Shannon Anderson, PhD | Senior Consultant, Strategic Advisory – Trinity Life Sciences

Shannon has expertise in the early-stage development and commercialization of cell and gene therapies.

Theresa Morley-McLaughlin | Consultant, Strategic Advisory – Trinity Life Sciences

Theresa Morley-McLaughlin | Consultant, Strategic Advisory – Trinity Life Sciences

Theresa has gene therapy expertise that centers on early-stage forecasting and portfolio planning.

Nathan Buchwald | Senior Consultant, Strategic Advisory – Trinity Life Sciences

Nathan Buchwald | Senior Consultant, Strategic Advisory – Trinity Life Sciences

Nathan has expertise in early-stage product strategy, particularly for novel therapeutic approaches, including gene therapies.

Keren Shani, MPH | Executive Director, Cell & Gene Therapy – Trinity Life Sciences

Keren Shani, MPH | Executive Director, Cell & Gene Therapy – Trinity Life Sciences

Keren is an expert in global gene therapy launch strategy and implementation, with specific expertise in site readiness and network strategy for cell and gene therapies.