Establishing And Maintaining A Treatment Network For Your Cell And Gene Therapy Product

By Sanjay Srivastava, Ph.D., Mathias Cousin, Adam Volini, and Amit Agarwal, Deloitte Consulting LLP

Part 3 in a three-part series (Click here to read Part 1 and Part 2.)

“Location, location, location” is a long-held real estate truism: Where a property is situated can greatly influence its attractiveness to potential buyers. Location is also a deciding factor when a cell and gene therapy manufacturer is establishing or growing a network of healthcare providers (HCPs) and treatment centers.

Delivering cell and gene therapies is an expensive and highly complex process, and there are a number of critical metrics that manufacturers should consider when selecting treatment sites. Subsequent activities — preparing sites to receive and initiate therapy, and managing site training and ongoing certification — can be equally, if not more, challenging.

This article looks at key challenges and lessons learned in selecting, developing, and managing a network of healthcare providers and treatment centers.

Selecting Treatment Centers

Cell and gene therapy manufacturers looking for potential HCP network partners often have diverse priorities when selecting clinical trial sites and later converting them to commercial treatment centers. These partners may serve dual roles in a commercial setting: a supplier of the patient’s cells that serve as raw material for the final product, and a customer that selects and delivers the therapy.

Cell and gene therapy manufacturers looking for potential HCP network partners often have diverse priorities when selecting clinical trial sites and later converting them to commercial treatment centers. These partners may serve dual roles in a commercial setting: a supplier of the patient’s cells that serve as raw material for the final product, and a customer that selects and delivers the therapy.

Some companies focus on institutions that have the capacity to accept patients and the necessary capabilities to deliver cell and gene therapies. Others value the reputation certain institutions have in the medical community or their vision and willingness to invest in treatment capacity to support the growth of gene and cell therapies.

Academic medical centers and tier-one hospitals are proving to be sought-after network partners for cell and gene therapy developers. They tend to be in major population centers, have adequate financial and personnel resources, and value the prestige that comes with being first movers in an innovative treatment area. In addition, they often have the experience to deliver therapies for specific, highly specialized conditions.

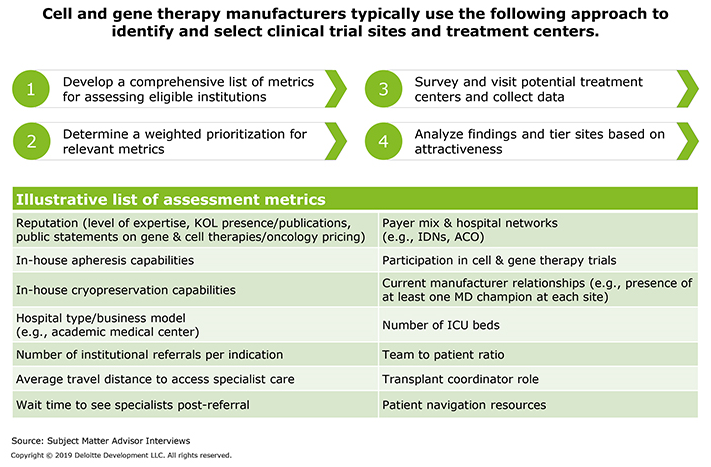

While the overarching strategy may differ, manufacturers typically employ a four-step approach when selecting treatment centers (Figure 1).

Figure 1: How should manufacturers select treatment centers?

There are a number of critical metrics that manufacturers should consider when evaluating potential treatment centers. For example, the facilities should have adequate capacity to prioritize cell and gene therapy patients and house physical assets (such as cryopreservation facilities) needed to deliver the therapy. In addition, treatment centers should provide local access to skilled personnel, offer colocated or nearby apheresis and Day 0 processing capabilities, and be within easy travel distance for patients.

If the treatment center is part of a larger provider organization, key opinion leaders (KOLs) should be clearly aligned with center leadership’s clinical and financial goals. Center staff also should have relationships with the oncologists and other specialists who refer patients for treatment and care for them after.

Preparing Sites To Receive And Initiate Therapy

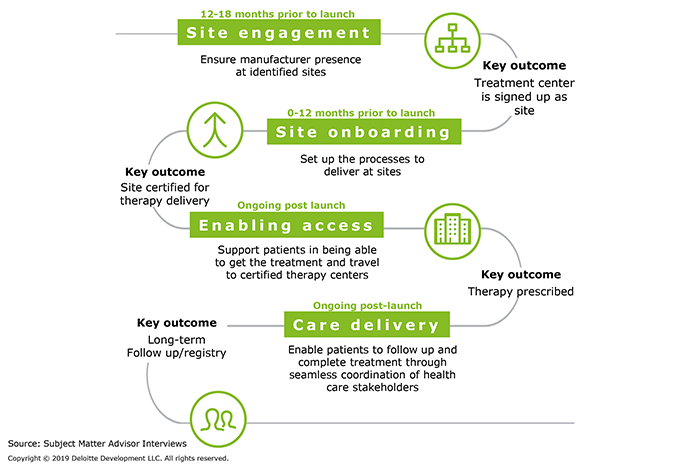

Delivering cell and gene therapy requires specialized facilities, capabilities, and clinician skills. It is, therefore, essential that a manufacturer works with its chosen treatment centers to establish the protocols and procedures necessary to receive the product and initiate therapy. Manufacturers and senior site leadership should begin engaging 12 to 18 months prior to product launch, with staff onboarding following soon after and care delivery ongoing post launch (Figure 2).

Figure 2: How should manufacturers prepare sites to receive and initiate therapy?

An important aspect of site preparation is aligning process guidelines among key trial/treatment stakeholders to enable faster site onboarding. These stakeholders include:

- Manufacturer — Commercial representatives, medical affairs staff, information technology professionals, and the head of country operations

- Healthcare provider — CFO/financial decision-maker, principal investigator, chief nursing officer, apheresis head, clinical lab head

- Third-party consultants or other external resources.

During process guideline alignment, which should take place six to 12 months prior to submitting a biologics license application (BLA) and launching treatment, manufacturers typically visit four to five treatment centers, hold multiple meetings at each to map standard operating procedures (SOP), and create process guidelines customized to provider workflows. The actual site certification process may take an additional six months to complete.

Manufacturers’ site preparation strategy should address the primary stakeholder requirements throughout each phase:

- Site engagement — Engage senior site leadership early and define the tone of the relationship. Highlight potential issues and areas of support to avoid delays in completion. Have a defined process to maximize “must-have” site conversions.

- Site onboarding — Train staff to provide consistent delivery excellence. Execute a stakeholder model that drives engagement and patient satisfaction. Create stakeholder-aligned process guides enabling faster onboarding.

- Patient access — Establish effective patient referral and data exchange protocols. Minimize the impact of financial gating on the overall treatment timeline. Explore options to assist with patient transportation and lodging, when necessary.

- Care delivery — Develop straightforward patient registration and follow-up processes. Reduce the complexity of data collection and reporting activities.

Managing Training And Ongoing Certification

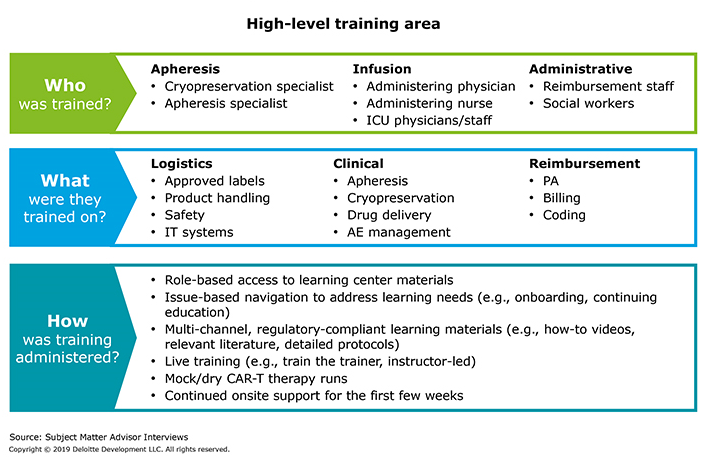

Cell and gene therapies’ complexity and rapid evolution can create clinical, operational, and administrative pain points for providers dispensing treatment — and, by extension, training and ongoing certification challenges for manufacturers. The current site certification process is complex, time-consuming, and resource-intensive, and it may divert scarce resources away from providing care. Treatment centers often express concerns with most aspects of the site certification process.

Providers want training and certification processes to be simple and, where applicable, to allow sites to follow institutional policies to minimize change management. Stakeholders also desire turnkey educational materials (e.g., video training models for apheresis, administration, adverse event management).

From an operational perspective, multiple full-day trainings can exhaust staff; providers prefer that the manufacturer train the trainers who, in turn, coach the staff. In addition, providers may not have all of the requisite capabilities to collect clinical and operational data that manufacturers demand for initial and ongoing site certification. Providers also typically prefer online training versus paper-based documentation. They may feel burdened by cumbersome risk evaluation and mitigation strategies (REMS) certification requirements and want to leverage existing FACT certificates, wherever possible.

To manage ongoing site certification, manufacturers generally require protocol compliance reporting, comprehensive documentation, and ongoing REMS communications. In addition, they typically conduct full-day audits of apheresis centers, flow labs, SOPs, and staff training, with re-audits at six and 12 months.

Figure 3 illustrates an effective way for manufacturers to manage clinician training challenges.

Figure 3: How do manufacturers manage training and ongoing certification?

Cell and gene therapy manufacturers also play a significant role in helping healthcare providers prepare for and manage adverse events. Support often includes training and education to extended HCPs on cytokine release syndrome (CRS) management protocols; dedicated, in-person support for treatment centers during and after onboarding; and access for providers to a network of experts for education and mentoring.

Incorporating Lessons Learned Into HCP Network Strategy

Based on our observations of and experience with cell and gene therapy development efforts, we suggest that biopharma companies incorporate the following learnings into their strategy to establish, grow, and manage their healthcare provider network.

Consider clinical and business factors when choosing centers.

Manufacturers prioritize different factors when selecting clinical trial sites and, later, converting them to commercial treatment centers. In addition to the provider’s business model and capabilities, investor and external stakeholder relations strongly influence HCP network strategy. Also important are considering patient access issues and modeling networks to incorporate existing patient referral pathways. For example, hub-and-spoke models where the apheresis and the transplant take place at different locations.

Develop multilevel and multifaceted partnerships with treatment center personnel.

Site visits and multiple conversations with clinical and administrative staff, from the shop floor to the C-suite, can help manufacturers understand workflows, issues, and areas of desired support to create stakeholder-aligned process guidelines and training approaches.

Align your treatment protocol across manufacturers.

Manufacturers should aim to deliver a simple site certification process that addresses pain points and delivers a positive experience. For example, instituting SOPs for all manufacturers using center facilities can reduce staff time needed to learn multiple treatment SOPs and improve operating efficiency. Likewise, supporting adoption of a standard set of processes, technology requirements, and training can further simplify the process of adopting new treatments and enable patient access to these life-saving therapies.

About The Authors:

Sanjay Srivastava, Ph.D., is a senior manager and the lead for Deloitte's Next Gen Therapy consulting practice, helping biopharma and biotech companies define and implement fundamentally new and transformative capabilities to develop, produce, and commercialize next-generation therapies. His project work centers around defining and implementing innovative R&D and commercial strategies to design value-added activities that optimize operations and deliver therapies to the market. Srivastava earned his Ph.D. in bio-organic chemistry from the University of Maryland with post-doctoral training at Johns Hopkins University and Cornell University with a focus on neurodegenerative diseases, such as Parkinson’s disease.

Sanjay Srivastava, Ph.D., is a senior manager and the lead for Deloitte's Next Gen Therapy consulting practice, helping biopharma and biotech companies define and implement fundamentally new and transformative capabilities to develop, produce, and commercialize next-generation therapies. His project work centers around defining and implementing innovative R&D and commercial strategies to design value-added activities that optimize operations and deliver therapies to the market. Srivastava earned his Ph.D. in bio-organic chemistry from the University of Maryland with post-doctoral training at Johns Hopkins University and Cornell University with a focus on neurodegenerative diseases, such as Parkinson’s disease.

Mathias Cousin is a senior manager in the Life Sciences strategy practice of Monitor Deloitte, and one of the leaders of Deloitte’s biotech, and next generation therapy practices. He is passionate about how technological changes will impact the life sciences industry and potentially disrupt existing players. During his consulting tenure, Mathias has led engagements in corporate, BU, and commercial strategy, both in pre- and post-launch environments for life sciences companies. He has worked across industries and geographies.

Mathias Cousin is a senior manager in the Life Sciences strategy practice of Monitor Deloitte, and one of the leaders of Deloitte’s biotech, and next generation therapy practices. He is passionate about how technological changes will impact the life sciences industry and potentially disrupt existing players. During his consulting tenure, Mathias has led engagements in corporate, BU, and commercial strategy, both in pre- and post-launch environments for life sciences companies. He has worked across industries and geographies.

Adam Volini is a New York City-based manager at Deloitte Consulting, with over 10 years of life sciences consulting experience. As a leader in Deloitte’s NextGen Therapies practice, he is focused on helping biopharmaceutical organizations to address key customer experience and supply chain challenges to advance cell and gene therapies to market. He has a strong track record of delivering future-state processes and business requirements and leading operating model transformations supporting all aspects of the R&D value chain.

Adam Volini is a New York City-based manager at Deloitte Consulting, with over 10 years of life sciences consulting experience. As a leader in Deloitte’s NextGen Therapies practice, he is focused on helping biopharmaceutical organizations to address key customer experience and supply chain challenges to advance cell and gene therapies to market. He has a strong track record of delivering future-state processes and business requirements and leading operating model transformations supporting all aspects of the R&D value chain.

Amit Agarwal is a managing director in Deloitte Consulting’s life sciences practice. He has more than 25 years of management consulting experience and has led multiple projects in both strategy and operations. Agarwal co-leads the Next Gen Therapy practice, which focuses on advising clients on taking advantage of and/or developing strategic responses to new disruptive technologies which leapfrog older business models and establish new clinical practices. Agarwal has worked with life sciences clients in the U.S., Europe, and Asia on high-impact projects. He holds an MBA in finance and technological innovation from the MIT Sloan School of Management and a bachelor’s degree in history and pre-med from Occidental College.

Amit Agarwal is a managing director in Deloitte Consulting’s life sciences practice. He has more than 25 years of management consulting experience and has led multiple projects in both strategy and operations. Agarwal co-leads the Next Gen Therapy practice, which focuses on advising clients on taking advantage of and/or developing strategic responses to new disruptive technologies which leapfrog older business models and establish new clinical practices. Agarwal has worked with life sciences clients in the U.S., Europe, and Asia on high-impact projects. He holds an MBA in finance and technological innovation from the MIT Sloan School of Management and a bachelor’s degree in history and pre-med from Occidental College.

As used in this document, “Deloitte” means Deloitte Consulting LLP, a subsidiary of Deloitte LLP. Please see www.deloitte.com/us/about for a detailed description of our legal structure. Certain services may not be available to attest clients under the rules and regulations of public accounting.

This publication contains general information only and Deloitte is not, by means of this publication, rendering accounting, business, financial, investment, legal, tax, or other professional advice or services. This publication is not a substitute for such professional advice or services, nor should it be used as a basis for any decision or action that may affect your business. Before making any decision or taking any action that may affect your business, you should consult a qualified professional advisor. Deloitte shall not be responsible for any loss sustained by any person who relies on this publication.