Embracing Robotics To Scale Cell And Gene Therapy Manufacturing

Kealy Walters, Management Consultant, Cell & Gene Therapies; Martha Perez Linares, Management Consultant, Cell & Gene Therapies; Lena Walton, Management Consultant, Cell & Gene Therapies; and Dr. Sanjay Srivastava, Managing Director, Cell & Gene Therapy Lead at Accenture

Within the last decade, the growth of cell and gene therapies (CGTs) has been undeniably exponential. With more than 1,000 cell and gene therapies currently in development, and 50–75 therapies expected to be approved in the US by 20301; the impact of these therapies on patient populations is evident. Nevertheless, the industry continues to experience significant operational bottlenecks and challenges to efficiently meet demand. While a lot of information already exists on these challenges and even potential automation, our goal is to address how should we strategically think about selecting and implementing the right technology to address the unique and complex challenges of cell and gene therapy manufacturing.

Current State Manufacturing Processes are Key Bottlenecks

CGT manufacturing is mired in challenges: high out-of-spec rates, unmet demand, talent shortages, extremely high cost of goods (COGS), etc. Many experts point to raw material shortages as the critical factor in commercial manufacturing bottlenecks; however, we posit that current manufacturing processes could be an equally -- if not more -- significant factor. When the time comes for commercialization, manufacturing processes are not robust enough to efficiently support production at the desired scale. This is not just due to the sponsor’s desire to minimize time to market, but also the reality of the accelerated development pace required for these innovative therapies to achieve breakthrough designations and fast track approval, and ultimately improve patient access.

To exacerbate these challenges further, patient demand is only expected to increase. Thus, to better understand these challenges, let us review the root causes:

- Minimal process characterization – Due to the highly competitive nature of the CGT industry and shorter development time, therapies reach the market with “good enough” manufacturing processes. In a race against time, manufacturing teams must make a viable process with little-to-no business strategy during early development and then begin to scale, quickly. Minimal process characterization occurs for regulatory needs, but fully developed process characterization of highly complex biological products in these accelerated timeframes is not feasible.

- Highly skilled, manual processes – Large-scale CGT manufacturing remains nascent. Due to this, many automated technologies and potential solutions do not yet exist in the market, and so manufacturing processes remain entirely or partially manual. To compound this issue, the manual processes require highly specialized and highly sought-after labor.

- Lack of data collection & integration – With so many manual processes and isolated automated systems, process data collection remains difficult. Without a proper data collection strategy, manufacturers cannot leverage their own historical manufacturing data to perform process improvement analytics.

Most Scalability Strategies Attempt to Meet Patient Demand but Do Not Address Root Causes

Thus far, most companies have chosen to significantly invest in expanding their facility footprint to increase their manufacturing capacity and meet patient demand. Although this strategy may be able to meet demand in the mid-term, it is ultimately short-sighted and unsustainable. By only expanding capacity footprints, manufacturers exacerbate their costs by increasing the rate of inefficient manufacturing, intensify talent shortages due to the increased need of labor, and increase data outputs without proper data storage & analytical tools.

Emerging Technologies as Key Enablers to NextGen CGT Manufacturing

Due to the unsustainable nature of ever-expanding facility footprints, manufacturers have started to investigate emerging technologies to optimize existing and new facilities. Since the advent of commercialized CGT therapies, we have seen rapid advancements in automated manufacturing. However, most CGT equipment and technology still operates in silos with little to no integration with other systems to enable process optimization or scalability. Recently, there has been significant investments in technologies to improve manufacturing reliability and throughput. The next generation of technologies promises to ease major bottlenecks in the production of CGT, not only by eliminating human errors but also enabling process scalability and reliability via large-scale automated platforms. The goal of these NextGen technologies is to deliver end-to-end (E2E) robotic systems that can work alongside humans to bring more CGT therapies robustly and reliably to patients. Therefore, partnerships between CGT manufacturers and technology vendors are being established to drive this industry paradigm shift and move towards a more sustainable reliable manufacturing strategy.

Figure 1. Key Benefits of Introducing Robotics into CGT Manufacturing Operations

Understanding the CGT Robotics Landscape

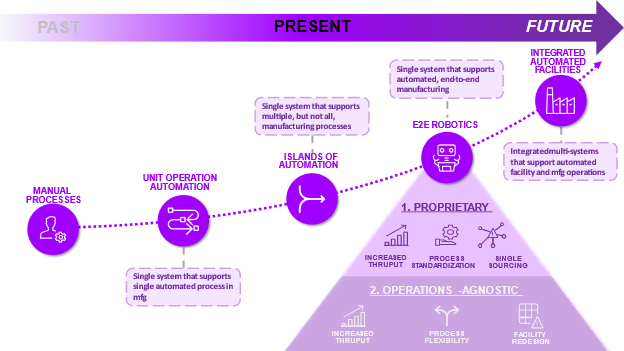

Although many of these technologies may be promising, we should first understand what is currently available in the market prior to developing any investment strategies. Many consider the terms “automation” and “robotics” interchangeable. However, in the CGT manufacturing space, these two processes should be thought as two distinct solutions. Currently, most CGT manufacturers use single step/multi-step automation solutions. Automated solutions involve bespoke machines that execute a single or series of CGT manufacturing process steps, such as cell washing or virus purification. Currently, these machines are the foundation of CGT commercial manufacturing because they allow for mix-and-match flexibility during process development. These machines reduce the variability of manual processing, but large labor costs remain due to the need of human operators to move product, monitor machines, and collate multiple machines’ data. Manufacturers are looking to move towards fully E2E automated and agile systems to increase capacity, further reduce COGS, and improve batch variability. As a response, the market has moved towards robotic solutions. Robotics solutions provide not only automated processes but also intelligent services depending on process results.

Thus far, two versions of E2E robotic systems exist: Proprietary Robotics Systems and Operations Agnostic Robotic Systems. “Propriety Robotics Systems” can be defined as a bespoke machine that creates an E2E closed-loop system integrating adaptable, yet proprietary unit operations. Alternatively, “Operations Agnostic Systems” are E2E systems that connect separate, multi-vendor automated unit operation systems.

Proprietary E2E Robotics

Currently, the first generation of CGT E2E Proprietary Robotics is the only commercially available robotics system, and multiple vendors exist in the space. In this generation, all manufacturing processes are performed within a propriety closed-loop system. An operator can attach the raw materials to a machine, program the settings they desire, press start, and walk away until the manufacturing is finished. Although these robotics systems reduce the need for manual manipulation, this first generation is specific to autologous T cell therapies, and therefore, quite limited in flexibility. Additionally, the machines on the market today can only process one patient at a time. These machines are a great solution for startup manufacturers generating doses for small volume clinical trials, but they significantly hinder growth of large-scale commercial manufacturing.

Recently, multiple industry players have attempted to tackle the rigidity faced in the First Gen E2E Robotics. New players are beta-testing closed-loop machines that can:

- Increase patient throughput through parallel processing

- Provide increased flexibility in process design and therapeutic modality

- Reduce manufacturing footprint

While these machines offer solutions to the First Gen Propriety Robotics, multiple issues remain with propriety manufacturing solutions. By using a completely proprietary system, a significant number of reagents and consumables most likely will be dependent on the robotics vendor’s supply. Although propriety systems provide streamlined manufacturing solutions, manufacturers take on increased risk the fewer suppliers they utilize.

Operations-Agnostic E2E Robotics

An alternative E2E robotics strategy in the pipeline today is an “Operations-Agnostic” robotics system. With this system, manufacturers can still mix and match the single-unit operations of their choice, but instead of needing a human operator to transfer the product between machines, a robotic arm would handle this procedure. With this system, CGT providers can still have the increased process and supplier flexibility of single-unit operations and have the decreased labor costs of fully automated E2E systems. Additionally, manufacturers are not constrained to the “One Patient, One Machine” approach; the system can run multiple batches simultaneously with the only rate limiting step being the number of automated machines.

Nevertheless, this system faces its own unique set of challenges. From the beginning, manufacturing facilities must be designed with the robotic systems’ physical movements in mind (particularly with the movements of an independent robotic arm), and the system must be programmed to work with your machines of interest. Additionally, the data from each single unit operation typically exists on its own machine, so CGT manufacturers’ data architects are still responsible for ensuring all separate in-process monitoring and batch records can be accurately and efficiently integrated for each lot. Robotic arm facilitation is often used in typical manufacturing facilities, but the concept is quite nascent in CGT manufacturing. Few companies exist within this space, providing an opportunity for existing vendors to make impressionable first starts and emerging vendors to fill the existing gaps.

Figure 2. The evolution of CGT manufacturing

How to Introduce Robotics into Your Business

Step 1: Plan & Define the organizations’ CGT vision & business strategy

Selecting the right robotics technology to invest in is highly dependent on the current and future state of your business. There is not a ‘once size fits all’ strategy to technology selection. Therefore, companies should have a vision on what modalities and CGT platforms they would like to purse. For example, a pharmaceutical company pursuing to be a leader in cell therapies will have a different robotics strategy compared to a CDMO aspiring to be a premier viral vector process developer. Additionally, you should define your vision and robotics strategy sooner rather than later. Integrating robotics early within process development will improve drug product consistency throughout trials, support rapid scaling efforts for commercialization, reduce post-commercial process changes, and transform your manufacturing process into a valuable asset itself.

Step 2: Identify “no-regret” High-Impact Common Capabilities

It is important to note that implementing robotics will not benefit all CGT platform manufacturing capabilities equally. Companies should identify and prioritize common capabilities that provide the highest business value in terms of cost savings and increase in productivity across their existing platforms and potential future platforms. Whether your modalities of focus are autologous cell therapy, allogeneic cell therapy, or gene therapy - there are common capabilities across these that are high value areas for robotics investments. By identifying these “no-regret” areas to automate, companies can fully optimize their robotics investment even when managing a mixed portfolio of assets. This capability prioritization strategy allows companies to initiate integrating automation into multi-step processes and reducing manual intervention without over-investing into a robotics that may not provide significant business value.

Additionally, a key factor to consider as you identify and prioritize these high value capabilities is the maturity of your portfolio. Changing your manufacturing processes to integrate robotics will affect your portfolio the older it is. When in early stage, robotics adoption is more flexible and agile, else, changes become more complex and costly. Considering robotics within early process development is ideal due to the fact your process changes can be more flexible and agile. Proprietary robotics solutions could be a more appealing option due to the fact the solution can even aid in process development.

If your products have already reached commercial launch, robotics integrations will be more challenging and costly due to regulatory hurdles. Nevertheless, operations-agnostic solutions would be the best robotics strategy to prioritize due to the fact the robotics system will not require significant technology & process changes. In an ideal world, companies should consider your robotics investment strategy hand in hand with your vision and business strategy early on during development to facilitate easy adoption and reduce regulatory impact.

Step 3: Support Expansion Plans

Once you have selected your robotics strategy, you need to consider how you plan to expand your capacity within your existing and potential network. Optimizing your capacity enables you to increase your throughput to meet patient demand while expanding your network. To expand manufacturing capacity, you can increase throughput at manufacturing sites, increase the number of manufacturing sites, or a hybrid between the two. Ideally, your robotics strategy should be expanded across the network and not just at one manufacturing site. Multi-site robotics manufacturing allows for higher production efficiency and flexibility. If robotic technologies are implemented at limited sites, your supply will be unequal across the network which can pose a future challenge with meeting patient demands, supply chain network, and more.

Based on your robotics investment strategy you can begin to quantify the increase in throughput you will get from a single robotics system. This will enable your network development team to define how many robotics systems are needed in total to meet potential demand and which sites should implement robotics to have a 'right location, right size' network.

Key considerations: Building a robust data strategy & tech transfer strategy to leverage the full potential of robotic manufacturing

It should be noted that investing in robotics is not the complete solution to scaling CGT Manufacturing. In parallel to aligning with the business strategy prior to implementing robotics, we must ask the question: do we have the adequate data structure to support these technologies? Data collection and analytics must be built within the automation architecture. Real-time data monitoring will provide meaningful insights into process parameters’ impact on final drug product quality and will lead to maximum process optimization and efficiency hand-in-hand with robotics.

Additionally, we must also think about the implementation and tech transfer activities required to successfully introduce and transition to robotics. If moving forward with a proof-of-concept approach initially, consider the infrastructure needed and impact to the current processes and facilities. Define a robust implementation plan at each stage for minimal impact. Leverage data collection to track and monitor key performance indicators to measure overall impact of these technologies and how they fit into the current processes. Lastly, consider change management strategies to ensure a smooth transition and robust training prior to implementation.

Staying Ahead of the Curve

Ultimately, emerging robotics systems provide novel solutions for CGT manufacturing and alleviates scalability challenges. These technologies will increase throughput while decreasing end-to-end cycle times, decrease COGS due to reduced labor and facility needs, decrease batch variability due to reduced human handling, and relieve manufacturing bottlenecks for both commercial and development manufacturing. Emerging robotics technologies are not far in the future and are becoming a reality at breakneck speed. Many of these robotics systems are still in beta-phase, so now is the time to consider partnerships and investments strategies that align to the vision and business strategy of the organization. To stay ahead of the competition, CGT manufacturers should consider the applicability of robotics in their manufacturing strategy and how it fits in their current business strategy while also considering their current operational state, data infrastructure and technology transfer impacts.

References

About the Authors:

Kealy Walters – Management Consultant, Cell & Gene Therapies

Kealy Walters – Management Consultant, Cell & Gene Therapies

Kealy is a Management Consultant in Accenture Life Sciences Supply Chain & Operations practice, with biopharmaceutical industry experience specializing in Cell & Gene Therapies.

Martha Perez Linares – Management Consultant, Cell & Gene Therapie

Martha Perez Linares – Management Consultant, Cell & Gene Therapie

Martha is a Consultant in Accenture Life Sciences Supply Chain & Operations practice, with a specialized focus on Cell and Gene Therapies. Martha has over 4 years of biopharmaceutical industry and consulting experience working across multiple areas including Manufacturing, Quality Assurance and Operational Excellence.

Lena Walton – Management Consultant, Cell & Gene Therapies

Lena Walton – Management Consultant, Cell & Gene Therapies

Lena is a Consultant within the Accenture Life Sciences R&D practice and specializes in Cell and Gene Therapies. She has both industry and consulting expertise in supporting biopharma companies develop, launch, and sustain Cell and Gene Therapy pipelines.

Dr. Sanjay Srivastava – Managing Director, Cell & Gene Therapy Lead at Accenture

Dr. Sanjay Srivastava – Managing Director, Cell & Gene Therapy Lead at Accenture

Sanjay has a broad and deep expertise in the underpinning science and business challenges in developing and launching both in-vivo and ex-vivo cell & gene therapies. He directs his C> team at Accenture, who has global expertise in R&D, supply chain, manufacturing, and commercial operations