Deal Building From Testing The Water To Hitting The Market

By Suzanne Elvidge, Contributing Writer

Follow Me On Twitter @suzannewriter

This article originally appeared in Life Science Leader magazine.

In 2017, UK-based gene and cell therapy company Oxford BioMedica won a key contract from Novartis to provide the commercial and clinical supply of lentiviral vectors used to produce Big Pharma’s CAR-T cell therapy Kymriah (tisagenlecleucel). The deal could be worth upwards of $100 million over its three-year span.

2011-2013: BEGINNING THE CONVERSATION AND TESTING THE WATER

According to John Dawson, Oxford BioMedica’s CEO, the relationship between Oxford BioMedica and Novartis dates to initial conversations in 2011, which developed further through 2012.

“We started by testing the process and optimizing the vector,” said Dawson. “And then in 2013, we signed an initial agreement with Novartis to manufacture clinical- grade material using our LentiVector gene delivery technology and to provide process-development services. We manufactured a number of batches of the lentiviral vector encoding the tisagenlecleucel technology, but at that point neither we nor Novartis had made a formal long-term commitment.”

The initial deal was worth up to $5.2 million from Novartis over 12 months and allowed Oxford BioMedica to make strategic investments in its specialist manufacturing capabilities, which Dawson described as a pivotal step toward building a financially self-sustaining business, as well as an example of how the company could commercialize its expertise.

OCTOBER 2014: BUILDING THE DEAL

In 2013 and 2014, Novartis’ tisagenlecleucel moved through Phase 2 trials, and in October 2014, the two companies signed a further cash and equities deal, building on the previous agreement. This included a $14 million up-front payment from Novartis, including a $4.3 million equity subscription for a non-exclusive worldwide development and commercialization license in oncology for Oxford BioMedica’s LentiVector platform. The manufacturing deal would be worth up to $90 million in total over three years, including the up-front license payment, equity investment, manufacturing and process development services and various performance incentives. Under the terms of the deal, Oxford BioMedica is the sole manufacturer of the lentiviral vector used to transfect the T cells to produce tisagenlecleucel.

![]()

"While we’re not yet EBITDA positive, this deal with Novartis will strengthen our balance sheet immediately and support our continued growth over the next three years."

John Dawson

CEO, Oxford BioMedica

The October 2014 deal also included an exclusive license for the worldwide development and commercialization of all CAR-T cell products arising from the process development collaboration. Oxford BioMedica will receive undisclosed royalties on potential future sales of all Novartis CAR-T products, including tisagenlecleucel.

"This deal was part of Novartis’ preparation to move its cell therapy onto the market, and its commitment endorsed our approach and capabilities,” said Dawson.

2016: DESIGNING AND BUILDING

Oxford BioMedica began 2014 with only one GMP suite. Because of the investment made possible by the deal with Novartis, and through the deals with other companies for its LentiVector technology platform, the company was able to create a state-of-the-art GMP manufacturing facility to manufacture the batches for clinical trials. In 2016, it also had a warehouse facility up and running.

In 2016, Oxford BioMedica completed a design-and-build program, creating new bioprocessing and laboratory space. This included three cleanrooms, with cell factories and single-use 200 liter bioreactors in dedicated production suites.

“By optimizing our processes, we have been able to cut the cost tenfold; however, we plan to reduce costs further by continuing to innovate. When we get to scale-up stage, we should be able to keep the same process, perhaps with minor changes. We are confident we can hit the ground running as we are already making commercial products,” said Dawson.

With CAR-T therapeutics currently priced in hundreds of thousands of dollars per patient, being able to cut manufacturing costs could be critical for ensuring that more patients can gain access to treatment.

2017: GETTING TO THE MARKET

The deals with Novartis have been structured to generate income from sales of the CAR-T products. Oxford Bio- Medica has, therefore, been watching the progress of the regulatory process very closely, as Kymriah could be a key driver for revenue over the next few years.

In March 2017, the FDA accepted the biologics license filing for Kymriah and granted it a priority review designation, which would shorten its anticipated review time. This and other planned activity for 2017 and 2018 needed to be backed up with a manufacturing agreement. So, in July 2017, Oxford BioMedica announced signing a major supply agreement with Novartis for the commercial and clinical supply of lentiviral vectors used to generate tisagenlecleucel and other undisclosed CAR-T products.

As in earlier deals, the overall amount ($100 million over three years) includes an up-front payment ($10 million), various performance incentives, and bioprocessing and development services. The supply agreement is extendable to five years subject to the agreement of both parties.

“Putting together this deal was a detailed process that involved both FDA and MHRA [Medicines and Healthcare products Regulatory Agency] inspections. We anticipated being at this point, which was why we spent £26 million [approximately $35 million] in developing the GMP suite in 2016. So we had to be successful! Now that we have the facility, we can plan for future deals,” said Dawson. “While we’re not yet EBITDA positive, this deal with Novartis will strengthen our balance sheet immediately and support our continued growth over the next three years. It is also a great validation of our approach and technology.”

“Putting together this deal was a detailed process that involved both FDA and MHRA [Medicines and Healthcare products Regulatory Agency] inspections. We anticipated being at this point, which was why we spent £26 million [approximately $35 million] in developing the GMP suite in 2016. So we had to be successful! Now that we have the facility, we can plan for future deals,” said Dawson. “While we’re not yet EBITDA positive, this deal with Novartis will strengthen our balance sheet immediately and support our continued growth over the next three years. It is also a great validation of our approach and technology.”

In mid-July 2017, Kymriah gained a unanimous recommendation from the FDA’s Oncologic Drug Advisory Committee in favor of approval. Around six weeks later, Novartis’ Kymriah became the first CAR-T therapy to be approved worldwide. This approval, for certain pediatric and young adult patients with a form of acute lymphoblastic leukemia (ALL), was five weeks before the proposed Prescription Drug User Fee Act (PDUFA) date of early October. Kymriah has been followed to U.S. approval by Kite’s Yescarta (axicabtagene ciloleucel), a CAR-T cell therapy for adult patients with certain types of large B-cell lymphoma (BCL) who have not responded to other treatment or who have relapsed.

As a result of the activity over Kymriah, Oxford Bio- Medica has seen its share price more than double over the course of 2017.

2018: THE FUTURE FOR OXFORD BIOMEDICA – IN-HOUSE AND PARTNERING

Oxford BioMedica has 20 years of experience in gene and cell therapy and eight years of clinical experience with its lentiviral platform. This expertise has led to seven regulatory approvals for clinical studies in the United States and Europe. The company is growing fast, as Dawson explains: “In January 2014, we had just 80 people. We now have around 300 in manufacturing and research. We need to keep working to stay ahead of the game; we can’t afford to stand still in this field.”

While working with Novartis has been hugely important for Oxford BioMedica, Dawson is keen not to rely too much on a single partner or product.

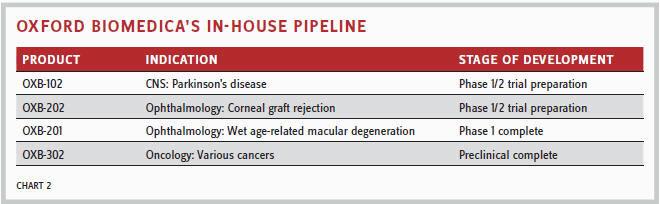

“We have bioprocessing and process development partnerships (Chart 1) with Immune Design and Orchard Therapeutics. We also have licensed products and technology rights to Sanofi , technology rights to GlaxoSmith-Kline, and an R&D collaboration with Green Cross to identify and develop gene modified natural killer cellbased therapeutics for diseases like cancer,” said Dawson.

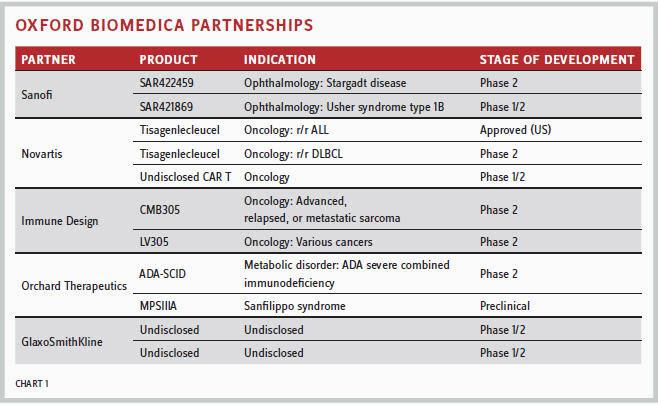

There are four products in Oxford BioMedica’s in-house pipeline (Chart 2), and the company’s business plan is to develop products to preclinical and then seek partners.

“We plan to progress our wholly-owned products via spin-outs and out-licensing opportunities, while continuing to invest in our LentiVector platform. We are hoping to set up significant deals over 2017 and 2018 to ensure long-term funding through royalties,” said Dawson. “We could look to take projects further into development in the future if we have the funding.”

Dawson is confident of the company’s future and says: “We want to become the world leader in lentiviral vectors, both in vivo for gene therapy and ex vivo for cell therapy.”