Cell Therapies For Solid Tumors: Considerations To Make Before Embarking

By Tahel Noy, Pamela Chiesi, and Zack Kleiman

In the past decade, innovators have made significant progress in developing cellular therapies to treat hematological malignancies. The FDA approved the first two cellular therapies — chimeric antigen receptor (CAR) T-cell therapies to treat acute lymphoblastic leukemia (ALL) and diffuse large B-cell lymphoma (DLBCL) — in 2017. These cellular therapies use a patient’s own immune cells to attack and kill the cancer and have shown promise in treating, and in a few cases “curing,” otherwise incurable hematological malignancies. For example, in diseases like non-Hodgkin lymphoma (NHL) where relapse is a constant threat, CAR-Ts have demonstrated remarkably durable responses — axicabtagene ciloleucel, for example, showed a four-year overall survival rate of 44% in refractory large B-cell lymphoma in late 2020. The clinical promise of these therapies triggered substantial follow-on research to harness T cells, natural killer (NK) cells, and other cell types to treat other cancers, including multiple myeloma (MM) and solid tumors.

Encouraged by the results, innovators are eager to translate those outcomes to successfully target solid tumors. So far, however, only a few cellular therapies have been approved over the last five years for use in hematological malignancies, and none have shown a compelling proof of efficacy in solid tumors. Developers are running into unique scientific challenges that must be overcome before a novel cellular therapy in solid tumors can show a compelling proof of efficacy similar to those observed in hematologic malignancies.

Buying into this value proposition and waiting for mature and de-risked data requires a hefty sum and much patience. As such, many investors are shifting their focus to early-stage assets as promising lower-cost entry points. But with multiple approaches currently in early development, interested pharmaceutical companies must figure out how and where to focus resources in order to maximize potential and mitigate risk. The fact that efficacy data for cellular therapies in solid tumors is sparse presents a critical challenge, and companies need a strategic, stepwise approach to identify the most attractive opportunities to focus on.

This article shares insights to help decision-makers determine the most compelling courses of action for their organizations.

Considerations For Cell Therapy Developers

Unfortunately, transferring the success of cellular therapies from hematological malignancies to solid tumors is proving very difficult and has produced underwhelming clinical trial results so far. Key clinical challenges include:

-

Trafficking immune cells to the tumor – This presents the first of many challenges in eliciting a robust anti-tumor response. While some tumors demonstrate strong immune infiltration (e.g., lung, hepatocellular carcinoma, and melanoma), other tumors (e.g., prostate and pancreatic cancers) have poor infiltration. This means different cellular therapy approaches must be tailored to address specific tumor types, and learnings from success in one tumor type cannot be readily translated to others.

-

Limited antigen targets – Unlike the biomarker CD19 in hematological malignancies, solid tumors offer no ideal target. The repertoire of tumor-specific antigens is either limited and often does not elicit deep and durable responses with a single-target therapy or, in other cases, targets are not unique to tumor cells and their presence on healthy tissue can generate an unacceptable safety profile. Furthermore, solid tumors often evade the immune system by downregulating target antigens, which leads to intra-tumoral heterogeneity and impairs the ability of cellular therapies to eradicate the tumor.

-

Presence of immunosuppressive factors – Even when a target is identified and immune cells reach the tumor, immunosuppressive factors in the tumor-immune microenvironment (TME) can prevent a robust immune response. These suppressive factors can take many shapes and forms, ranging from regulatory T cells and macrophages that secrete immune-suppressive cytokines to immune inhibitory molecules expressed on the surface of or secreted by tumor cells, such as PD-L1 and NKG2D.

Recognizing these critical barriers, scientists are working diligently to explore novel means to overcome them and extend cellular therapy’s reach to treat solid tumors. So far, however, it remains unclear which specific barrier is key to overcome or which approach might be best in doing so. In the face of these uncertainties, scientists are experimenting with critical functions of various cell types to combat the current treatment issues within the solid tumor microenvironment. For example:

- Self-driving CARs that express their own chemokine receptor have better tumor homing and may overcome challenges associated with immune migration into the tumor.

- Tumor infiltrating lymphocytes (TILs) can recognize tumor-specific antigens, which hold the promise of tailoring an immune response against the tumor with minimal effect on healthy tissue that does not express these antigens.

- NK cells have the ability to link between the innate and adaptive immune systems. In addition to their tumor-killing properties, these cells are being explored as means to reshape the tumor immune microenvironment from immunosuppressive and anti-inflammatory into pro-inflammatory, thereby enabling a more effective anti-tumor response.

Each offers a different targeting and defense approach to potentially overcome the solid tumor targeting issues, and each has its own advantages and disadvantages when it comes to treating solid tumors. Understandably, life sciences companies want to be at the forefront, if and when a breakthrough occurs. The question is, with so many development programs, assets, and platforms in the pipeline, how does an organization choose where to focus resources?

To date, CAR-Ts are leading the cellular therapy market, ahead of NK, TILs, and T cell receptor engineered T cells (TCR-T). Based on available data from the third quarter of 2020 through the third quarter of 2021, research activity has been mainly focused on cellular sources that target three of the primary clinical challenges – limited antigen targets, presence of immunosuppressive factors in TME, and nonspecific expression of target in healthy tissue. This could point to where investors believe the greatest potential lies to leverage cellular therapies in solid tumors.

Considerations For Investors

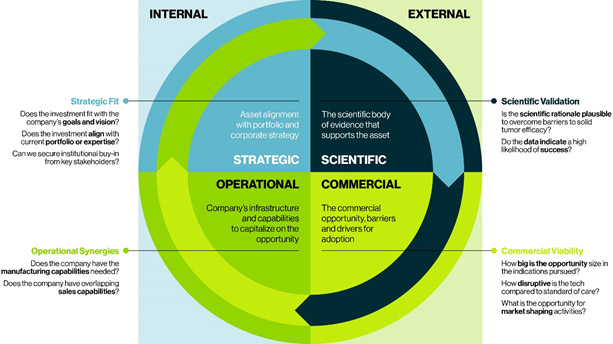

Whether considering initiating research and development efforts or vetting potential assets for acquisition, the optimal approach depends on evaluating and prioritizing the following four critical factors to weigh the clinical, operational, strategic, and commercial risks.

Scientific Validation

Evaluate the scientific body of evidence that supports the asset to determine the plausibility of overcoming the many significant challenges of solid tumor cellular therapies. Keep in mind, because data in humans is limited, organizations will need to evaluate preclinical data regarding tumor regression in mice models, and these models differ. A xenograft model usually presents a lower bar to anti-tumor response than genetic models aiming to mimic the natural progression of the tumor.

Another factor to consider is how many other companies or laboratories are exploring this mechanism and specific construct – logically, the more investigating it, the more likely it is a relevant and potentially viable technology.

Commercial Viability

Evaluate the proposed asset against the current landscape and known pipeline to determine the asset’s real market potential. How disruptive could it be compared to other therapies? Does it have the potential to become the standard of care?

Cellular therapies in solid tumors attempt to penetrate areas that are currently dominated by PD-L1 inhibitors. Determine if the evidence presented is robust enough to disrupt this well-established treatment paradigm. In addition, assess how likely a cellular therapy asset is to drive change in practice behaviors. For solid tumors, physicians are accustomed to prescribing and administering off-the-shelf intravenous drugs that usually can be readily administered in their site’s infusion suite. Does the potential cellular therapy offer enough clinical promise to change the physician’s behavior and, for example, warrant referral to a specialized center to receive a complicated therapy that takes time to manufacture and ship?

Also, considering the high cost of manufacturing and administering cellular therapies currently, evaluate and forecast the required investment, accounting for cost sensitivities across global markets to understand the realizable market potential.

Strategic Fit

Evaluate the potential asset against the business mission, vision, and current portfolio to determine if institutional buy-in can be secured from key stakeholders. To do so, examine if the asset fulfills any existing gaps in the organization’s pipeline and aligns with identified future investment areas. The asset in question may also complement existing pipeline assets and improve their efficacy. For example, a company that is heavily invested in checkpoint inhibitors could add a cellular therapy to complement existing pipeline assets and in-line drugs.

Also consider if a potential asset offers superior properties to bolster current assets or provide defense for the organization’s portfolio, such as for example, a multinational pharmaceutical company partnered with a small biotech company that develops autologous and allogeneic approaches in solid tumors. This partnership filled a gap in the pharma company’s portfolio and will allow it to play in the rapidly evolving immune therapy space.

Operational Synergies

Evaluate the potential asset against the company’s infrastructure and capabilities (e.g., manufacturing, sales, etc.) to determine if the organization can readily add it into its pipeline, or if it would require significant investment to pursue and capitalize on the opportunity. For example, a cellular therapy asset may require specialized field force capabilities, such as product specialists and patient support services, that may not be present in, say, an oral drug business. In addition, consider the unique manufacturing capabilities needed to produce a highly time-sensitive drug product. Also consider the need for continued investment as technologies advance and/or pressure increases to speed and scale manufacturing without jeopardizing manufacturability success rates.

Cellular therapies present as a high-risk, high-reward opportunity. While most pharmaceutical companies are aware of the hefty price tag to acquire a late-stage asset with validated data, they understandably struggle to determine the risk of early-stage assets. Using this framework to assess assets strategically against multiple internal and external factors can help identify the assets likely to fit best. While the relative weight of these parameters may shift depending on an organization’s individual objectives, capabilities, resources, and preferred road map, considering each will help companies filter and prioritize the most compelling opportunities for their organization.

About the Authors:

About the Authors:

Tahel Noy, Ph.D., associate director at Guidehouse, provides global portfolio development strategy, commercial planning, and competitive assessments for biotechnology and pharmaceutical companies. She has extensive expertise in cellular therapies, including for hematological and solid tumors.

Pamela Chiesi, associate director at Guidehouse, advises biopharma clients on oncology commercial strategy, including portfolio strategy, new product planning, indication prioritization, pre-launch global pricing and market access, and LCM strategies.

Zachary Kleiman, managing consultant in life sciences strategy at Guidehouse, advises biotech and pharma clients on commercial and opportunity assessments, innovative market access strategies, and brand/function value stories. He is a steering committee member of Guidehouse’s Oncology Expert Community and is also a member of Guidehouse’s Cell & Gene Therapy Expert

Zachary Kleiman, managing consultant in life sciences strategy at Guidehouse, advises biotech and pharma clients on commercial and opportunity assessments, innovative market access strategies, and brand/function value stories. He is a steering committee member of Guidehouse’s Oncology Expert Community and is also a member of Guidehouse’s Cell & Gene Therapy Expert