Cell And Gene Therapy Bioprocessing: Hiring And Capacity Crunch On The Horizon

By Eric Langer, president and managing partner, BioPlan Associates, Inc.

Modern cellular and gene therapy therapeutics are easily on track to become multibillion-dollar markets within 10 years. Newer cell therapies are now viewed as biopharmaceutical products requiring standardization and regulatory approvals, rather than being largely unregulated, physician-prescribed medical procedures, such as red blood cells. Selling live cultured human cells as therapeutics is essentially a new manufacturing paradigm.

Newer cell therapies are now viewed as biopharmaceutical products requiring standardization and regulatory approvals, rather than being largely unregulated, physician-prescribed medical procedures, such as red blood cells. Selling live cultured human cells as therapeutics is essentially a new manufacturing paradigm.

The cell and gene therapy industry is currently comparable to the recombinant proteins/monoclonal antibody (mAb) industry in the mid to late 1980s — a few new products are entering major markets, with nearly 1,000 therapies in development. Similarly, major concerns are emerging regarding high product prices and the industry’s ability to commercially manufacture products to meet market needs.

With a very healthy R&D pipeline, we can expect multiple blockbuster products and various “orphan” niche products to be launched annually in coming years. As a result, the cell and gene therapy industry is heading for a capacity crunch, according to our recently released 17th Annual Report and Survey of Biopharmaceutical Manufacturing.1

And the industry is not just facing facility and capacity challenges. Hiring of bioprocessing professionals has remained a stubborn problem for most of biopharma over the past 11 years. As demand for expertise grows globally, the supply of qualified staff continues to get tighter. This can be particularly challenging for start-up areas, like cell and gene therapy, where the need to attract skilled, experienced staff is significant.

Competition for this expertise is also growing. New facilities, new technologies, biosimilars, cell and gene therapies, and industry expansion to developing markets, notably China and elsewhere, are contributing to the pinch.

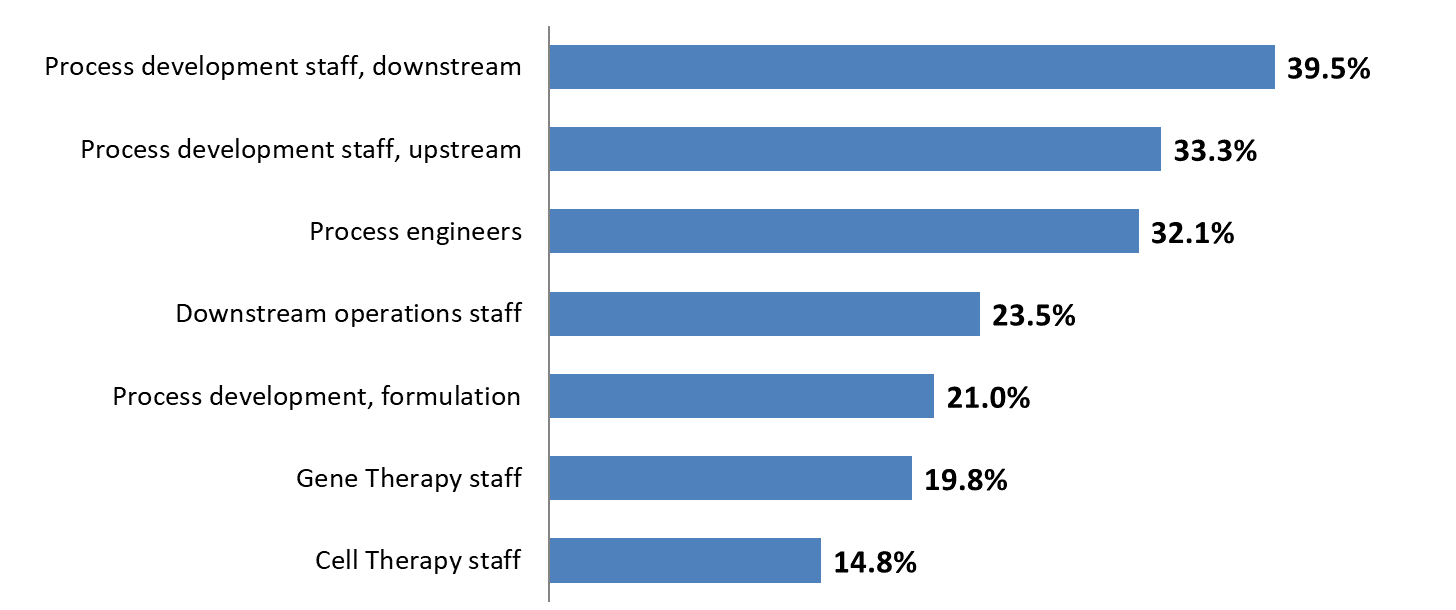

Figure 1: Selected areas where hiring difficulties at biopharma facilities exist (Source: 17th Annual Report and Survey of Biopharmaceutical Manufacturing1 )

Gene therapy staff are particularly hard to find. Challenges were noted by nearly 20 percent of respondents, but when you consider that gene therapy facilities make up a minority of respondents, we estimate that closer to 100 percent of GT facilities are experiencing real hiring pains.

Tools To Resolve Capacity Crunches

Hiring is not the only problem the cell and gene therapy segments are facing. Operational issues, logistical challenges, and availability of purpose-designed equipment are creating bottlenecks.

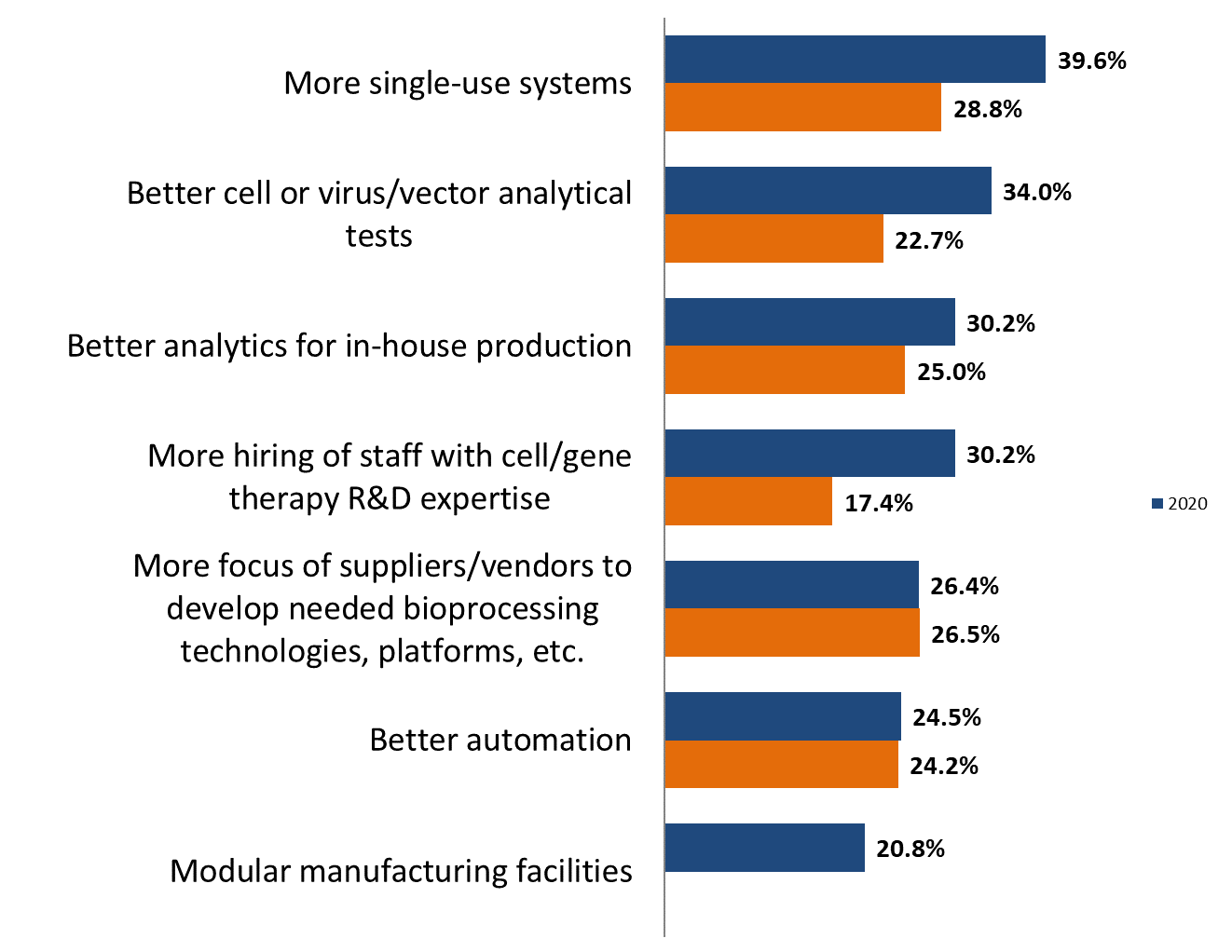

From our study, we present below some of the 18 ways the industry indicated that it expects to resolve these problems. The top solution involves the development of more relevant single-use devices, and better analytics. Compared to 2019, we found that the No. 1 spot this year, up from No. 7, was “More single-use systems” at 39.6 percent. “Better cell or virus/vector analytical tests” moved to the No. 2 spot, with 34.0 percent of respondents, up from 22.7 percent in 2019.

Both “Better analytics for in-house production” and “More hiring of staff with cell/gene therapy R&D expertise” were noted by nearly a third of the industry respondents (30.2 percent); both showed increases from 2019. These data indicate the relatively rapidly evolving situation in these novel therapeutic areas.

On the other hand, essentially all (>98 percent) found significant manufacturing problems: “There are no significant manufacturing problems for cell/gene therapy today” remains at the bottom of the list, at 1.9 percent.

Figure 2: Most needed cell and gene therapy manufacturing improvements, 2019 vs. 2020 (selected data)

Cellular Therapy Bioprocessing Bottlenecks

There is a distinct lack of bioprocessing technologies and devices purpose-built and suitable for cellular therapies. The bioprocessing technologies that are available are generally based on legacy technologies that have not fundamentally changed in decades. This includes the use of open systems, manual pipetting, etc. Because many cell therapy developers lack sources for bioprocessing technologies, many have resorted to cobbling together manufacturing equipment using existing devices developed for more mainstream bioprocessing.

The lack of appropriate equipment and the use of manual techniques have led to manufacturing capacity bottlenecks at facilities, and as more therapies reach clinical and commercial scale, the current capacity crunch is likely to get worse. BioPlan studies and related publications report that ~90 percent of cellular/gene therapy developers would prefer to use contract manufacturing organizations (CMOs) for their product manufacturing needs, if sufficient CMO capacity and expertise were available. But developers report that current wait times at CMOs to start new projects now average ≥18 months, with only a relatively small number of CMOs having the needed resources and expertise. There are very few CMOs yet involved, and their cellular therapy bioprocessing capacity and expertise are limited. A large number of new process lines and facilities will increasingly be needed.

There will be a worldwide expansion of building replicated manufacturing facilities as products approach commercial manufacturing. The inefficiencies in cellular therapy bioprocessing and logistical needs (due to the short lives of cells) require manufacturing to be geographically distributed, with multiple facilities needed to cover U.S. regional markets. Unless other logistical solutions are developed, some products will require dozens, perhaps even 50 to100, manufacturing facilities worldwide to handle regional markets.

Demand For Better Cellular Therapy Bioprocessing

Cellular therapy bioprocessing is still in its infancy. Even those practicing and defining the state of the art agree that cell therapy bioprocessing is inefficient, and in some cases optimal processes are simply not available. Most operations involve manual, open systems processing that has been used in research settings for decades. Further, the field is chaotic, including inefficient – or even a lack of – technical communications. Some new technologies have been created by developer companies, but these remain proprietary.

Cellular therapy bioprocessing is not automated and involves massive manual labor, such as man-weeks of experts’ time for manufacture of each patient’s product (or allogeneic product batch/lot for multiple patients). Even allogeneic cellular therapies involve bioreactor runs generally producing sufficient cells for just hundreds of patients vs. often hundreds of thousands with current mainstream biopharmaceuticals. There is reliance on the use of hoods and cleanrooms, rather than closed systems, to assure prevention of microbial and other contamination. But, importantly, regulatory expectations will eventually require full(er) GMP compliance.

Cellular therapy bioprocessing needs some basic improvements if it is going to scale up and meet regulators’ expectations, including:

- Closed systems

- Sterilization ability

- Automation

- Sensors, assays, analytics

- Containers

- Scalability

- Expertise/staff

- Regulations

- Modular units

A reason for the current slow innovation cycle is that the market for cellular therapy bioprocessing is limited and is still mostly at research, and some clinical, scales. Thus, the return on investment in the development of new technologies is not quite there yet. And many innovative suppliers are in a holding pattern until they determine which technologies will prevail and which direction cell therapy bioprocessing will take in the near term.

We note, however, that markets for cellular therapy bioprocessing supplies in five to 10 years will expand significantly. The cellular therapies market itself 10+ years out will likely be >$30 billion/year, with related bioprocessing supplies and cost of goods running up to twice the cost of mainstream biologics.

Plans For Commercializing Cell And Gene Therapies

In 2019, about half of the respondents to our annual study indicated that they felt the future of cell therapy platforms would move from single patient toward batch production. We found “Cellular therapies, allogeneic (multiple patients, batch production)” to be indicated by 52.1 percent of respondents, while at the bottom of the list were “Non-viral vector-based gene therapies” and “Cellular therapies with no genetic modification,” both at 22.3 percent. Overall, relatively few developers are currently working in these areas.

In this year’s survey, respondents involved with cell and gene therapies described their plans for GMP and commercial manufacturing. Over one-third of respondents (36.0 percent) responded “Manufacture viral vectors/gene therapies (cellular therapies not involved)” as their leading plan for GMP and commercial manufacturing this year, followed closely by “Working on GMP-compliant commercial-scale manufacturing” at 34 percent. Tied for the No. 3 position are “Currently have 1 or more products now in clinical trials” and “Already implemented GMP-compliant manufacturing” at 26.0 percent.

In the 2020 survey, we asked cell and gene therapy respondents to describe their capacity expansion plans for in-house bioprocessing facilities over the next five years (2025). We found that 17 percent of respondents would increase total capacity for cell and gene therapy by as much as three times, while 14 percent noted a doubling of capacity over the period. We predict an average capacity increase of over 100 percent for the industry segment.

Conclusions

More experienced people are clearly needed in cell and gene therapy segments. Capacity bottlenecks are being driven by facility and equipment challenges, bioprocessing inefficiency, and staffing problems. Hiring strategies and training and retraining programs must include recognition that retention of high-quality, highly educated people is not easy. This will be a long-term process for most, requiring attention and investment. While mainstream biologics manufacturing focuses on investments in productivity and efficiency (producing more with fewer staff and resources), cell and gene therapy segments continue to evolve. So, establishing a narrow strategy, such as simply applying more single-use devices, or better and more integrated automation will not easily resolve the near-term challenges.

References:

- 17th Annual Report and Survey on Biopharmaceutical Manufacturing Capacity and Production, April 2020, BioPlan Associates, Inc, Rockville, MD.

About The Author:

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. He can be reached at elanger@bioplanassociates.com or 301-921-5979.

Eric S. Langer is president and managing partner at BioPlan Associates, Inc., a biotechnology and life sciences marketing research and publishing firm established in Rockville, MD in 1989. He is editor of numerous studies, including Biopharmaceutical Technology in China, Advances in Large-scale Biopharmaceutical Manufacturing, and many other industry reports. He can be reached at elanger@bioplanassociates.com or 301-921-5979.