CAR T-Cell Therapies In The EU5: What Can We Expect From Payers?

By Yulia Privolnev and Rachel Webster, Decision Resources Group

In June 2018, in a landmark move toward advanced therapy medicinal products (ATMPs) — groundbreaking treatments based on genes, tissues, or cells — the European Medicines Agency (EMA) recommended the first two CAR T-cell therapies receive marketing authorization in Europe. Novartis’ Kymriah (tisagenlecleucel-T) and Gilead’s Yescarta (axicabtagene ciloleucel) secured approval from the European Commission (EC) in August 2018 for select aggressive hematological malignancies. Kymriah is indicated for relapsed or refractory diffuse large B-cell lymphoma (DLBCL) after two or more lines of systemic therapy, as well as pediatric and young adults (up to 25 years of age) with B-cell acute lymphoblastic leukemia (ALL) that is refractory, in relapse post-transplant, or in second or later relapse. Yescarta is also indicated for relapsed or refractory DLBCL and also for primary mediastinal large B-cell lymphoma (PMBCL) after two or more lines of systemic therapy.

Notably, these innovative, personalized treatments are the first to be approved through the EMA’s Priority Medicines (PRIME) program, which is designed to accelerate the approval of innovative drugs. The approved CAR T-cell therapies are patient-specific and produced by extracting a patient’s own T cells (i.e., autologous). T cells are modified to express CARs that recognize a specific tumor antigen (e.g., CD19 in the case of Kymriah and Yescarta) before being infused back into the patient, where they proliferate and seek out and destroy the tumor cells (CD19-positive cells in the case of Kymriah and Yescarta). The first pioneering CAR T-cell therapies represent a paradigm shift in the treatment of cancer and a breakthrough for some relapsed or refractory hematological malignancies, showing durable responses and potential for long-term disease control unrivaled by conventional therapy. However, there are weaknesses that are expected to hinder the widespread commercial uptake of the first CAR T-cell therapies. Not least, the hefty price tag of these one-time treatments will inevitably pose challenges for already budget-constrained national reimbursement authorities in Europe, and thus represents a potential barrier to ensuring widespread patient access and adoption.

The difficulty of balancing paying for innovation with budgets has plagued Europe for years, and the emergence of cell and gene therapies has only exacerbated that conundrum. The launch of the first two CAR T-cell therapies will likely prove to be useful case studies for how payers and physicians will respond to this new reality.

Payer Landscape

In the U.S., Novartis has implemented indication-specific pricing for Kymriah: $475,000 for B-cell ALL and $373,000 for DLBCL. Yescarta’s U.S. list price is $373,000 for DLBCL and PMBCL. In Europe, pricing strategies for Kymriah and Yescarta will be critical for securing optimal access and reimbursement from national authorities, and discussions are ongoing. At the time of EC approval, Novartis announced it “continues to collaborate with national health and reimbursement authorities across Europe on a fair, value-based pricing approach that is sustainable for national healthcare systems."

Germany

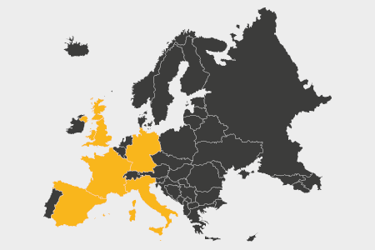

When it comes to health technology assessment (HTA) and ultimately pricing and reimbursement, the approved CAR T-cells will benefit from their orphan drug status, as the EU5 countries (France, Germany, Italy, Spain and the U.K.) have formal or informal processes in place that allow for more lenient appraisals of orphan drugs. In particular, this is crucial for success in countries that are typically quite rigid about clinical trial design, such as Germany (where overall survival is the only acceptable efficacy end point for oncology therapies and single-arm trials are heavily frowned upon).

Although all drugs in Germany are reimbursed once they are approved by the EMA, not all drugs are guaranteed a good price. This is determined by the added benefit rating, as assessed by the Institute for Quality and Efficiency in Healthcare and the Federal Joint Committee (G-BA). Orphan drugs are guaranteed a positive added benefit rating under the German HTA system, meaning they will not be reference-priced and do not have to submit full HTA dossiers. However, because HTA and final price negotiations do not happen until after a drug has been available for 12 months, we do not currently know how Germany will assess the CAR T-cells. Initially, Novartis has set a price of 320,000 euros (approximately $371,000), although that is presumably under negotiation with the sickness funds that will pay for the treatment.

One thing we do know, however, is that German payers anticipated the arrival of these high-cost agents. In January 2018, in response to the emergence of cell and gene therapies and their high price tags, the G-BA removed a previously little-used exemption from its HTA system, where drugs whose use would be limited strictly to the hospital setting did not have to undergo a benefit assessment. How do we know this was because of cell and gene therapies? The G-BA mentioned it right in the press release. In November 2018, Decision Resources Group (DRG) interviewed payers across the EU5 on the emerging market access landscape for Yescarta and Kymriah in DLBCL, and it became clear that removing the hospital-only exemption was not the only change anticipated in Germany.

Germany is a country that traditionally shies away from complex managed entry agreements (MEAs) or other forms of discounts, yet interviewed German payers indicated the high prices and high levels of uncertainty that come with Kymriah and Yescarta meant not only were they considering outcomes-based agreements, but they were actively pushing for them.

“We are highly interested in contracts regarding paying in installments and paying for performance, and that is something that Novartis and Gilead are not really interested in, but a lot of other companies are. We think it makes sense that we only pay a handling fee to the hospital, and say okay, that's enough for the CAR T-cell therapy and the hospital is getting 2,000 euros and the rest is something we have to negotiate between Novartis and ourselves. And I say to the company, we will pay not at once, we will pay it over five years and if specific metrics are not met after three years because they were not really cured, then we will stop paying. So this is something we are thinking about, and we discuss with the politicians.” — Krankenkassen member, Germany

United Kingdom

German payers were not the only ones to anticipate the need for monitoring the efficacy and outcomes of these therapies, with the National Institute for Care and Health Excellence (NICE) in the U.K. already coming to a similar conclusion by relegating the drugs to the Cancer Drugs Fund (CDF), where they will have a set amount of time to prove their efficacy through collected real-word data before being re-reviewed for baseline commissioning for the National Health Service (NHS).

NICE and the NHS were hailed by the industry for the quick acceptance of CAR T-cell therapy when they published draft guidance in September 2018 announcing the NHS would fund Kymriah for the treatment of ALL via entry into the CDF, despite its list price of 288,000 pounds ($366,000), considered to be the fastest funding approval in NICE history. This expediency was likely in part due to preparedness on the part of U.K. payers, who completed a mock assessment prior to approval that demonstrated the drugs would likely be cost-effective, at least in some populations. As a result of that mock assessment, the NHS began to build a network of specialist clinics in preparation for actual approval, meaning patient access would not be hampered once the drugs were properly approved. It should be noted that both Yescarta and Kymriah were rejected in draft guidance for the treatment of DLBCL (in August and September 2018, respectively) owing to lack of comparative data against salvage chemotherapy. However, in November 2018, Yescarta beat Kymriah to become the first CAR T-cell therapy to secure a positive recommendation in final guidance from NICE for DLBCL (and PMBCL). Yescarta was approved as a result of a confidential discount; it would have cost nearly 300,000 pounds ($387,000) per patient at its full list price, but Gilead’s commercial agreement with the NHS enabled NICE to approve its entry into the CDF.

Notably, in January 2019, the Voluntary Pricing and Access Scheme replaced the Pharmaceutical Pricing Regulation Scheme (the backbone of how drugs are priced in the U.K.), and one key tenant of the new scheme was a promise for earlier engagement to ensure NHS physicians and NHS infrastructure are ready to accommodate and use new technologies arriving on the market, particularly cell and gene therapies.

U.K. payers interviewed by DRG were concerned about the trial design of the CAR T-cell therapies, specifically the lack of data comparing the therapies to chemotherapy, and their ability to demonstrate cost-effectiveness. They were ultimately proven correct with the initial rejections due to lack of cost-effectiveness. However, the introduction of MEAs through the CDF meant the therapies could be recommended for use, despite the costly monitoring required.

“You have to deal with three issues: cost-effectiveness, affordability, and uncertainty. So, the cost-effectiveness story … If you're saying you can cure ALL relapse, say give 10 years, you can put a list price of half a million, $250,000 to be effective over five years. Affordability is this 20-million-per-item in any three years, that’s the budget impact test. But for these compounds and these indications, we're going to blast that out of the water. So, what's going to happen is the budget impact of 20 million per year is going to be breached. So, we've got to go back to the drawing board on price. The final bit is uncertainty. Now, if you look at, for example, Kymriah. There was significant uncertainty in their model. Kymriah failed, I think, on three things. The first is the single-arm study had no comparative data to standard of care. And, so, there were arguments around survival and standard of care. … We have to resolve that before we can move forward.” — NICE advisor, U.K.

France

In France, Kymriah and Yescarta have been available for prescription through the early access program known as the l’Autorisation Temporaire d’Utilisation (ATU) since July 2018 for all eligible ALL and DLBCL patients (not just on a named-patient basis). The ATU program is important for gathering real-world data that can be used during pricing negotiations, as well as for winning over key stakeholders and uptake among key opinion leaders. French payers interviewed by DRG acknowledged the difficulties in terms of infrastructure and logistics associated with the manufacture of Kymriah and Yescarta, but were adamant they would be reimbursed and qualify for the highest possible improvement in actual benefit rating (Amélioration du service médical rendu [ASMR]), an ASMR I, meaning they show important added benefit over currently available treatments and would thus qualify for a premium price. However, a high ASMR rating also means these treatments must present pharmacoeconomic data to payers, a relatively rare occurrence in the French system.

“I think that the results are very important. But don't forget that these therapies require specific units, specific infrastructure and installations, and specific personnel. We also need to determine the daily pricing for this technique and to ensure that all will follow this price, but, once this is all done, these therapies will be used. I think they will get an ASMR I.” — HAS advisor, France

Italy

The reaction of payers in Italy has so far been less transparent, as the drugs are still undergoing pricing and reimbursement negotiations. However, interviewed payers believed Kymriah and Yescarta would be reimbursed and awarded innovative status. In Italy, this means exemptions from certain payback schemes and instant inclusion on all formularies. Italy has historically used outcomes-based agreements to fund high-cost therapies, particularly for oncology therapies, and it is likely such schemes will be used for the CAR T-cell therapies.

“Obviously, the payers are terrorized by the idea of paying for CAR T-cell therapies — terrorized how to limit their use and to be sure that the prescription is appropriate. I think that the CAR T-cell therapies, as well as other high-cost therapies, will be limited, strongly limited, to some specialists, for instance, in this case oncologists and only to high-ranked hospitals, not to all of the hospitals. In Italy, there are a number of different hospitals. Usually the only ones that are enabled to prescribe expensive drugs are the university hospitals.” — PTOR member, Italy

Spain

In a surprisingly quick approval, the Spanish healthcare system approved the reimbursement of Kymriah in December 2018. Notably, national payers, working with the regions, agreed on an outcomes-based agreement for ALL and DLBCL that will result in a price that is sustainable for the national health system. It was also announced that a similar agreement was being negotiated with Gilead for Yescarta for its approved indications.

“I think the CAR T-cell therapies at the beginning will be restricted to a small number of patients, and later some more patients will start to use them. But at the beginning its use will be restricted for reasons of cost-containment, and secondly because there are a lot of uncertainties about clinical outcomes for these patients. Payers at different levels will require more clinical data for these therapies to be used widely.” — DGFPS advisor, Spain

Will Physicians Be Free To Prescribe CAR T-Cell Therapies?

In October 2018, DRG surveyed 250 hematological oncologists across the EU5 on their anticipated use of CAR T-cell therapies in DLBCL (the indication both Yescarta and Kymriah are labeled for) and what barriers to prescribing they anticipate. Unsurprisingly, most surveyed physicians agreed or strongly agreed the CAR T-cell therapies will fulfill an important unmet need for relapsed and refractory DLBCL treatment and that they have the potential to replace allogeneic stem cell transplantation in select patients.

Despite heralding a paradigm shift in treatment for select patients, physicians anticipate multiple factors will limit the uptake of Kymriah and Yescarta for DLBCL, owing to clinical, access, and reimbursement hurdles. Approximately half of surveyed physicians across the EU5 (47 to 59 percent) expect the budgetary impact of these therapies to be the main factor limiting their prescribing. Also, a smaller percentage of physicians acknowledge the national-level payer restrictions (27 to 50 percent), along with the regional/local/hospital/clinical restrictions (30 to 35 percent), will likely limit the uptake of these therapies.

Aside from the frequent factors limiting prescribing/uptake, approximately a quarter of surveyed physicians across the EU5 reported the limited number of specialized units/centers for treatment (38 to 55 percent), the lack of experience/familiarity (24 to 47 percent), and safety and tolerability concerns (30 to 54 percent) will also limit uptake of Kymriah and Yescarta for DLBCL.

Like the interviewed payers noted, it’s clear from the physicians surveyed that the specialized units/centers required will be a big factor in determining the uptake of the CAR T-cell therapies. Payers in the U.K. have been proactive about such a hindrance, but it’s not clear all EU5 payers have.

Conclusion

The recent approval of the first CAR T-cell therapies in the EU5 has been quite a promising sign for other emerging cell and gene therapies, proving payers can stomach a hefty price tag when the drug’s efficacy warrants it. Despite concerns about uncertainty in the data, payers have embraced CAR T-cells and physicians anticipate prescribing them to a cohort of their patients. However, CAR T-cells have also demonstrated the importance of preparation and engagement with relevant stakeholders as early as possible, as seen in the U.K., because healthcare systems are not necessarily prepared for the logistical challenges presented by these innovative therapies. Furthermore, as was seen in the U.K. and Spain, and will likely be seen in Italy and Germany, the likelihood that these types of therapies will have to be accompanied by MEAs, specifically outcomes-based ones, is quite high. These agreements allow payers to better balance paying for innovation and their budgets and for manufacturers confident in their products to achieve a higher price when the drug works. If Kymriah and Yescarta are anything to go by, the future looks bright for ATMPs in Europe.

About The Authors:

Yulia Privolnev is a manager on the Global Market Access Insights team at DRG. She is responsible for monitoring, analyzing, and reporting on global market access through the production of DRG’s Global Market Access Solution (GMAS) and Access & Reimbursement products. Privolnev’s specific focus is on all aspects of market access in Western and Eastern Europe, as well as international reference pricing and MEAs on a global scale. She earned a bachelor’s degree from the University of Toronto and a master’s degree from the London School of Economics.

Yulia Privolnev is a manager on the Global Market Access Insights team at DRG. She is responsible for monitoring, analyzing, and reporting on global market access through the production of DRG’s Global Market Access Solution (GMAS) and Access & Reimbursement products. Privolnev’s specific focus is on all aspects of market access in Western and Eastern Europe, as well as international reference pricing and MEAs on a global scale. She earned a bachelor’s degree from the University of Toronto and a master’s degree from the London School of Economics.

Rachel Webster is a principal director of the Oncology practice at DRG. She leads a team of oncology business insights analysts in producing syndicated primary and secondary market research reports and custom analysis on a wide range of oncology indications. She also provides client support for all oncology products and helps global biopharmaceutical companies uncover strategic opportunities through data-driven insights from a variety of channels. Webster has 10 years of experience in market forecasting and a broad knowledge of oncology indications and markets; she has particular interest and expertise in immuno-oncology. Additionally, Webster has published numerous oncology market assessment articles in Nature Reviews Drug Discovery.

Rachel Webster is a principal director of the Oncology practice at DRG. She leads a team of oncology business insights analysts in producing syndicated primary and secondary market research reports and custom analysis on a wide range of oncology indications. She also provides client support for all oncology products and helps global biopharmaceutical companies uncover strategic opportunities through data-driven insights from a variety of channels. Webster has 10 years of experience in market forecasting and a broad knowledge of oncology indications and markets; she has particular interest and expertise in immuno-oncology. Additionally, Webster has published numerous oncology market assessment articles in Nature Reviews Drug Discovery.