Building New Business Models To Support Cell And Gene Therapy R&D

By Lev Gerlovin and Walter Colasante

This article originally appeared in Life Science Leader magazine.

The global focus on gene and cell therapies has grown exponentially in recent years as more development programs have advanced to later stages or even approval. There are now clinical stage development programs in gene therapy targeting almost 50 different diseases, up from 10 only a few years ago. Development programs are underway around the world, with the largest share led by U.S. and EU companies (53 percent and 32 percent, respectively) and the remainder from companies in China and South Korea.

NEW NEEDS IN EXPERTISE ARE DRIVING UP COSTS

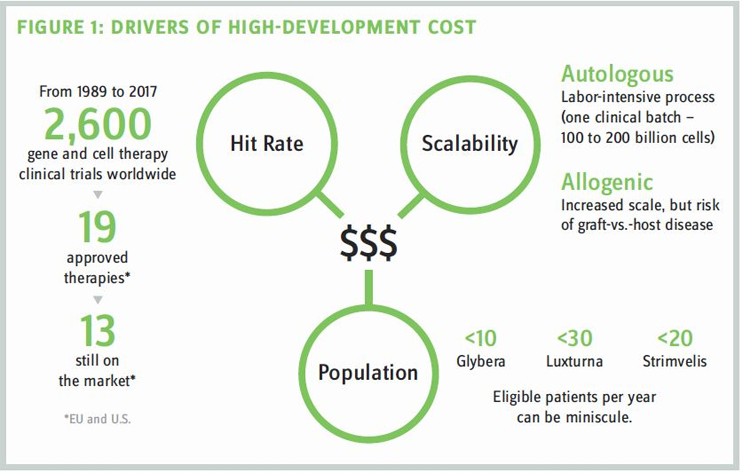

The unique development challenges for gene and cell therapies also manifest in higher costs incurred for discovery and translational research and during the production of approved therapies. As an example, while therapies based on CAR T cells hold immense potential for the treatment of cancer, they are complex to produce and are typically targeted to very limited patient populations. Personalized therapies produced for individual patients also present challenges in production because they do not support the economies of scale achievable in many small molecules when production levels rise.

The fact that many gene and cell therapies target rare diseases also can mean that identifying and accessing appropriate patients for clinical research is inherently more difficult. Smaller patient populations in research can result in limitations on data that can affect clinician confidence. In late 2017, the U.S. FDA issued guidance to help address the lack of available patients in research related to rare diseases by encouraging the extrapolation of data across different populations, the increased use of models and simulations, and the use of a single control group as the basis for more than one investigational drug. Again, these unique standards require new levels of expertise and could still result in over-reliance on computer simulations or findings that are less statistically sound than prevailing industry standards.

THE EFFECT OF CURATIVE EFFICACY

For manufacturers, curative therapies can present a limited and inadequate window of payment to allow them to recoup often substantial costs related to development, production, distribution, administration, and patient monitoring. Without new models, these challenges could keep many promising gene and cell therapy companies from reaching essential goals in financing to support their growth, especially in the early years.

ALTERNATIVE DEVELOPMENT AND FINANCING MODELS

Despite the challenges, experts are focusing on a range of strategic alternatives that can lead to new and more effective development and financing models to support cell and gene therapies in the years ahead. One example is the potential for platform diversification. In many cases, small molecules or monoclonal antibodies target a single pathway. An anti-CD20, for example, has potential in several indications, but the mechanism of action is limited to reduction in B cell activity. In contrast, gene and cell therapies can offer a diversified development platform with a unifying focus. When the development program for revusiran was not successful, Alnylam was well-positioned to change the program to target alternative therapeutic areas, such as hereditary TTR-mediated amyloidosis and acute hepatic porphyria. The ability to pivot and apply a platform to a different therapeutic area is a hallmark of gene and cell therapies that can expand growth opportunities and mitigate risk.

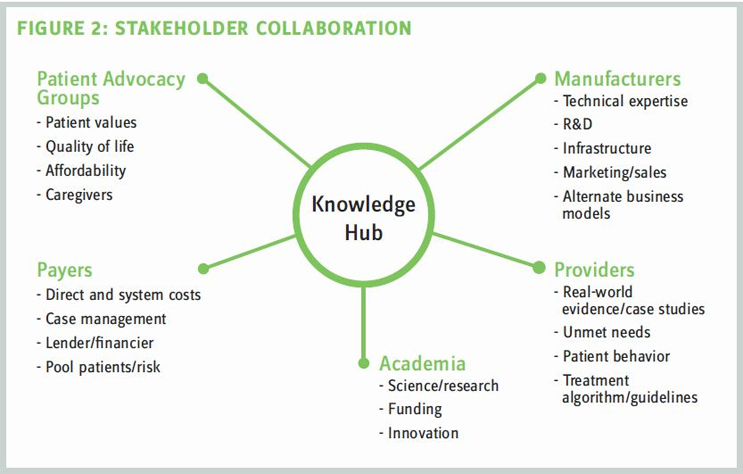

To promote knowledge sharing and allow for rapid technological advances in gene and cell therapy, industry also can consider new approaches in stakeholder engagement — comparable to the models used in the Human Genome Project or the International Rare Diseases Research Consortium. Bringing together a broader range of healthcare stakeholders — including manufacturers, academia, payers, providers, and patient advocacy groups — can facilitate innovative solutions by mitigating the fragmentation of gene and cell therapy research efforts. These collaborations also can help expand access to capital, stronger engagement, broader sharing of data, accelerated translational research, and support for development of improved manufacturing and processing technologies. A wide network of stakeholders spanning different geographies also could facilitate long-term postmarketing surveillance efforts to monitor real-world efficacy and adverse events and support broader understanding of the benefits and risks of gene and cell therapies.

Partnerships between manufacturers and academia, in particular, offer synergies that allow both parties to explore more programs that might be considered highrisk. For example, Orchard Therapeutics launched a transformative gene therapy development program built from partnerships with UCLA, Boston Children’s Hospital, University College London, Great Ormond Street Hospital for Children NHS Foundation Trust, and the University of Manchester. The program will exploit ex-vivo autologous stem-cell gene therapy for primary immune deficiencies, metabolic diseases, and hematological disorders. Established companies also may see benefit in partnering with and nurturing early-stage gene and cell therapy assets. A company with a robust portfolio of immunology assets might wish to engage with discovery-stage gene and cell-therapy platforms to expand their model to include next-generation curative therapies. Celgene’s acquisition of Juno Therapeutics and Gilead’s acquisition of Kite Pharma may be recent examples of larger companies expanding their pipelines in this way. Once proof-of-concept is established, these partnerships may be able to utilize their technology platforms to develop therapeutics at an accelerated rate. For example, could a viral vector designed to deliver a gene into a cell for treatment in an immunology indication be repurposed across other franchises? Several years of investments may yield rising returns as a single platform is spread across multiple therapeutic areas.

While the leaders and innovators in cell and gene therapy are developing new strategic approaches to support cell and gene therapy clinical programs, calls for new levels of innovation and financing will continue. New models will, of necessity, have to engage more stakeholders in many previously untried and often complex alignments that will require new approaches in risk- and responsibility-sharing. If executed successfully, these models can help make sure that more promising development programs reach the finish line and represent major advances in treatment and successful commercial opportunities for all stakeholders.

LEV GERLOVIN is a VP in CRA’s Life Sciences Practice.

WALTER COLASANTE is a VP in CRA’s Life Sciences Practice.'

They wish to acknowledge the contributions of Stephanie Donahue and Michael Krepps to this article.

The views expressed herein are the authors’ and not those of Charles River Associates (CRA) or any of the organizations with which the authors are affiliated.